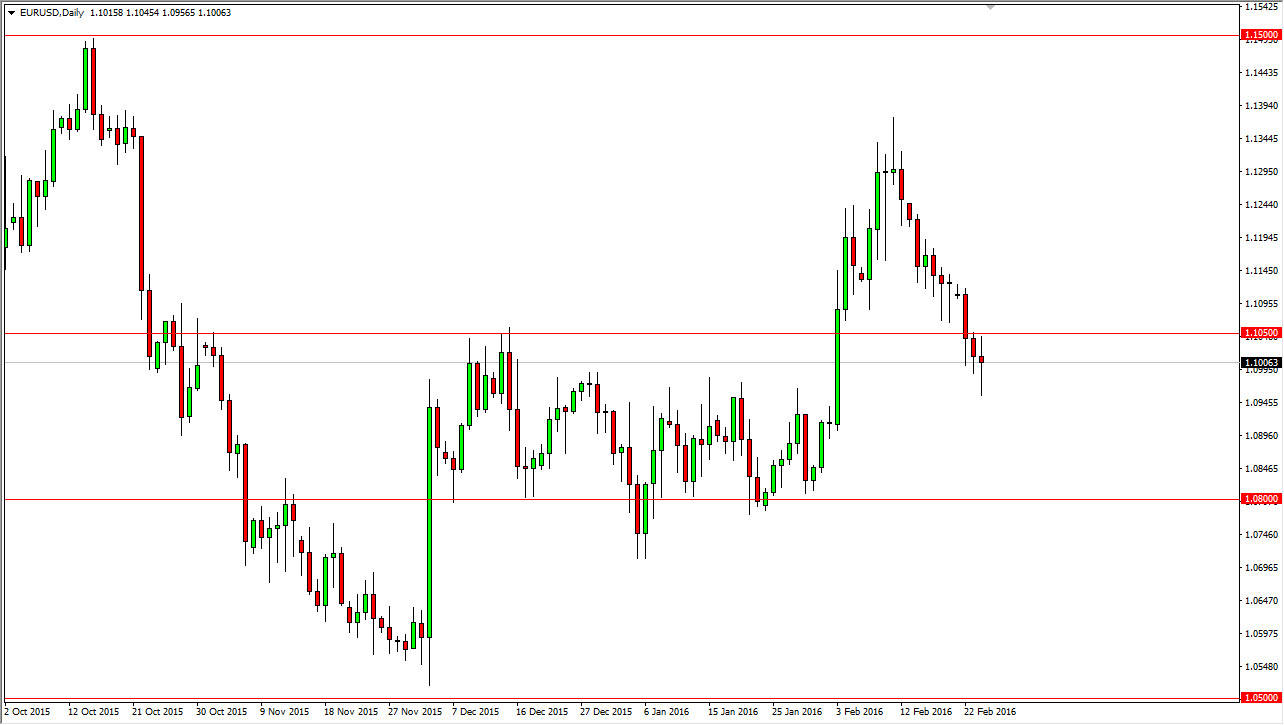

EUR/USD

The EUR/USD pair went back and forth during the course of the session on Wednesday, and at one point in time even managed to break down below the 1.10 level. However, we found enough support below there to turn the market back around and form a supportive looking hammer. Because of this, it’s likely that the market will try to rally from here, and if we can get above the 1.1050 level, we could grind our way up to the 1.13 handle given enough time.

I feel that this is simply a break out and then a retest of what had been serious resistance. Because of this, I am much more confident to the upside now than I was just a few sessions ago. It will be choppy, but at the end of the day I believe that the Euro continues to gain against the US dollar.

GBP/USD

The GBP/USD pair fell during the course of the day on Wednesday, breaking well below the 1.40 handle. By doing so, it broke down through major support zone, and it looks as if we are ready to continue going even lower. I would anticipate a short-term bounce, but there should be plenty of sellers somewhere near the 1.40 level, and therefore it’s going to be very difficult to go long in this market for any real length of time.

I also believe that if we break down below the bottom of the range during the session on Wednesday, quite a few sellers will enter the market and push the British pound down to the 1.35 handle. Given enough time, I think we will break down and continue to go even lower. Fears of the United Kingdom leaving the European Union have certainly put quite a bit of pressure on the British pound, but quite frankly there is also the safety aspect of the US dollar that has to be considered as well.