The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 7th February 2016

Last week I highlighted short GBP/USD and long USD/CHF as the probable best trades of the week. This did not work out well at all as the GBP/USD pair actually rose by 1.79% and the USD/CHF pair fell by 3.13%.

I was trying to remain with long-term trends but over the past week we have seen really strong shifts and turbulence in the markets in general and in the Forex market in particular. There have been very large and wild swings and there have been major shifts in which currencies are looking strong and weak. This creates a difficult and dangerous market and there are many traders right now who will prefer to remain on the sidelines for a while longer until things become clearer.

Fundamental Analysis & Market Sentiment

At the moment, fundamental analysis is not going to be very useful, as we look to be at the end of major trends. Markets are currently being driven very strongly by sentiment which can shift from day to day and not by the macro environment as expressed through fundamental analysis. The only point worth making here is that over the past couple of weeks several central banks have begun making more dovish noises, which have sent many currencies plummeting from day to day. The outstanding example is the USD which weakened a lot before recovering somewhat at the end of the week on better than expected unemployment numbers. However there is a lot of doubt surrounding the strength of the U.S. economy now and we may start to get a real trend of a weakening USD as a result, which would be a major change from the situation we have seen for the past couple of years with a strong USD.

An analysis of market sentiment is likely to be more fruitful. As the market becomes more fearful of a U.S. economic recession, the JPY and EUR tend to rise. As the market becomes more fearful of a global economic recession, the AUD and CAD tend to fall.

This week I have to abandon the long-term trends and simply pick three pairs that I think are behaving in a way where they are likely to provide some interesting trading opportunities.

Technical Analysis

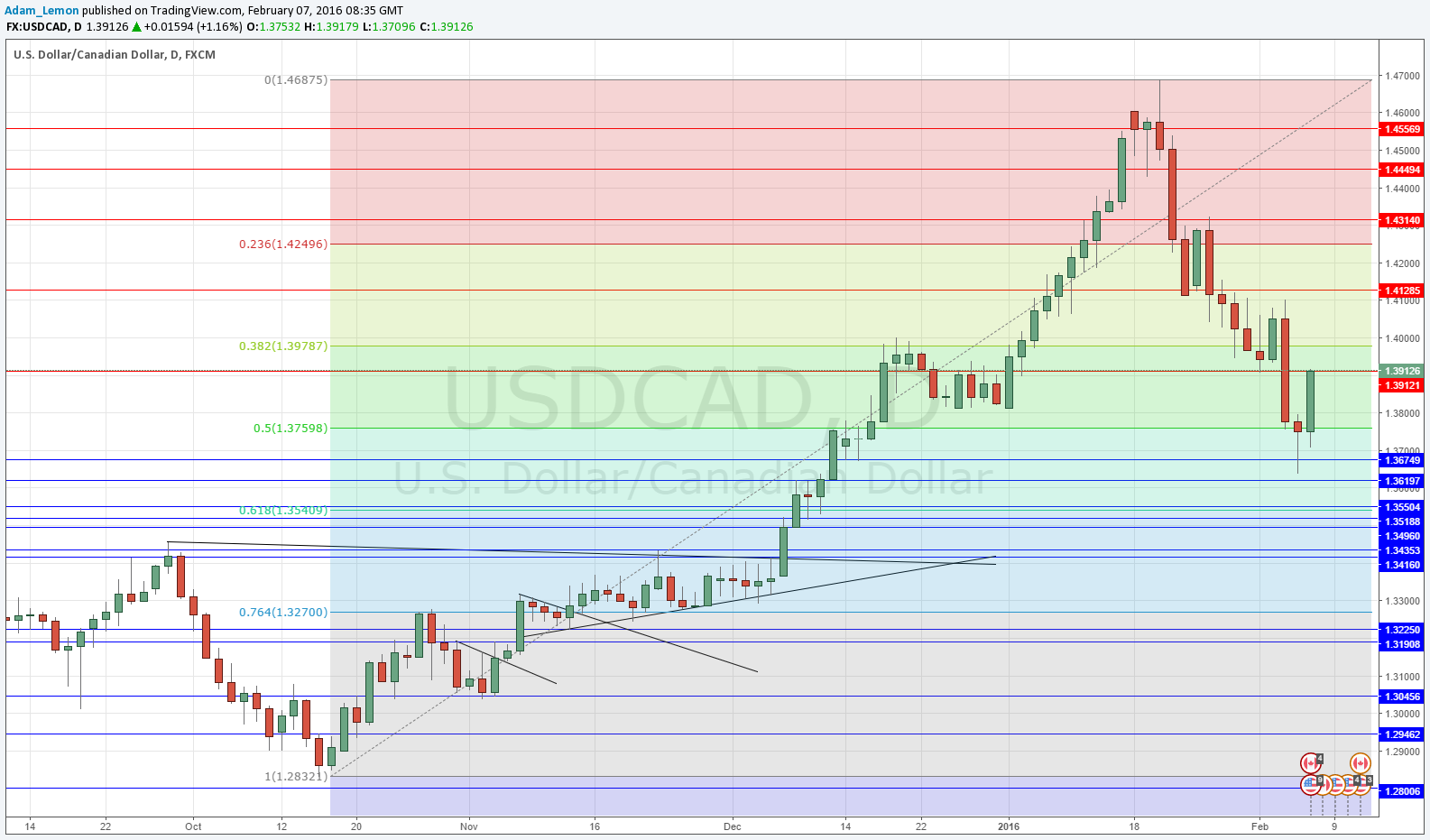

USD/CAD

This pair has been in a long, strong upwards trend over the past couple of years or so, reaching a new 12 year high just a few weeks ago. However over recent weeks the pair has seen a spectacular fall of about 1,000 pips, and it never really bottomed out, just stalled before falling further still.

It is important to keep in mind the very strong movements against a long-term trend usually do snap back, so although going long this pair has been frightening and unprofitable so far, at some point it is likely to resume its upwards move by at least a few hundred pips. This bottom may have arrived at the end of last week, as the price hit the 50% Fibonacci retracement level of its recent upwards leg. This level was marked by a pin candle on the daily chart followed by a very bullish candle the next day, as shown by the daily chart below. I would still exercise caution on an entry. A pullback followed by the start of another strong upwards thrust would be ideal, as the price has not really broken up out of its downwards channel:

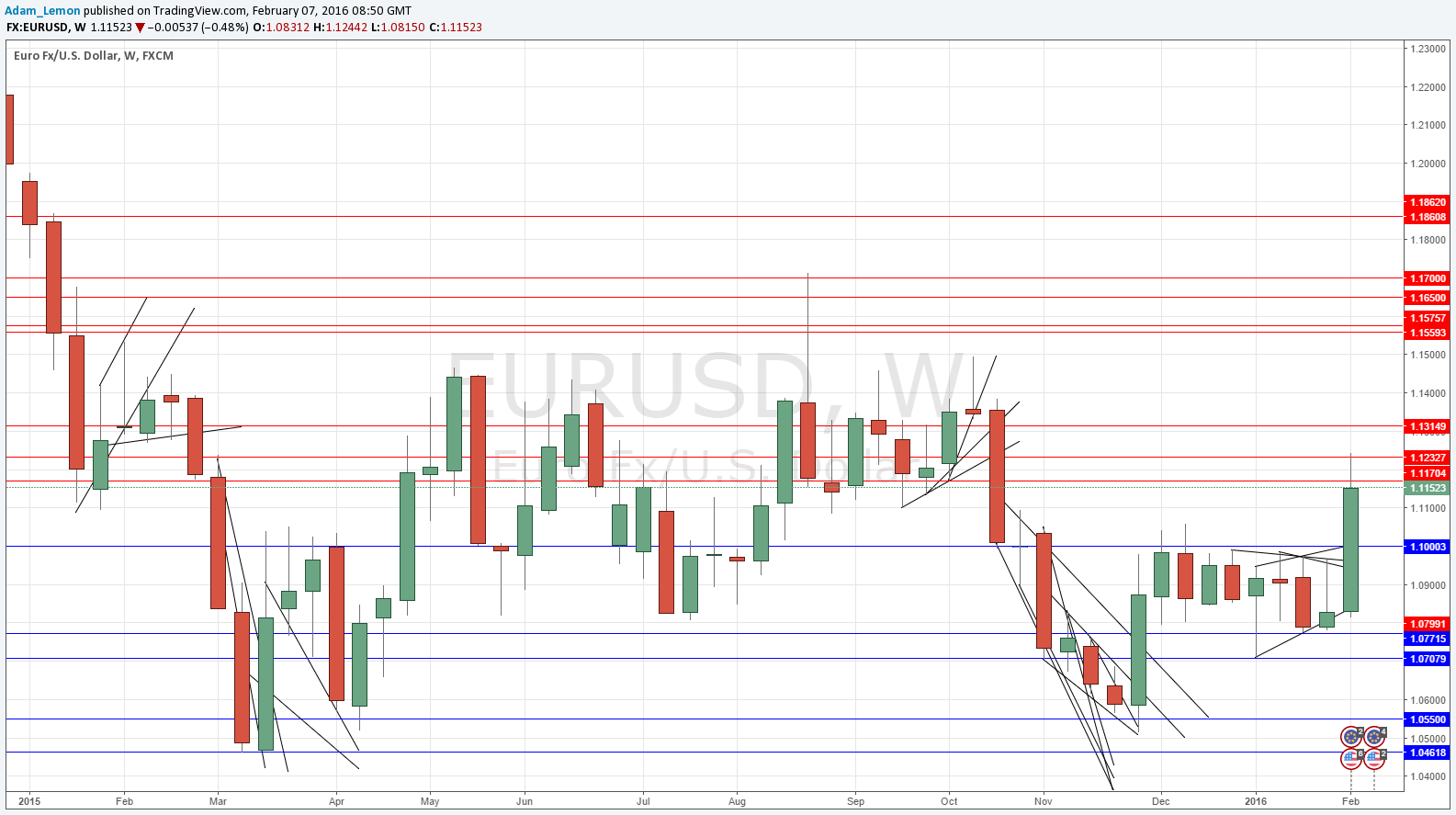

EUR/USD

The weekly chart below shows how for several weeks now, the price had been trying to rise above the area that begins at around 1.0960 and is essentially focused on the key psychological number at 1.1000 although this zone really stretches up to about 1.1050. There was finally a bullish breakout that was very strong, with the price even exceeding 1.1200 at one point before falling back. The EUR has been the strongest currency over recent months and the USD has weakened quite significantly. Additionally, we have put in a double bottom at around 1.0500. Therefore I see the beginning of a bullish trend here in this pair, although there is a lot of resistance starting at around 1.1200 so a serious pullback will probably be necessary first.

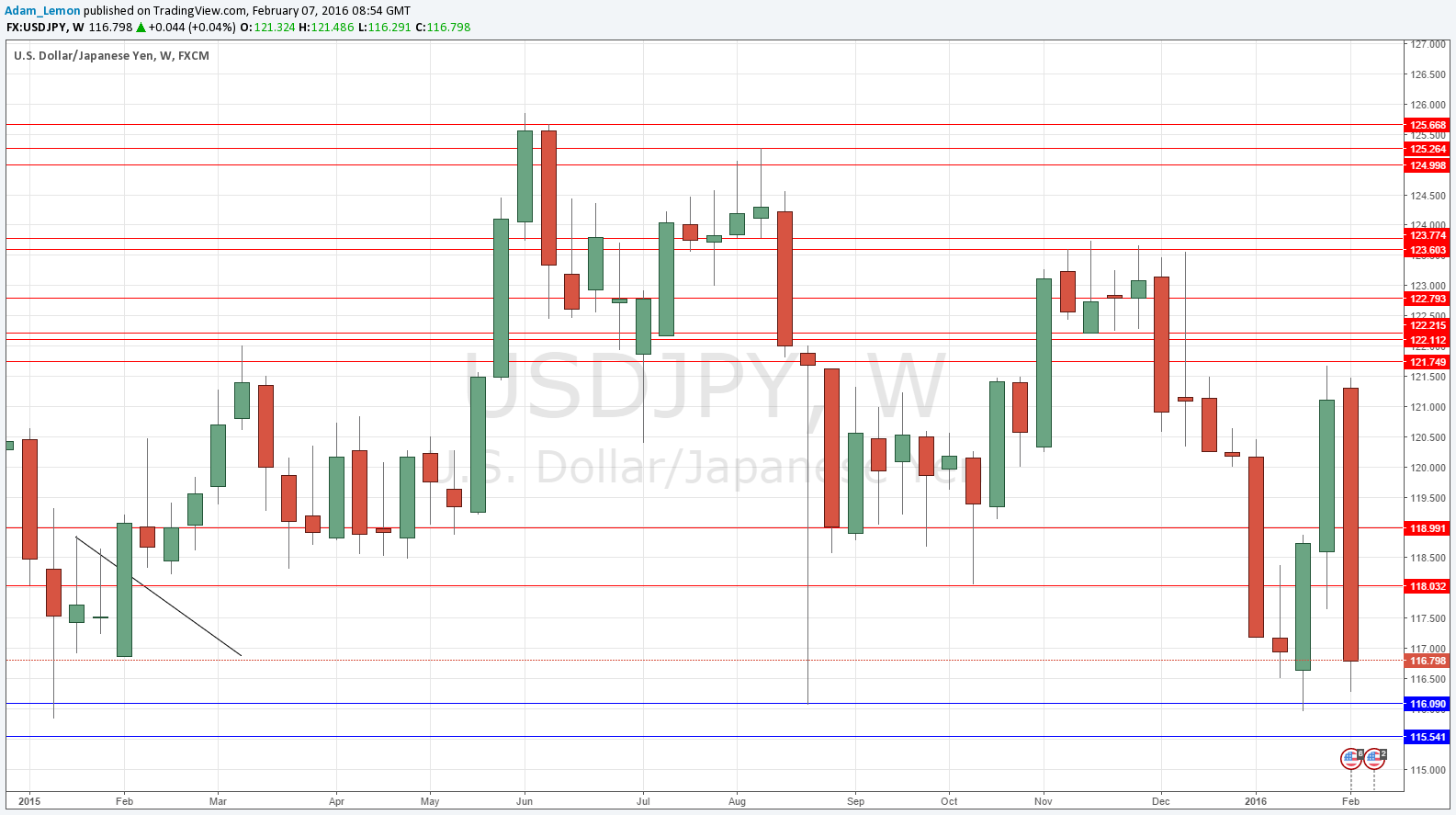

USD/JPY

The Japanese Yen has emerged as one of the strongest global currencies due to prevailing “risk-off” sentiment, and is now at a stronger level against the USD than it was before the Bank of Japan’s negative rate move! The weekly chart below shows there has been a choppy yet real downwards trend since June 2015. We are approaching very key support just above 116.00 however so be careful there.

The safest trades of the week are probably going to be long USD/CAD and EUR/USD, and to a lesser extent short USD/JPY. Cautious traders may prefer to remain on the sidelines for a while longer.