AUD/USD Signal Update

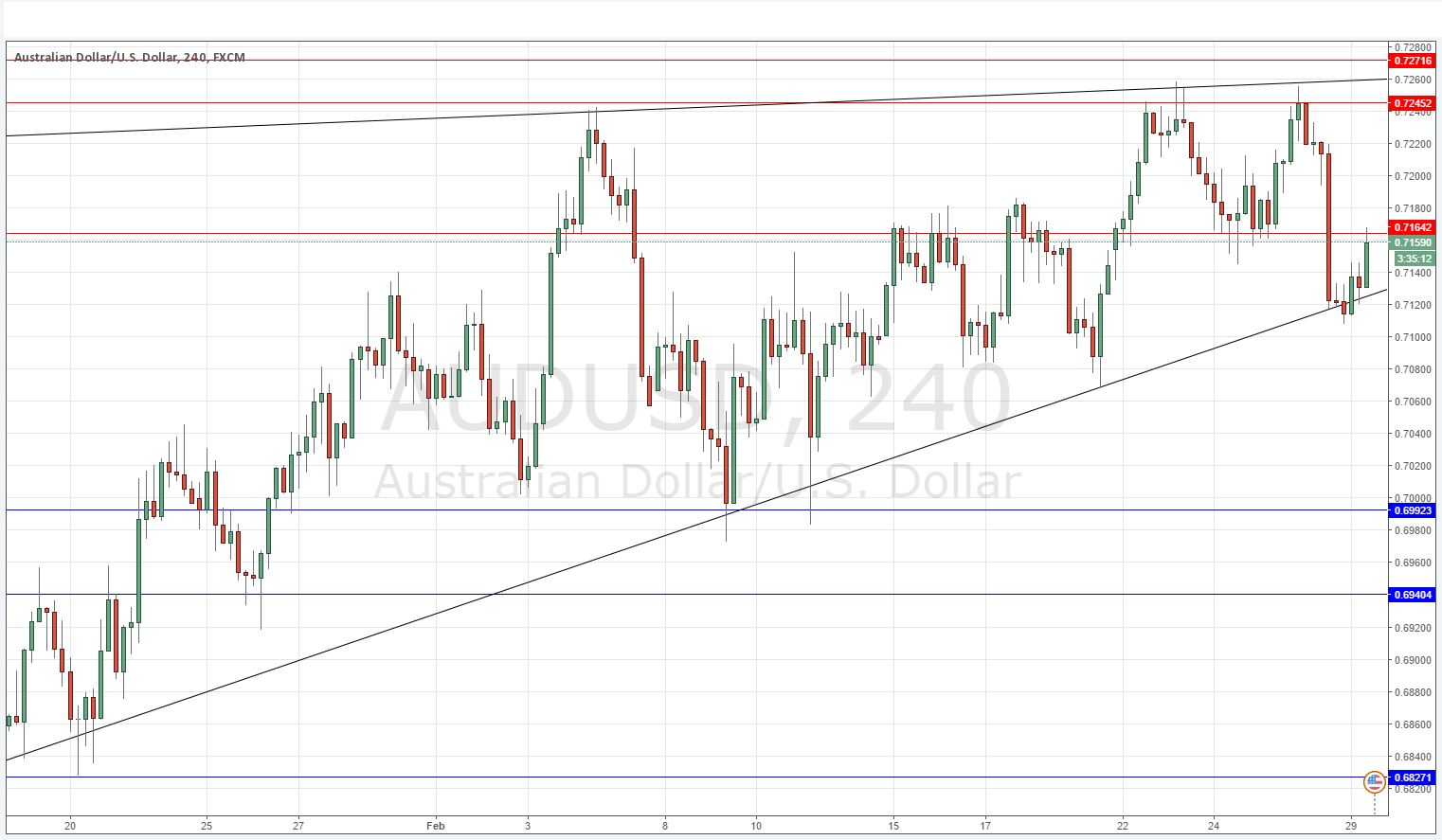

Last Thursday’s signals produced a nicely profitable short trade following the pin candle rejecting the resistance zone beginning at 0.7245. This could be a good trade to hold if the new resistance level at 0.7164 holds.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be taken from 8am New York time until 5pm Tokyo time.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6992.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry after bearish price action on the H1 time frame immediately upon the next entry into the zone between 0.7245 and 0.7271.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

AUD/USD Analysis

This currency pair is finally getting to an interesting position. It has been grinding upwards for a long time, but has now repeatedly failed to break up above 0.7245. It remains supported by the fairly long-term bullish trend line shown in the chart below. However it appears that new resistance is printing and holding at 0.7164, so the most probable scenario looks to be a break below the supportive trend line which would be likely to lead to a fast fall down to the psychologically key 0.7000 area.

Alternatively, a break up above 0.7164 will suggest another attempt at 0.7245. If the price manages to hold up above there it will suggest a new long-term bullish trend is really underway.

There is nothing due today concerning the USD. Regarding the AUD, there will be a release of Building Approvals data at 12:30am London time followed later by the RBA Rate Statement and Cash Rate at 3:30am.