The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 28th February 2016

Last week I highlighted long Gold and short USD/JPY as the probable best trades of the week. This did not work out very well as the USD/JPY rose by 1.37% and Gold fell by 0.28%. This gave an average loss of 0.83% per pair. However, Gold and USD/JPY did provide some of the best swing or day trading opportunities during the week, so I was right to highlight them as having good trading potential.

Fundamental Analysis & Market Sentiment

The stand out case where fundamental analysis and sentiment can be applied at the current time is the British Pound. Britain will be voting in June on a referendum on exiting the European Union. If Britain votes to leave – and that is a realistic prospect – it could call the entire future of the European project into question. Several senior politicians have come out in favor of exit, and at the same time the central bank has been revising its economic projections downwards and hinting at a delay in any possible future tightening of monetary policy. Taken together, these factors produce an excellent case for selling the British Pound.

There has also recently been a great deal of risk-off sentiment which has driven capital flows into the Japanese Yen as a safe haven currency. However the Bank of Japan does not want to see the Yen get overly strong, and it seems that it has been intervening to weaken the Yen every time it approaches the level of 111.00 against the U.S. dollar.

Both of these currencies have a strong trend behind them, although the strong Yen is in danger, so I am going to highlight these currencies for the week ahead.

Technical Analysis

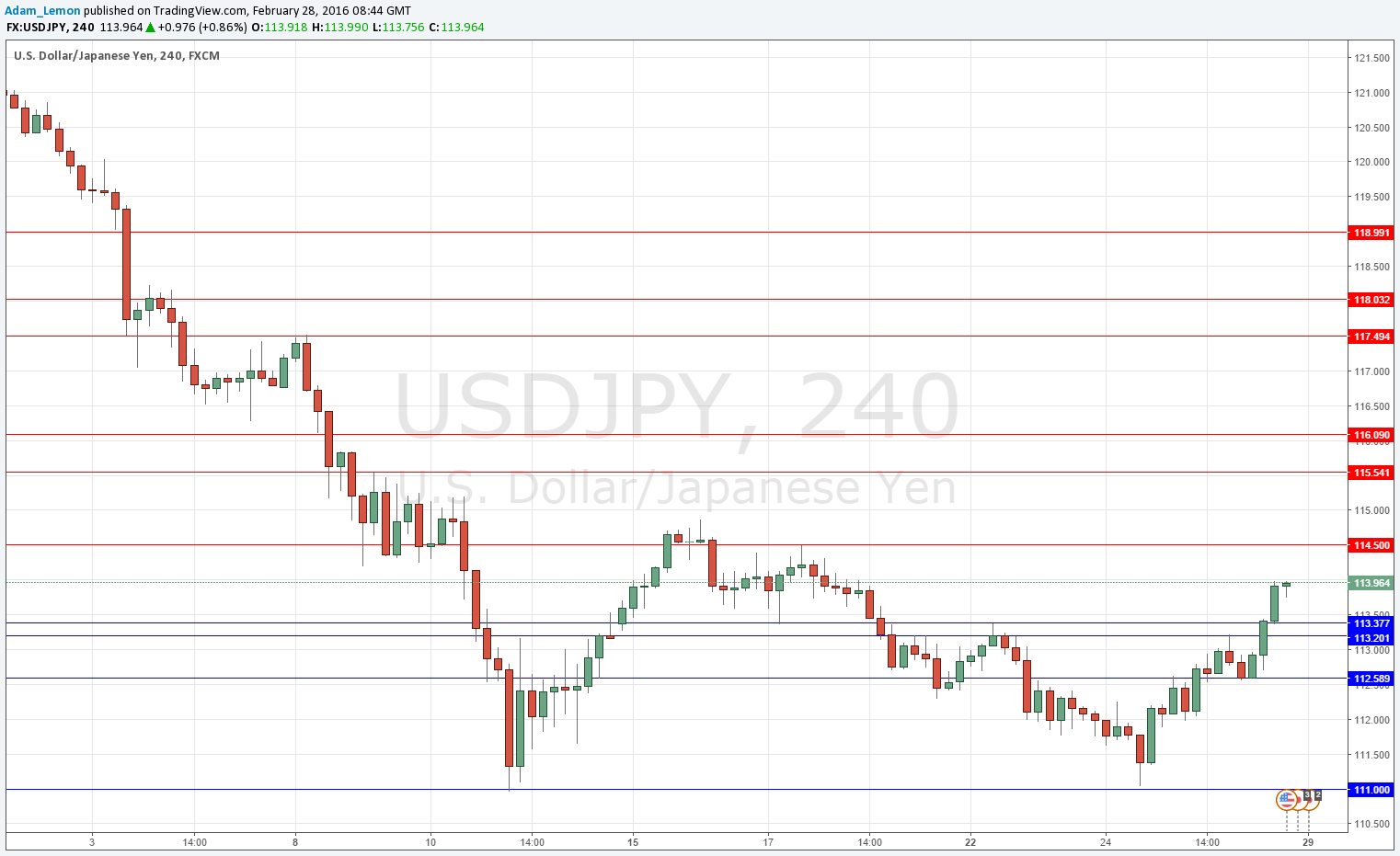

USD/JPY

The Japanese Yen has emerged as one of the strongest global currencies due to prevailing “risk-off” sentiment, and is now at a far stronger level against the USD than it was before the Bank of Japan’s negative rate move that occurred only three weeks ago! However, it seems that there is a strong floor at 111.00, and the price has been rising quite strongly since a double bottom was made there last week.

In spite of this development, and the printing of new support levels below, the area between 114.50 and 116.09 is likely to provide some resistance, and we will probably see a bearish turn and another downwards move if we get back up there.

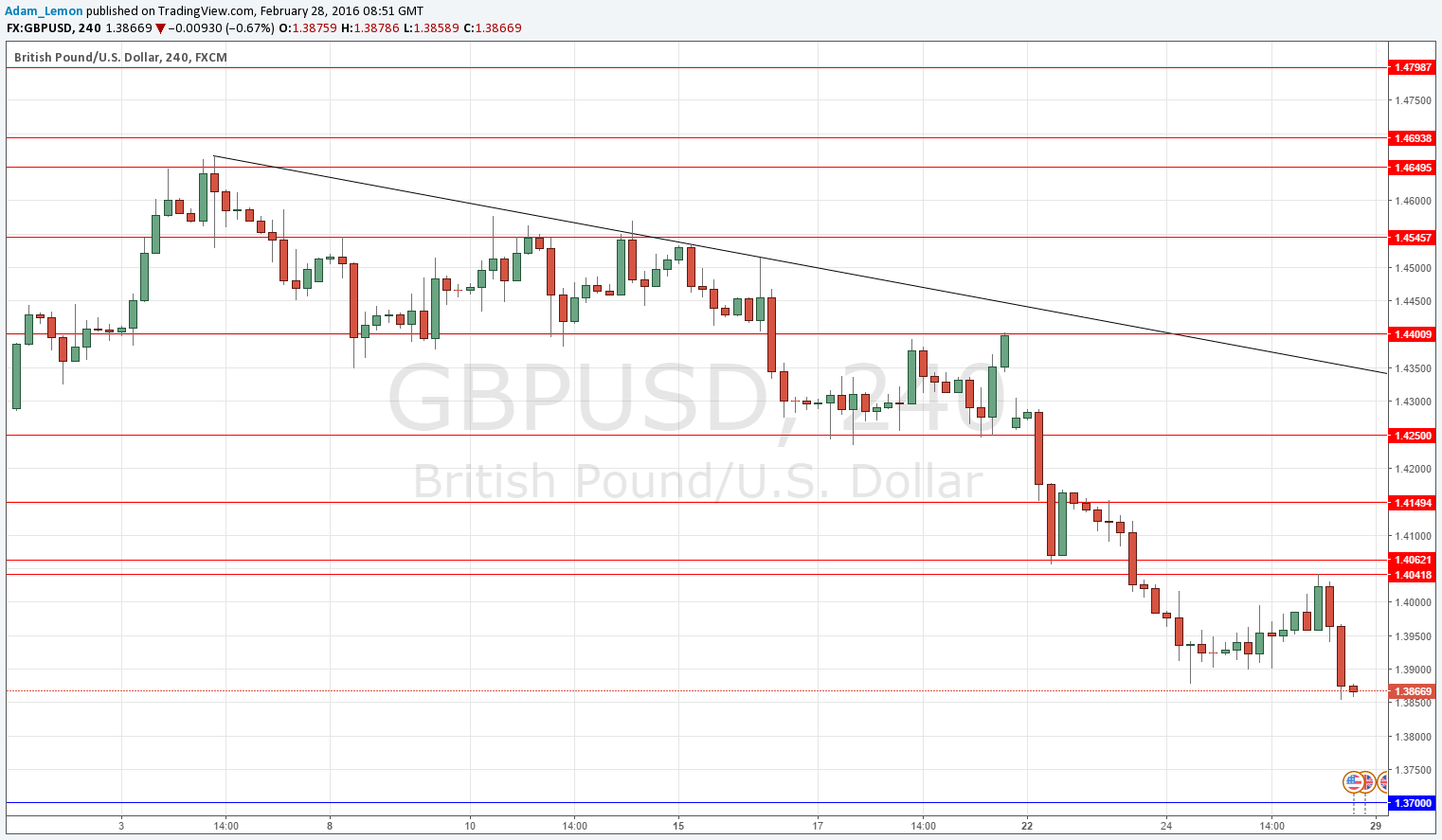

GBP/USD

This pair was beginning to pull back, but began to fall sharply right at the end of the week and that was given an added very strong impetus with the release of much better than expected U.S. GDP data when New York opened on Friday. The price fell to a new 7 year low and the price is actually less than 300 pips off a 20+ year low. This is blue sky, with the British Pound really standing out at the moment as the most strongly trending currency with both fundamentals and sentiment working against it.

It makes good sense to be looking to sell the pair this week, especially after a pullback that reaches 1.4000, but it might just keep on falling. Support might be expected at round numbers.

The safest trade of the week is probably going to be short GBP/USD.