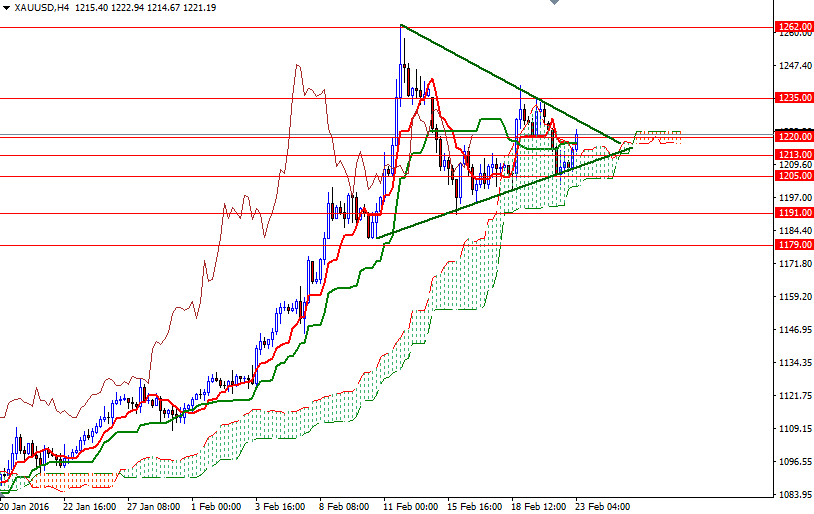

Gold declined for a second straight session yesterday as strength in the dollar and equities lured some investors away from the precious metal but continued skepticism that the Federal Reserve would be able to hike interest rates four times this year limited losses. The XAU/USD pair initially fell to the broken long-term bearish trend line but the market found support around the 1205 level and edged higher.

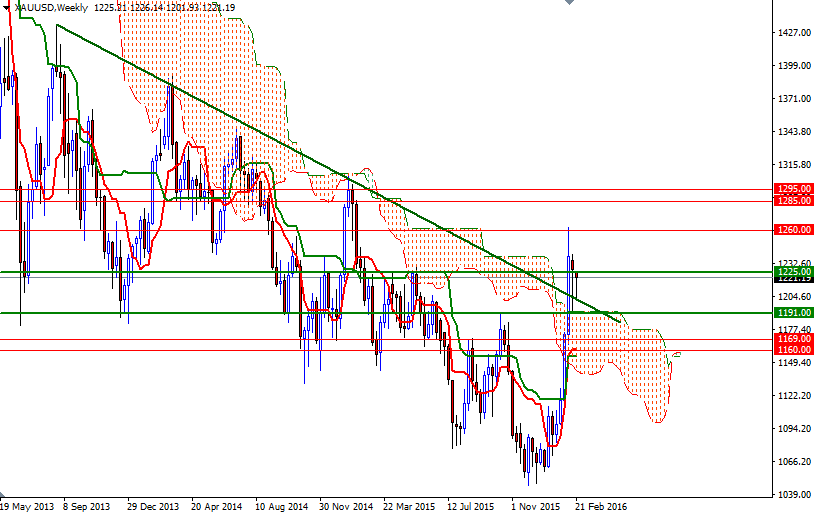

Technically, trading above the Ichimoku clouds (on both the daily and 4-hourly charts) gives the bulls an advantage over the medium-term. Positively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also support this theory. However, 1225 will be the key level for the bulls to pass in order to challenge the bears at the 1235 battle field. Penetrating this barrier would suggest an extension towards the 1250 resistance level.

To the downside, there is an anticipated support zone that stretches from 1213 to 1201. The bears have capture this area occupied by the 4-hourly Ichimoku cloud (and also the short-term ascending trend line) if they intend to drag prices towards the 1191 level. If the bears succeed in cracking the 1191 support, then they will probably aim for 1181/79 afterwards.