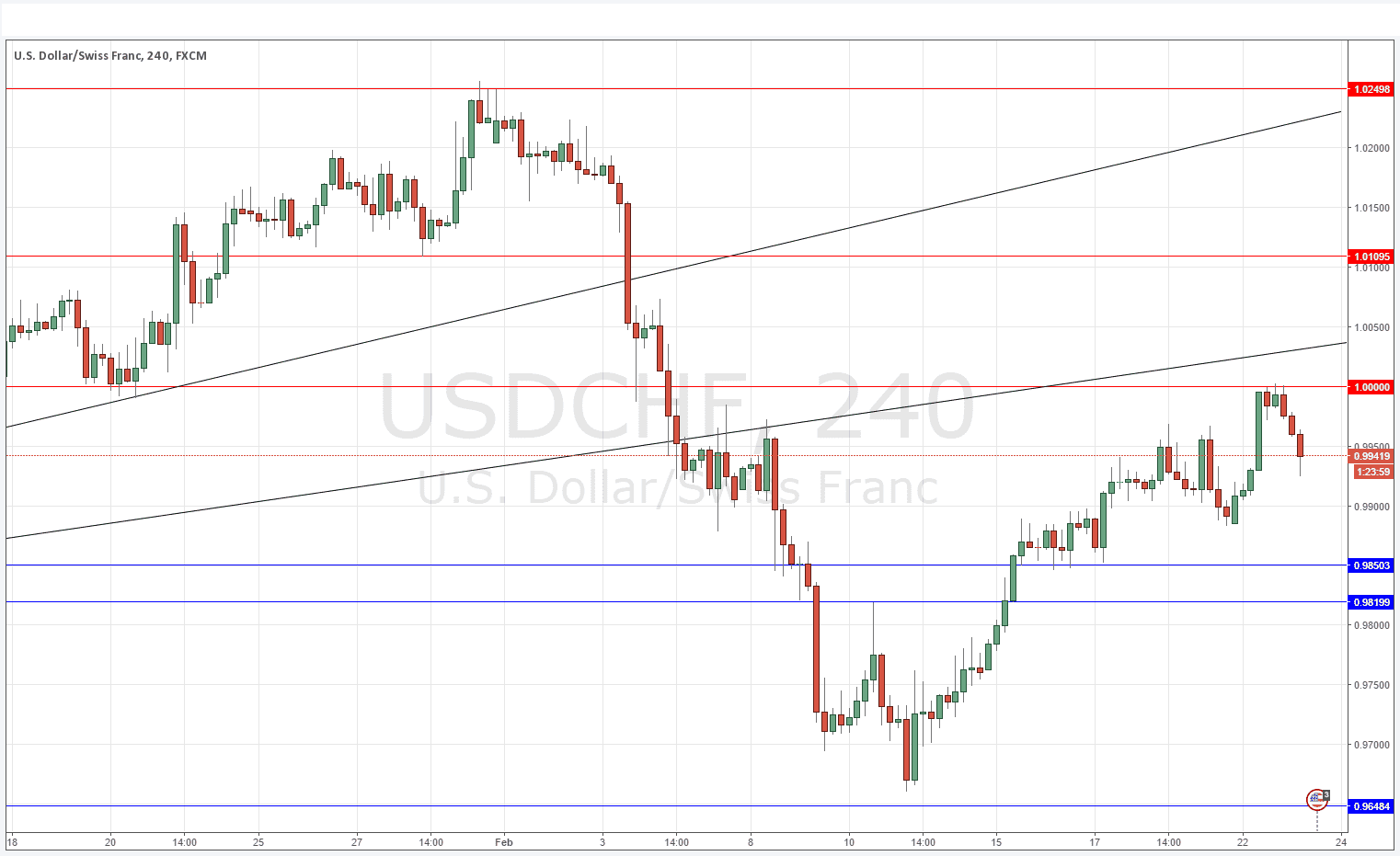

USD/CHF Signal Update

Yesterday’s signals did not produce a trade but were successful in forecasting a resistant zone close to 1.0000.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trade 1

* Long entry after bullish price action on the H1 time frame following the next entry into the zone between 0.9850 and 0.9800.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 1.0000.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry after bearish price action on the H1 time frame following the next touch of the trend line currently sitting at around 1.0030.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

As anticipated, the price was not able to penetrate the area at around 1.0000 and has fallen back from there by more than 60 pips since yesterday. We are still quite a way from support so there may be another short opportunity before then at another test of 1.0000 or possibly the trend line above it.

Alternatively a trip down to 0.9850 to 0.9800 which is a supportive zone could give a good opportunity for a long trade.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of CB Consumer Confidence data at 3pm.