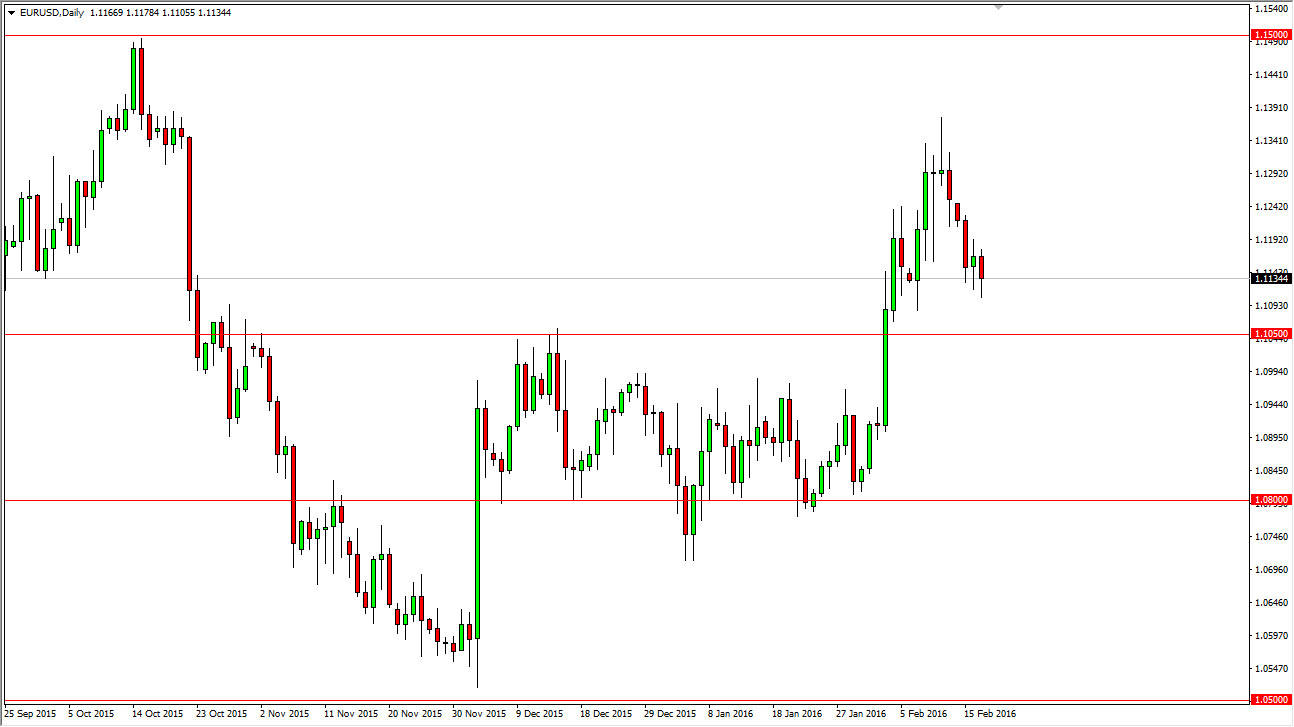

EUR/USD

The EUR/USD pair fell a bit during the course of the day on Wednesday, but did find a bit of support and that would not be much of a surprise to those of you who been following my analysis lately. I believe that the 1.1050 level is essentially the “floor” in this pair, and now that we have broken out and pulled back, it’s very likely that the Euro will continue to strengthen. This is a market that features a couple of super banks that are trying to kill off their own currencies, but at this game there is no competition for the Federal Reserve. With that, I believe that we will grind our way back towards the 1.13 level, and then eventually the 1.15 handle where I suggest that we will be changing trends on a move above.

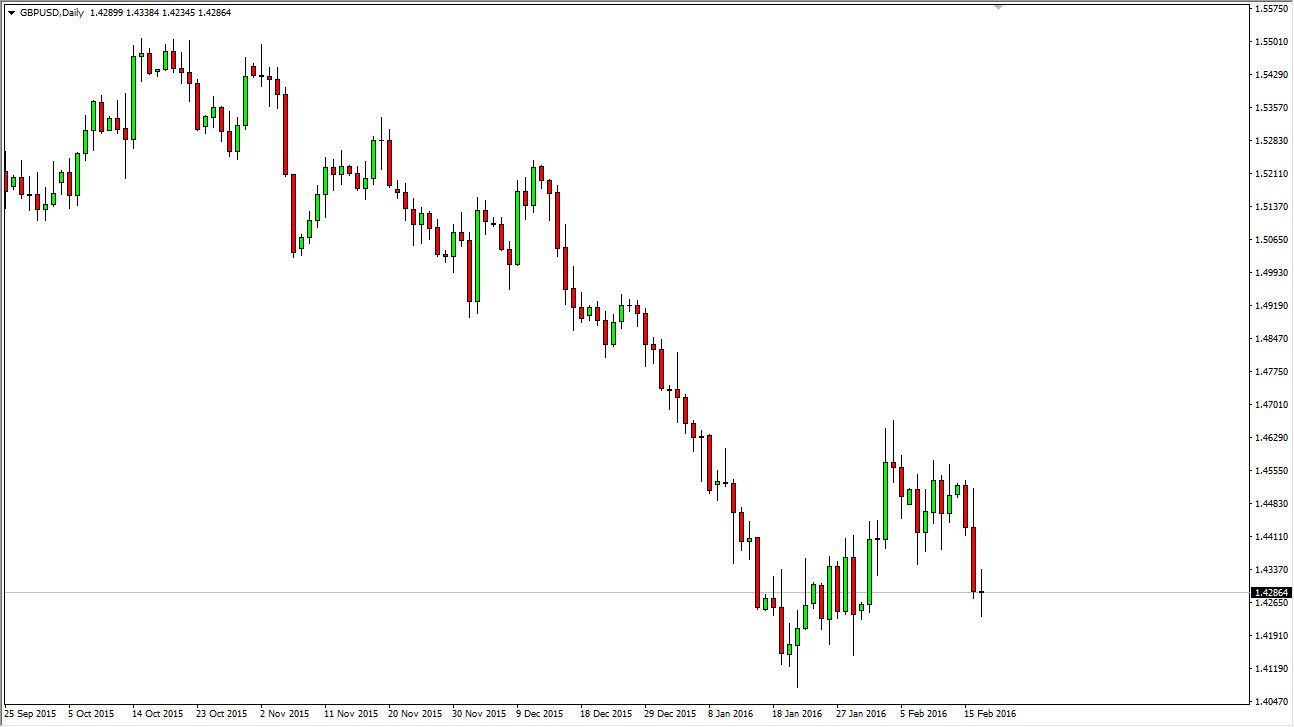

GBP/USD

The British pound had a volatile session as we went back and forth during the day, suggesting that the market is trying to come to terms with where to go next. I think that the 1.42 level below will continue to be important, and as a result its likely to bounce around in this area. The candle shows a bit of confusion, but at this point in time, I believe that we are going to favor selling as the markets continue to worry about a lot of different economic headwinds. The 1.41 level below will more than likely be the target eventually, but in the end we will see a lot of noise on our way lower.

The markets will continue to find a lot to worry about, and this could be a boon for the US dollar in general. It is because of this that I favor shorting this market, and I think we very well could drop below the 1.41 level, and onto the 1.40 level.