USD/CHF Signal Update

Yesterday’s signals were not triggered as there was no bearish price action at 0.9900.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

Long Trade 1

* Long entry after bullish price action on the H1 time frame following the next touch of 0.9900.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry after bullish price action on the H1 time frame following the next touch of 0.9820.

* Put the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short after bearish price action on the H1 time frame following the next entry into the zone from 0.9980 to 1.0025.

* Put the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

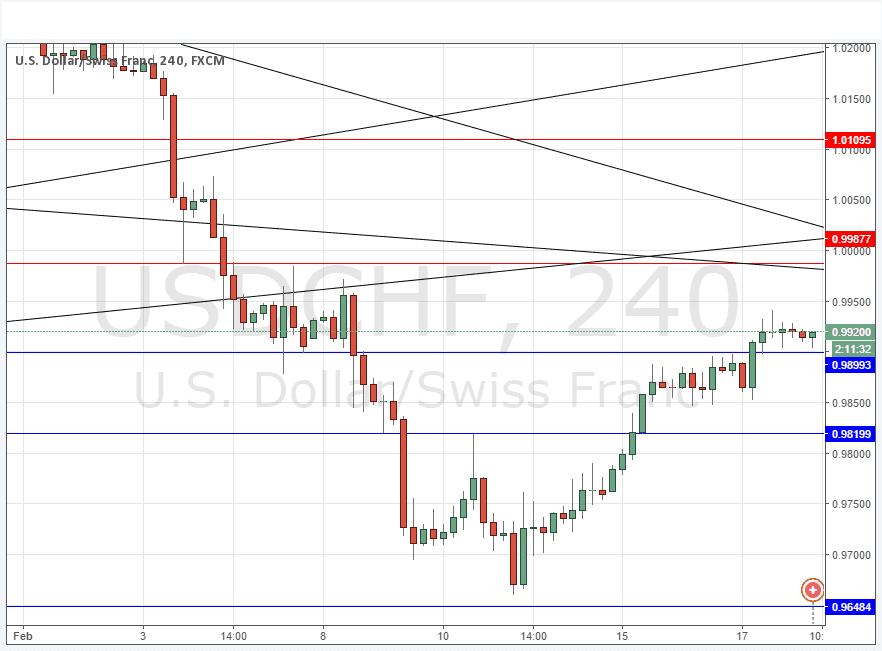

There has been a small change in the technical picture that indicates increasing bullishness: the price was able to break up above resistance at the round number of 0.9900 and this is quite likely to have become supportive.

The next major zone of resistance lies above confluent with the very large psychological number of 1.0000: there are three bearish trend lines as well as a flipped level. That is a pretty big confluence so it might be very strong and give a great short opportunity if and when it is reached.

There is nothing due today concerning the CHF. Regarding the USD, there will be releases of the Philly Fed Manufacturing Index and Unemployment Claims data at 1:30pm London time, followed later by Crude Oil Inventories at 4pm.