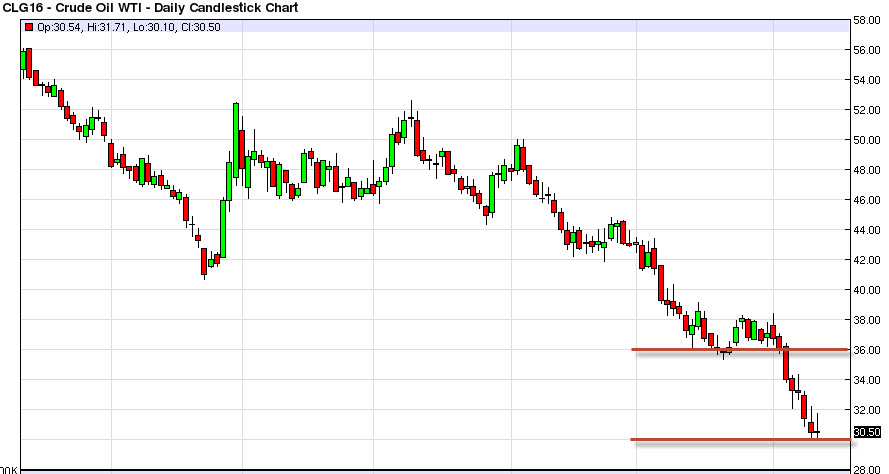

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the course of the session on Wednesday, but found the $32 level to be far too resistive to continue to go higher. With this being the case, the market looks as if it is going to continue to go lower though, as the daily candle is a shooting star. Anytime you see a shooting star at the bottom of the downtrend, it normally suggests that you are about to see a continuation of the downtrend itself. That being said though, we are sitting on top of the $30 level, which in my opinion means that if we can break down below there, the longer-term downtrend continues. A break above here should find plenty of resistance all the way to at least the $36 handle, so this at point in time I have no scenario in which I am willing to buy this particular market.

Natural Gas

The natural gas market initially tried to rally during the course of the session on Wednesday, but found quite a bit of resistance at the $2.35 level. Ultimately, we found enough selling pressure to push this market back down, forming a shooting star. The shooting star is of course a negative sign, but it is not until we break down below the $2.20 level that I am comfortable selling this market. I certainly don’t have any interest in buying this market though, because of the resistance that we see at the $2.50 level, and of course the downtrend line that has kept this market going lower. It is not until we break above the downtrend line that I would be comfortable buying at this point in time.

Once we get down below the $2.20 level though, I feel that this market should continue to go lower, reaching towards the $2 level. I think we could go even lower than that, but at this point in time that is my first target.