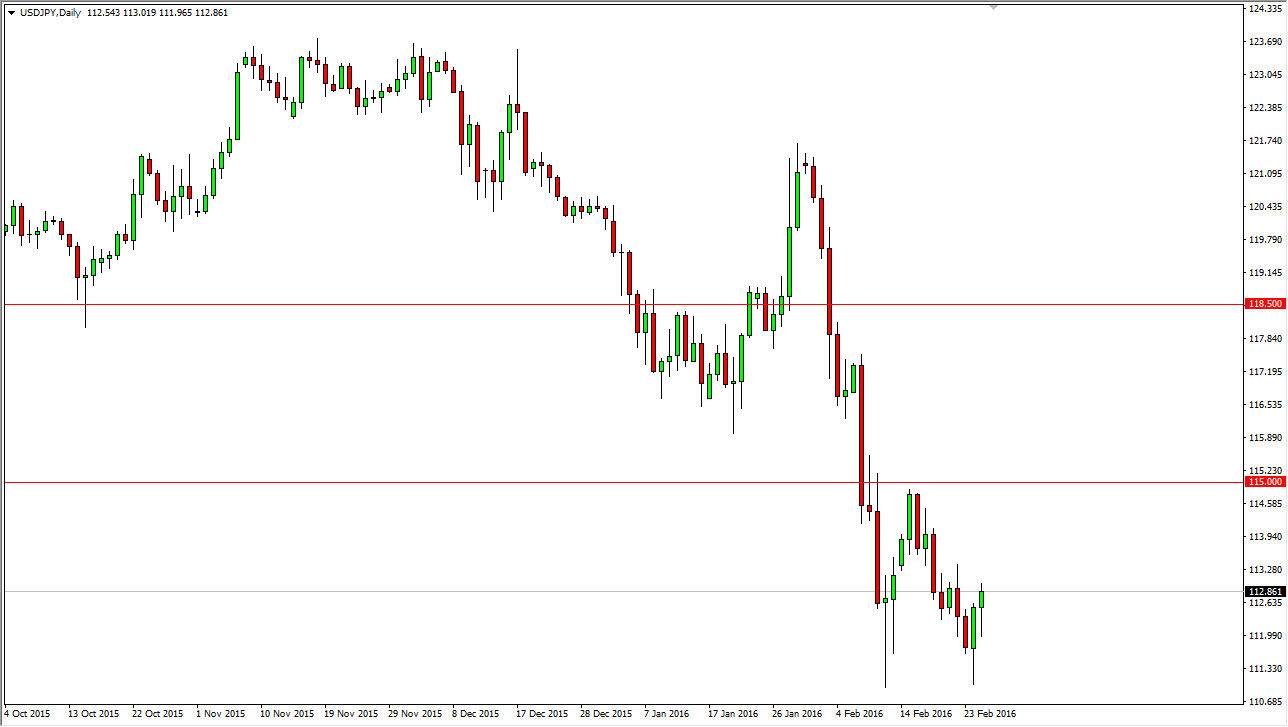

USD/JPY

The USD/JPY pair initially fell during the course of the day on Thursday, but found enough support near the 112 level to turn things around and form a hammer. This is a very bullish sign, and as a result I believe that if we can break above the top of the range for the day the market very well could go to the 115 handle next. I don’t necessarily think that were going to break out above there, just that this is a return to the consolidation that this pair has seen recently. However, if we do break above the 115.50 level, I feel that the market would then be very bullish and the only thing you can do is buy. Ultimately though, it’s likely that the 115 level will offer enough resistance to form an exhaustive candle and offer a shorting opportunity at that point.

NZD/USD

The NZD/USD pair rose during the course of the session on Thursday, slamming into the top of the recent consolidation area. Because of this, I think that if we can break above the 0.6750 level, the market could go as high as the 0.69 level but I don’t think it can to be an easy move to make. I have to admit that the fact that we closed towards the top of the candle suggests that we will eventually break out, so short-term pullbacks might be buying opportunities going forward.

I have no real interest in shorting this market at least not yet. At this point in time, keep in mind that the commodity markets are highly influential as to where the New Zealand dollar goes, so it is possible that we could get some massive commodity sell off again which of course would weigh heavily upon the New Zealand dollar. Ultimately, this is a market that should break out but will have a hard time going higher.