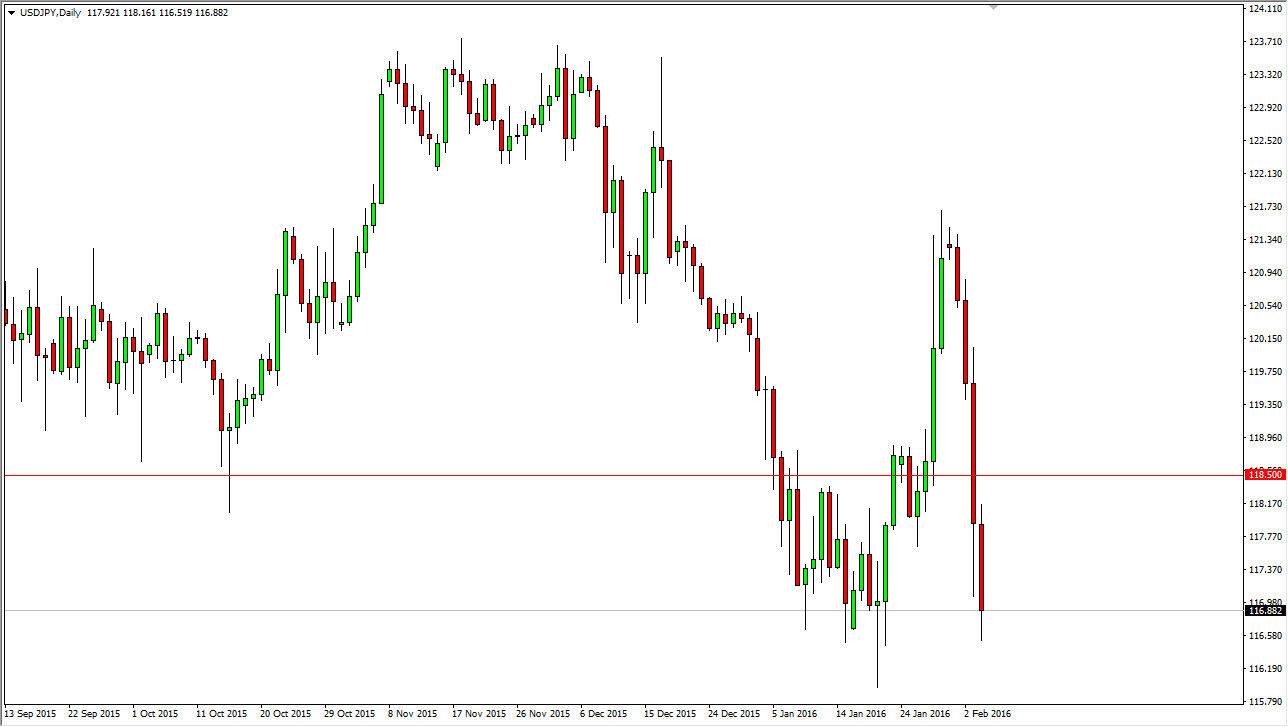

USD/JPY

The USD/JPY pair fell rather significantly during the course of the day on Thursday, as we prepare for the Nonfarm Payroll Numbers coming out later today. Because of this, it looks as if we are testing a very significant support level, and as a result we could have a significant breakdown later in the day. We would have to break down significantly below the hammer from a couple of weeks ago, which is extensively the 116 handle. However, the one thing that I do notice about this chart is that we have pullbacks so far that I think that the real threat of a shock move in the market would be to the upside. For example, if we got a better than anticipated jobs number, I think this market would skyrocket to at least the 118.50 level. One thing you can count on today though, that’s going to be massive volatility.

AUD/USD

The AUD/USD pair initially broke out during the day on Thursday, clearing the top of the previous uptrend line which I have been suggesting is massive resistance. The fact that we turned back around to form a shooting star suggests that perhaps the Australian dollar has gotten a little bit ahead of itself. Gold markets are most certainly helping the Aussie at the moment, but at the end of the day we still have to deal with the jobs number before we can decide what to do about the US dollar itself.

The candlestick is very bearish, and if we break down below we could very well find ourselves going lower. In fact, I would think that the market could go down to the 0.70 level pretty quickly. On the other hand, if we break above the shooting star from the session on Thursday, that would be a very bullish sign and I believe at that point the Australian dollar would continue to go much higher and for the longer term.