EUR/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s EUR/USD Signals

Risk 0.75%

Trades must be entered before 5pm London time today only.

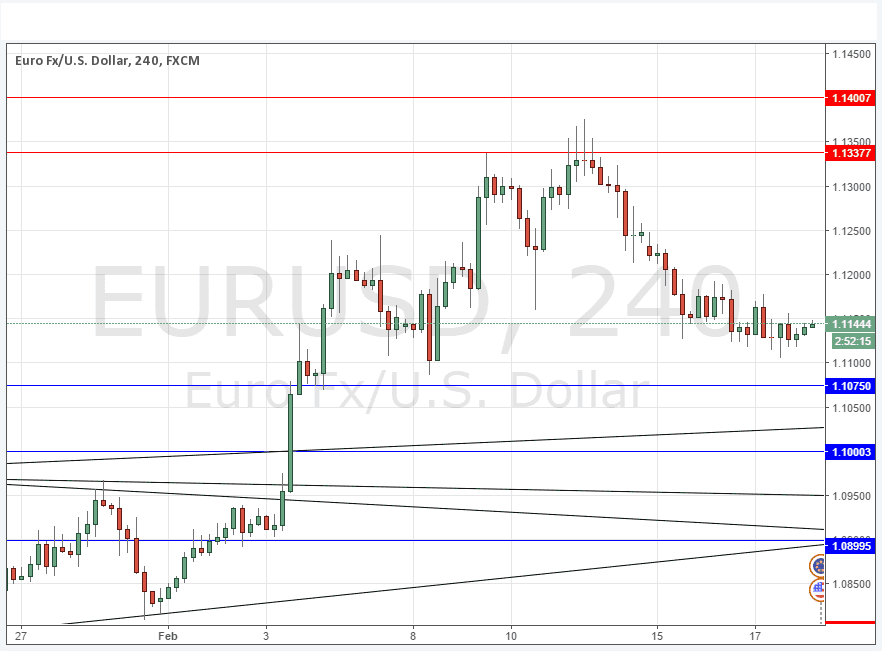

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1075.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of the trend line currently sitting at about 1.1025.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.1003.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.1337 and 1.1400.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

EUR/USD Analysis

Yesterday was a very quiet day. I had expected the FOMC release would be likely to inject some volatility into the market but in the end it was a non-event for most of the Forex market, including this day.

There is no change to the technical picture. There can be support anywhere from 1.1100 down to 1.1000 but I expect the area around 1.1075 to have the highest potential as the start of a major upwards thrust, if it comes.

There is nothing due today concerning the EUR. Regarding the USD, there will be releases of the Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time, followed later by Crude Oil Inventories at 4pm.