USD/JPY Signal Update

Yesterday’s signals were not triggered and expired.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken from 8am New York time to 5pm Tokyo time.

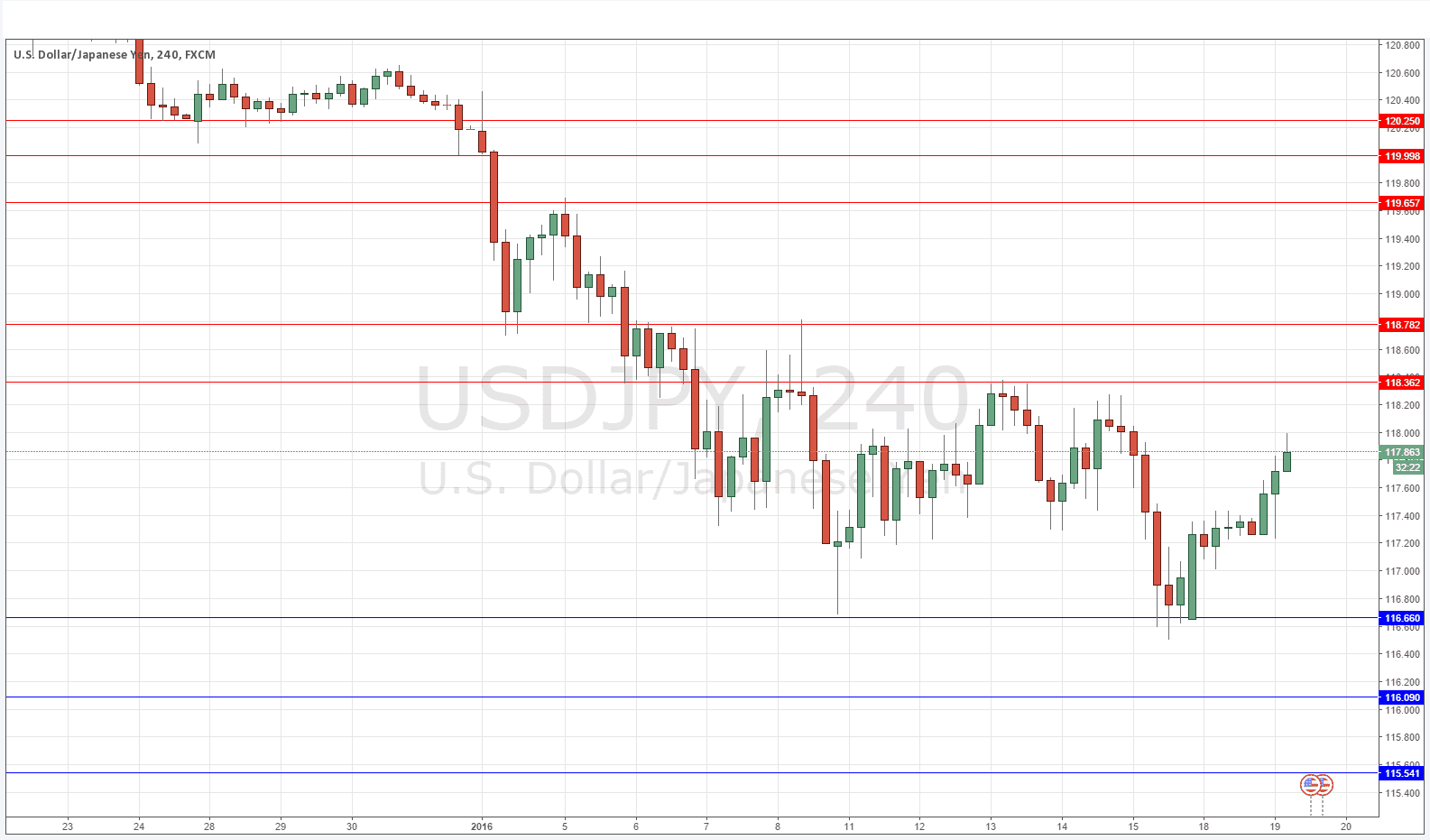

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 116.66.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 118.36.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 118.78.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Risk sentiment has improved and this has combined with a natural pullback from a support level to finally produce a meaningful rise in this pair. Note that we have still yet to break up past any key resistance levels, but if we reach 118.36 that is going to be a severe test. The established downwards trend suggests that prices at 118.36 and above are going to be good areas at which to seek a short trade entry.

Below, the weekly open at 116.66 is likely to be supportive if we get back down there and hit it.

There is nothing due today concerning either the JPY or the USD.