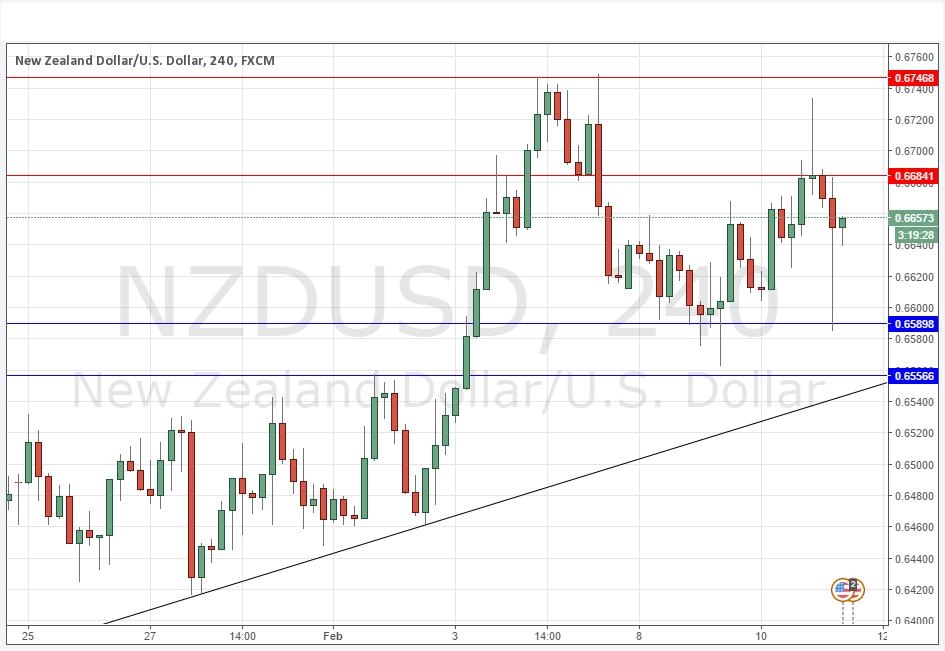

NZD/USD Signal Update

Yesterday’s signals were not triggered and expired as the bearish price action took place above 0.6681.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be made between 8am New York time and 5pm Tokyo time.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6590.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6557.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6681.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

NZD/USD Analysis

This pair is holding up quite well, with support levels and a bullish trend line below holding up the price. It looks as if we may be beginning a consolidation between about 0.6600 and 0.6750. I definitely maintain a bullish bias. Any good news from New Zealand arriving in the near future would be likely to get this pair moving upwards with some momentum.

There is nothing due today concerning the NZD. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time. The Chair of the Federal Reserve will be testifying before Congress at 3pm.