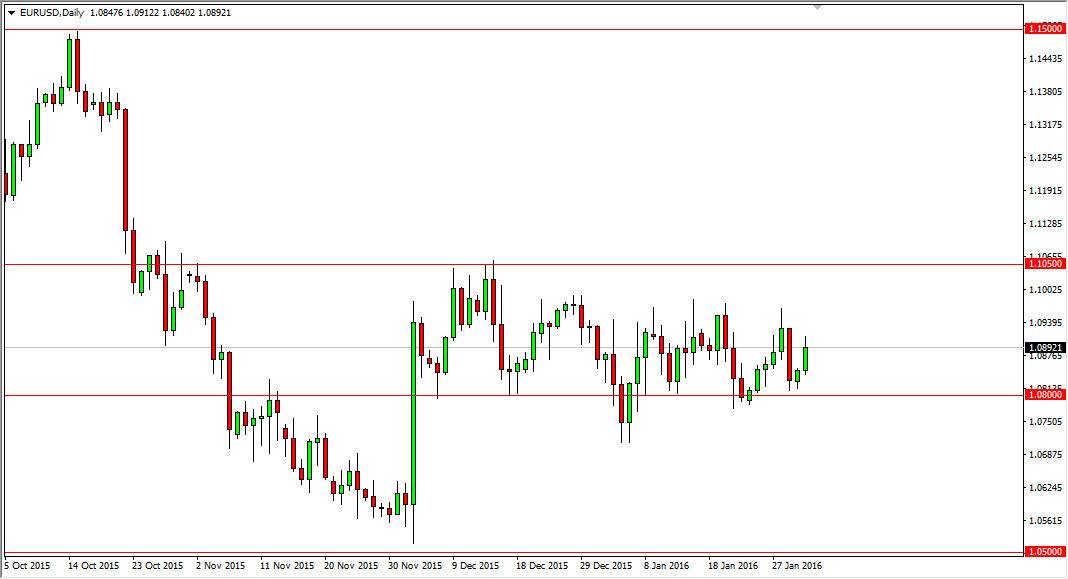

EUR/USD

The EUR/USD pair rose during the course of the day on Monday, showing that the 1.08 level has offered quite a bit of support. That’s not a huge surprise to me though, because it is the bottom of the overall consolidation area that we’ve been in for some time now. We broke higher, and it now appears that we will probably reach towards the 1.10 handle next. However, I’m not looking for anything major until we can clear the 1.1050 level, something that isn’t very likely to happen right away. I think the pullbacks do offer value though, but only if you have the ability to trade super short-term charts. Quite frankly, this is a market that doesn’t look ready to do anything major.

GBP/USD

The GBP/USD pair did break to a “higher high” at this point, so it does suggest that perhaps we are going to make a serious attempt to break above the 1.45 handle. If we do, that of course is a very bullish sign, and the market should then reach towards the 1.50 handle. That is where the trend changes for me, and as long as we stay below there I suggest that perhaps we will stay in a bearish attitude.

At this point, if we get a resistant candle I wouldn’t hesitate selling, but I think based upon the candle that we see for the session on Monday, it’s very likely that we will continue to go higher. Pullbacks at this point in time should have the ability to attract traders one way or the other, so I suppose I would be willing to buy a supportive candle below, but at this point in time I believe that we need to see more strength rather than some type of build up to be comfortable going long in this particular market.