The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 21st February 2016

Last week I highlighted long Gold and EUR/USD and short USD/JPY as the probable best trades of the week. This did not work out so very well as although the USD/JPY fell by 0.74%, Gold fell by 0.85%, and the EUR/USD also fell by 0.95%. This gave an average loss of 0.35% per pair. However, Gold and USD/JPY did provide the best swing or day trading opportunities during the week, so I was right to highlight them as having good trading potential.

Fundamental Analysis & Market Sentiment

At the moment, fundamental analysis is not going to be very useful, as we look to be at the end of major trends. Markets are currently being driven very strongly by sentiment which can shift from day to day and not by the macro environment as expressed through fundamental analysis. The only point worth making here is that over the past couple of weeks several central banks have begun making more dovish noises, which have sent many currencies plummeting from day to day.

An analysis of market sentiment is likely to be more fruitful. As the market becomes more fearful of a U.S. economic recession, the JPY, EUR and Gold tend to rise.

This week I cannot fully rely the long-term trends and instead want pick three pairs that have sentiment as well as trend behind them.

Technical Analysis

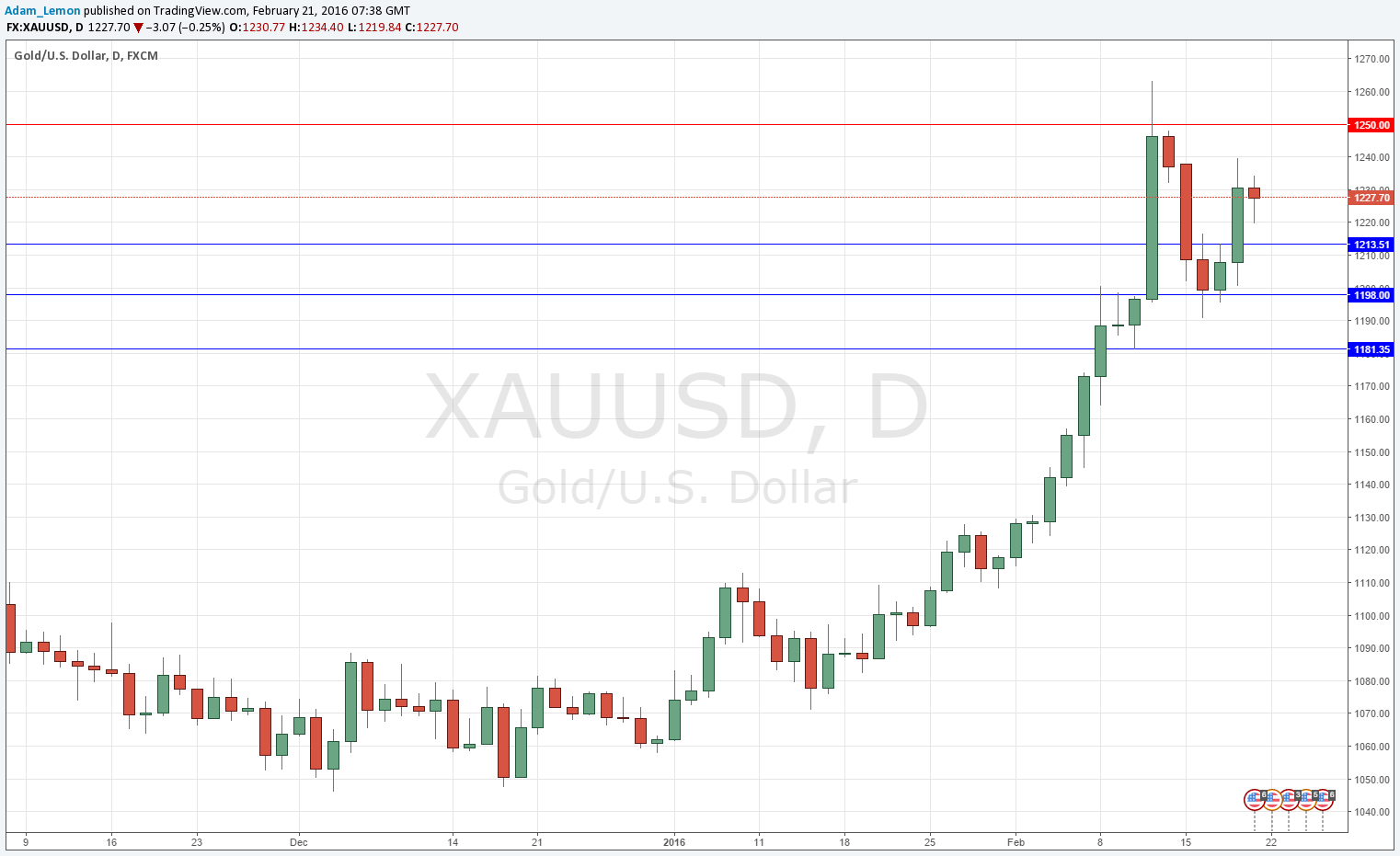

Gold

The daily chart below shows how this pair has shot upwards over the past few weeks, reversing the action of almost an entire year during which the price of the metal was very flat. The price has made a new 1 year high and touched the key psychological level of $1250.

We had a good healthy bounce off the $1200 area last week and I see this price as being likely to provide support again, as well as the higher level of $1213.50. Above there is key resistance at $1250. I would look to keep trading this commodity long.

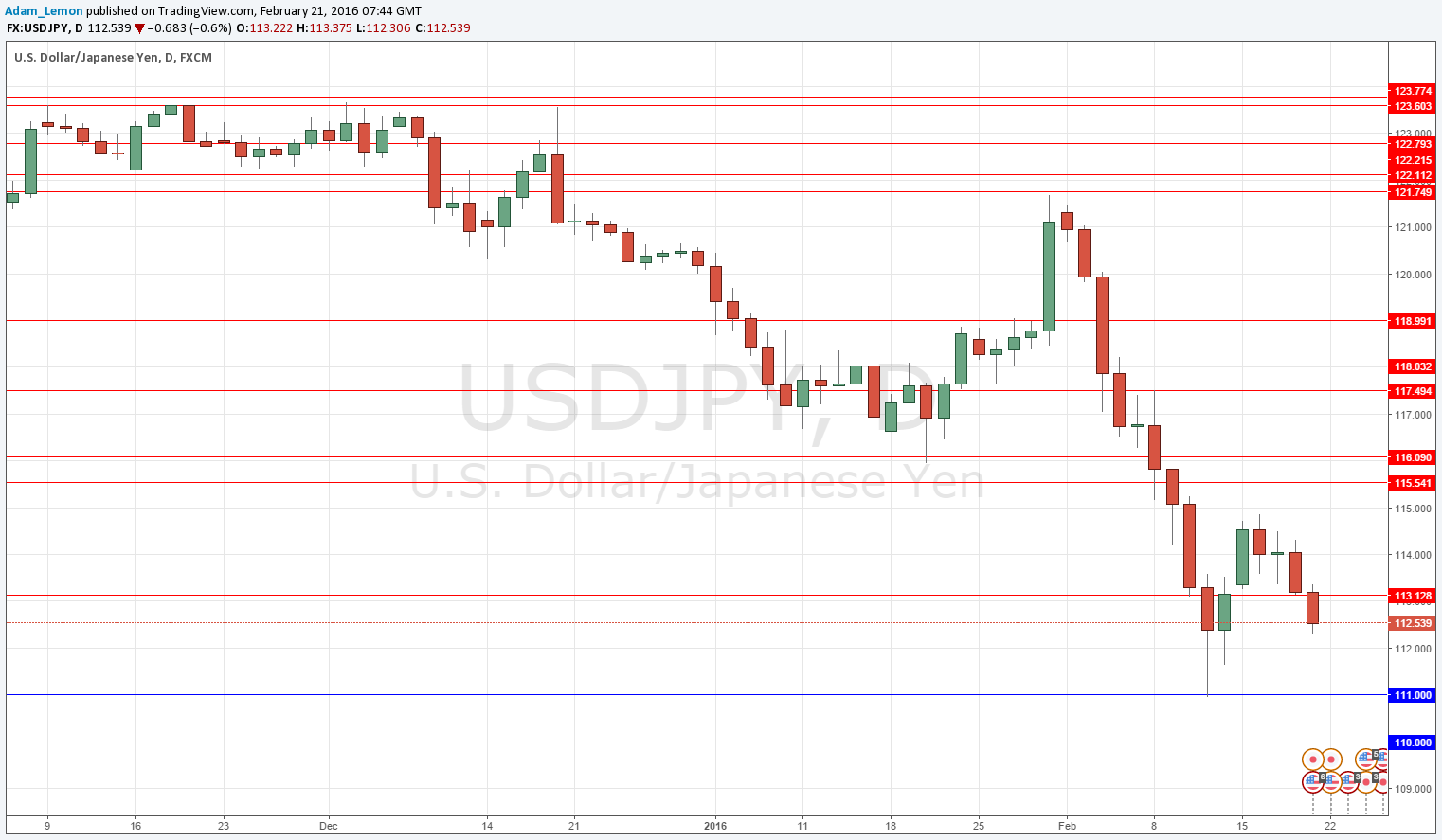

USD/JPY

The Japanese Yen has emerged as one of the strongest global currencies due to prevailing “risk-off” sentiment, and is now at a far stronger level against the USD than it was before the Bank of Japan’s negative rate move that occurred only two week ago!

The price broke down strongly past a very key level at around 116.00, making near 18 month lows and then breaking down again strongly after consolidating a little way above 114.00. The price was heading for a natural historical and psychological support at the very key round number of 110.00 but it seems the Bank of Japan intervened and bought this pair between 111.00 and 112.00.

This week the pair pulled back as far as 114.87 before turning round and falling again to prices below 112.50.

It looks like an attractive pair to short as it has the strongest trend of any major Forex currency pair. However we have to beware possible intervention by the Bank of Japan below 112.00 which might send the price up by two or three hundred pips.

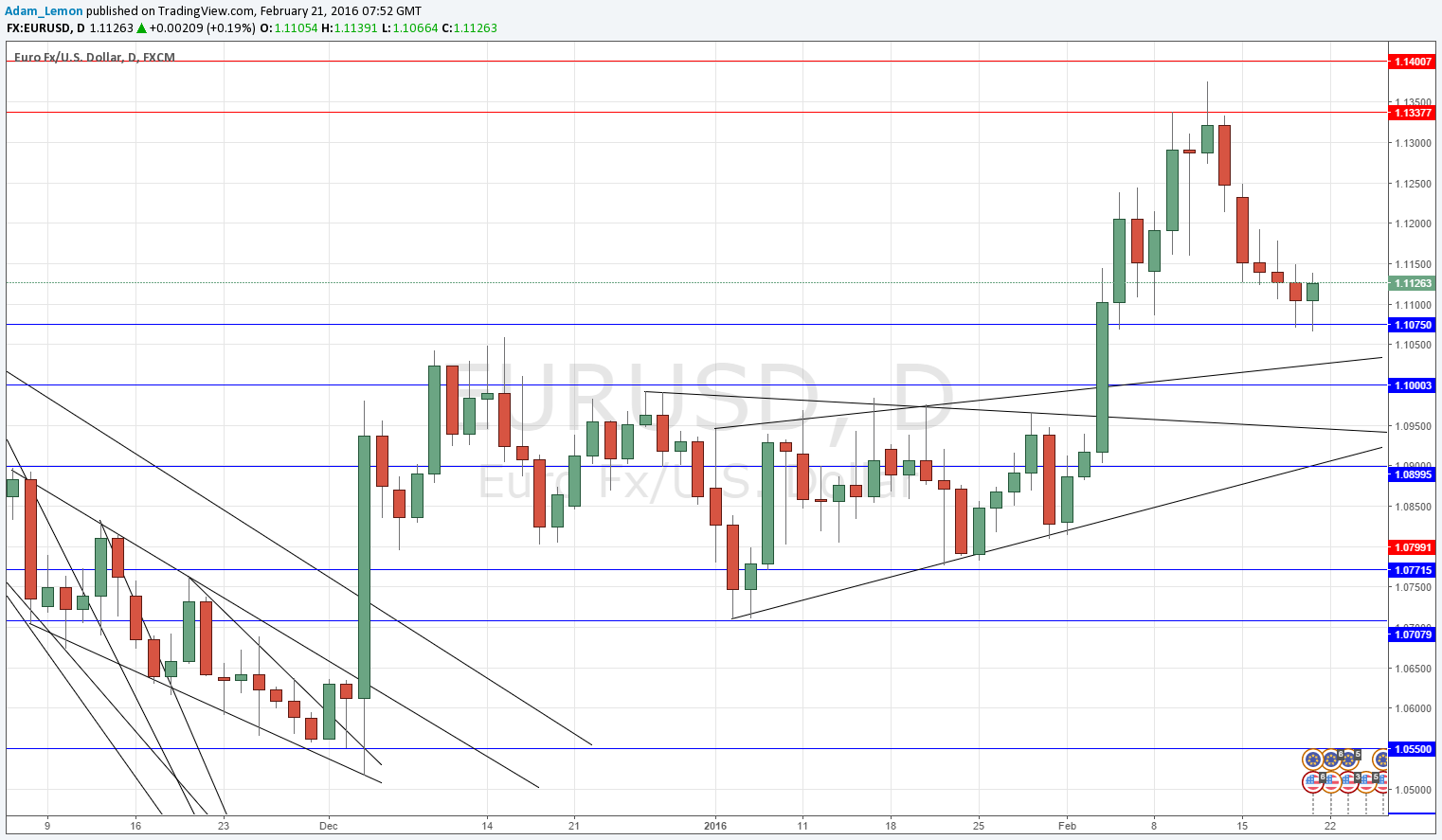

EUR/USD

This pair had been falling for several days, but finally had an up day after touching my anticipated support at 1.1075 shown within the daily chart below. I think there will be a bullish bounce either from here or possibly from a lower level closer to 1.1000, as this area was such strong resistance and held for many weeks before there was bullish break. Therefore it is liable to become strong support.

I have this pair as a “weak buy” that should definitely need to be confirmed by intraday price action.

The safest trades of the week are probably going to be long Gold and short USD/JPY.