EUR/USD

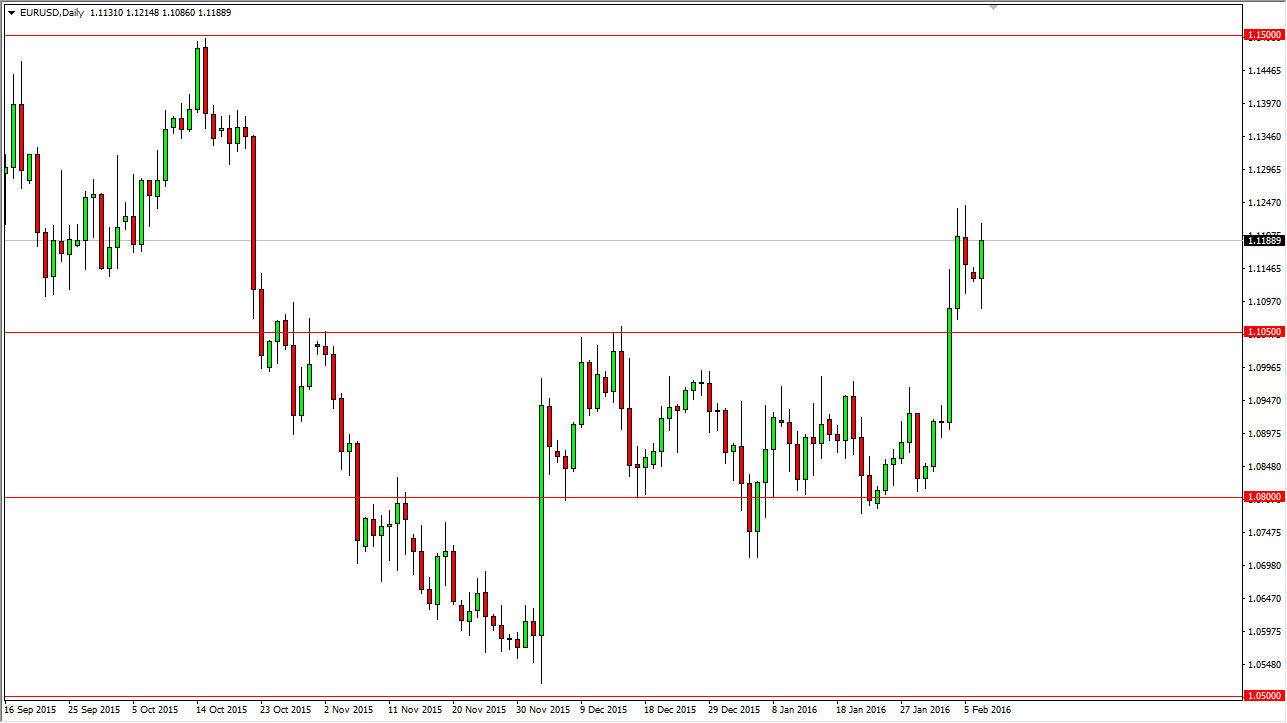

The EUR/USD pair initially fell during the course of the day on Monday, testing the area just above the 1.1050 level. That is an area that should be supportive, especially considering that the market had been so resistive in the past. That being the case, the market looks as if it should continue to find buyers and eventually grind its way higher. This is a market that I believe is trying to break out to the upside, reaching as high as the 1.15 level given enough time. It’s not going to be an easy move, but it should happen over the longer term.

It is not until we break down below the 1.10 level that I would consider selling this pair. At this point, I think that the support level just above there is going to continue to be very tenacious though, so I think it’s only a matter of time before the buyers get involved.

GBP/USD

The GBP/USD pair fell during the course of the day on Monday, breaking well below the 1.44 level. This was an area that had quite a bit of support though, so we turned back around and bounced significantly. By doing so, the market looks as if it’s trying to go little bit higher from here, but it will more than likely struggle somewhere near the 1.46 level. Ultimately, this is a market that will struggle to get above there, but if it does we could go to the 1.48 handle.

On the other hand, the market breaking down below the bottom of the range for the day on Monday should send this market much lower, perhaps reaching towards the 1.42 handle. Don’t think that we’re going go below there anytime soon, and quite frankly I feel that the market will probably grind back and forth in the short-term between those levels. It’s not necessarily going to be the easiest markets to be involved in.