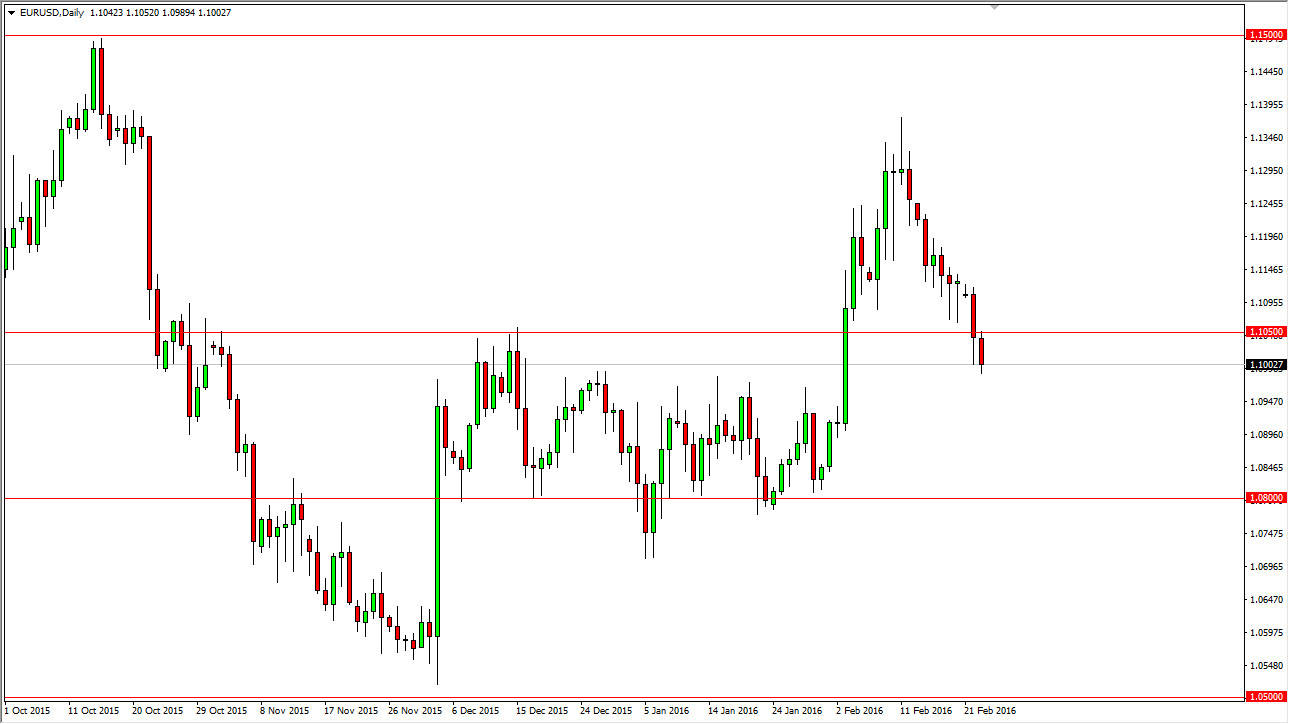

EUR/USD

The EUR/USD pair fell during the course of the day on Tuesday, as we find ourselves testing the 1.10 level. This is an area where the market should continue to see quite a bit of interest. After all, this is the area where I have suggested that perhaps the market has a massive amount of support. With that being the case, I think if we can break down below the 1.10 level, there is a good chance that we could go as low as the 1.08 handle over the longer term. On the other hand, if we turned back around and break above the 1.1050 level, that could send this market as high as the 1.13 level. Ultimately, the one thing that I think we will see today is a serious attempt to figure out where the next few handles will come from.

GBP/USD

The British pound broke down rather significantly during the course of the day, slicing below the 1.40 level. Ultimately, the fact that we are closing at the very bottom of the range suggests that we are going to continue falling, and that should send this market looking for the 1.35 level given enough time. We are at extreme lows, and there was quite a bit of support in this general vicinity previously, so having said that it is going to be choppy. I believe at this point in time that short-term rallies will be selling opportunities, and that the market really isn’t one that you can buy at this point. In fact, I don’t even necessarily have a signal in mind for turning the market back around.

I am selling the British pound again and again, as it seems to be absolutely broken at this point in time, and simply cannot get out of its own way. With that being the case, I expect to see much lower levels soon.