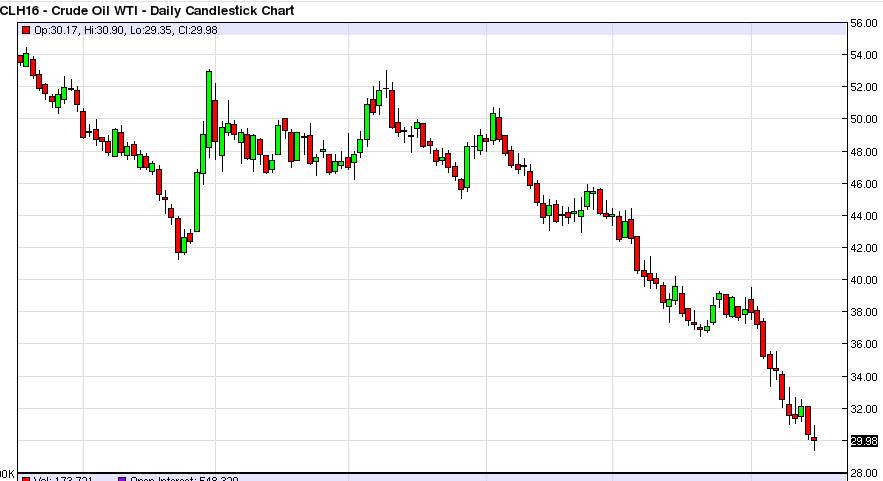

WTI Crude Oil

The WTI Crude Oil market fell below the $30 level during the session on Monday, as we continue to see plenty of bearish pressure in this marketplace. Because of this, it’s a very bearish market in my opinion, and therefore I am still ready to continue shorting this market every time we get a short-term rally. I think that the market will continue to struggle due to the fact that we have an oversupply, and of course we have the currency headwinds coming out of the United States dollar being so strong. With that being the case, it’s very likely that we will continue to see bearish pressure return when we rally, and of course an acceleration of that if we can break down below the lows from the Monday session. Because of this, I just don’t have any interest whatsoever in buying this market.

Natural Gas

Natural gas markets initially gapped lower at the open on Monday, but turned back around to not only fill that gap but to jump back over the $2.10 level. By doing so, the market looks as if it is going to continue to try to rise from here, but quite frankly I think this is just a nice selling opportunity waiting to happen. With that being the case, I am more than willing to sell resistive candles, and of course a break down below the lows from the session on Monday itself. I believe that we are reaching towards the $2 level given enough time, and that we will not only go there, but reached down towards the $1.80 level after that.

At this point in time, I do not have a scenario in which I am wanting to buy the natural gas markets. I believe we are in a downtrend for quite some time, and for significant reasons going forward. Each rally seems to be a selling opportunity as far as I can tell.