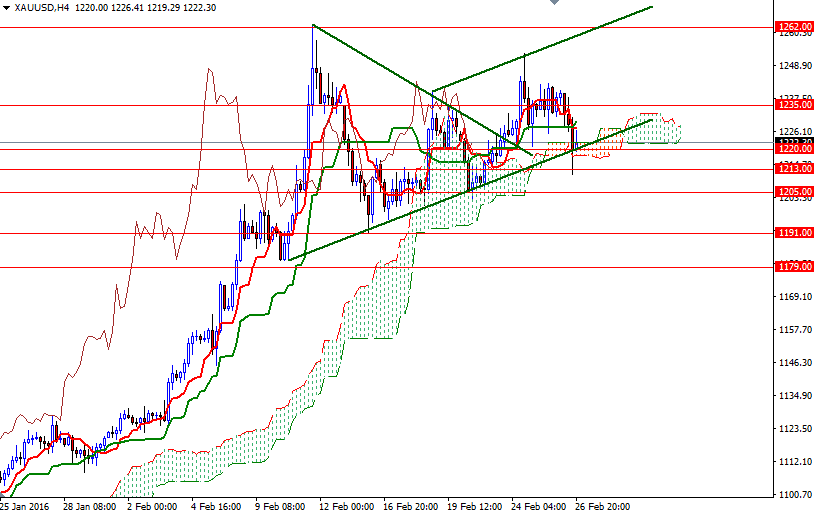

Gold ended the week down by 0.24% at $1222.30 an ounce but it rose nearly 9.5% in February. The XAU/USD pair tried to break out to the upside last week but the expected resistance between the $1250 and $1260 levels kicked in and capped the market, sending it back to the previous resistance now flipped to support at $1213. Gold has been struggling for the last couple of weeks as strength in the dollar weighed on the market and a recovery in stock markets reduced the need for insurance against risks.

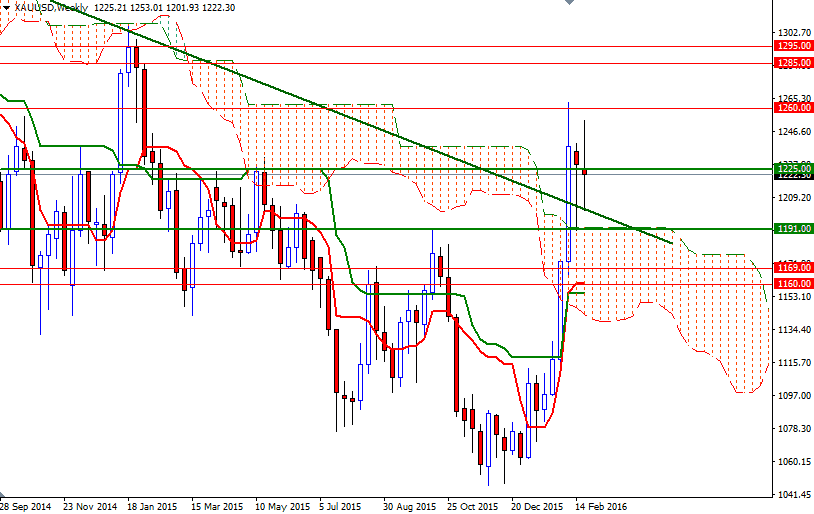

However, given the increasingly challenging investment and economic environment, investors' love affair with gold may not come to an abrupt end anytime soon. The precious metal absorbed a decent amount of profit taking and liquidation, since it broke out of its downtrend. On both the weekly and daily time frames, the XAU/USD pair is trading beyond the Ichimoku clouds and we have bullish Tenkan-sen (nine-period moving average, red line) - Kijun-sen (twenty six-period moving average, green line) crosses, indicating that we have more pressure from buyers than sellers over the medium-term. In other words, there is the possibility of further price gains, if the 1191/89 support remains intact.

The first hurdle gold needs to jump is located at 1235. The bulls will have to overcome the resistance at around 1245 in order to set sail for the 1262/0. Closing beyond that could attract new buying and open a path to the 1285 level. Despite the positive medium-term outlook, short term charts suggest that a retest of 1205/1 is likely unless the support around the 1213 level withstands and halts the bears' progression. Below 1201, the 1191/89 zone stands out and the bears will have to demolish this significant support so that they can test 1079 afterwards. A break below the 1179 support (the 38.2% Fibonacci of the 1046.33 - 1263.27 move) would open up the risk of a move towards 1169.