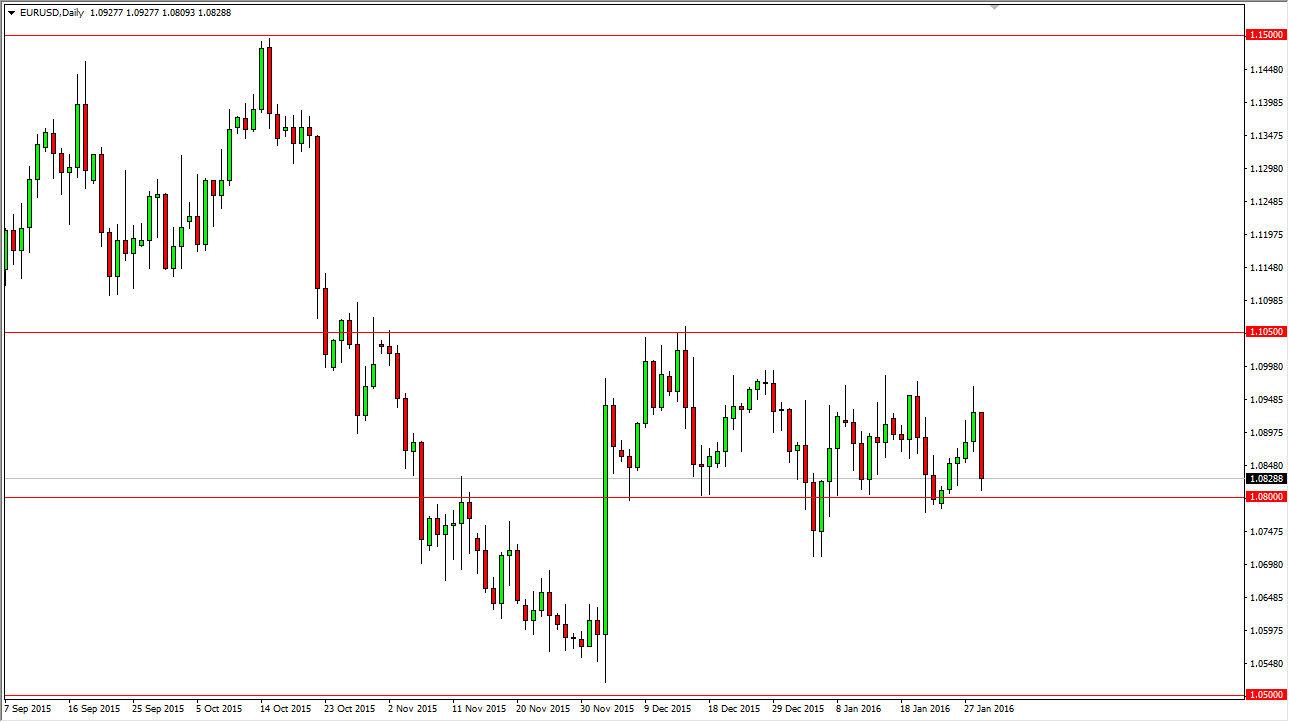

EUR/USD

The EUR/USD pair fell rather significantly, forming a very negative looking candle. The negative looking candle ended up testing the 1.08 level, and as a result it makes sense that we had buyers come back into the marketplace as this area has been important for so long. I feel that we are at the bottom of the overall trading range, so I don’t necessarily feel like we can start selling. I think it’s not until we break down below the 1.07 level that it’s easy to do so. In the meantime, I am simply waiting to see whether or not we get some type of supportive candle to turn things around and buy with a short-term bias. That being the case, I feel that the market will continue to be volatile, but should continue to float between this area and the 1.10 level above.

GBP/USD

The GBP/USD pair fell significantly during the course of the day on Friday, as we continue to see quite a bit of selling pressure against the British pound. With this, I still believe that the downtrend continues and as a result I am willing to sell this market every time it rallies. I believe that the 1.40 level will be a bit of a target, but it should also end up being fairly supportive. However, I do believe that it’s only a matter of time before we break down below there. With that being the case, I think that we may bounce a few times to try to build up enough momentum to finally go lower. I have no interest in buying this market, at least until well above the 1.45 level, which is something that doesn’t look very likely at this point in time due to the fact that there has been so much in the way of negativity recently and of course there are a lot of concerns about the global economy.