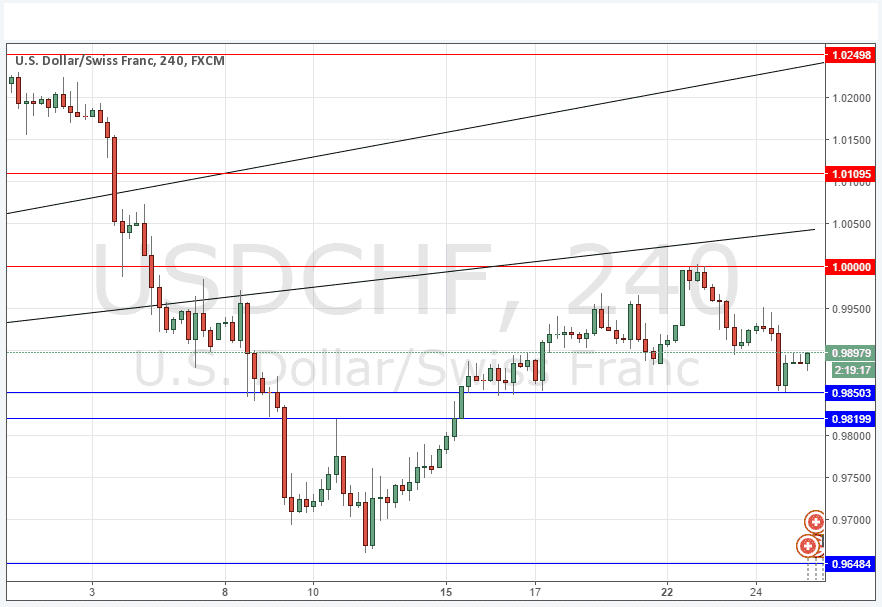

USD/CHF Signal Update

Yesterday’s signals were not triggered as unfortunately the price turned just 2 pips before reaching the anticipated support zone which begins at 0.9850.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today.

Long Trade 1

* Long entry after bullish price action on the H1 time frame following the next entry into the zone between 0.9850 and 0.9800.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry after bearish price action on the H1 time frame following the next touch of 1.0000.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I wrote yesterday that “round numbers seem to be extremely influential as support and resistance with this currency pair” and I would go even further and point out that .50 levels seem to be quite important as well!

We bounced off support at 0.9850, are struggling now at minor resistance at 0.9900, there is further probable minor resistance ahead.at 0.9950.

Where this pair is right now is a good example of how a pair that has no strong trend can be traded successfully by expecting reversals at support and resistance levels.

There is nothing due today concerning the CHF. Regarding the USD, there will be releases of Core Durable Goods Orders and Unemployment Claims at 1:30pm London time.