USD/JPY Signal Update

Last Thursday’s signals were not triggered.

Today’s USD/JPY Signals

Risk 0.75%

Trades must be taken from 8am New York time until 5pm Tokyo time only.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 111.00.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 114.21.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

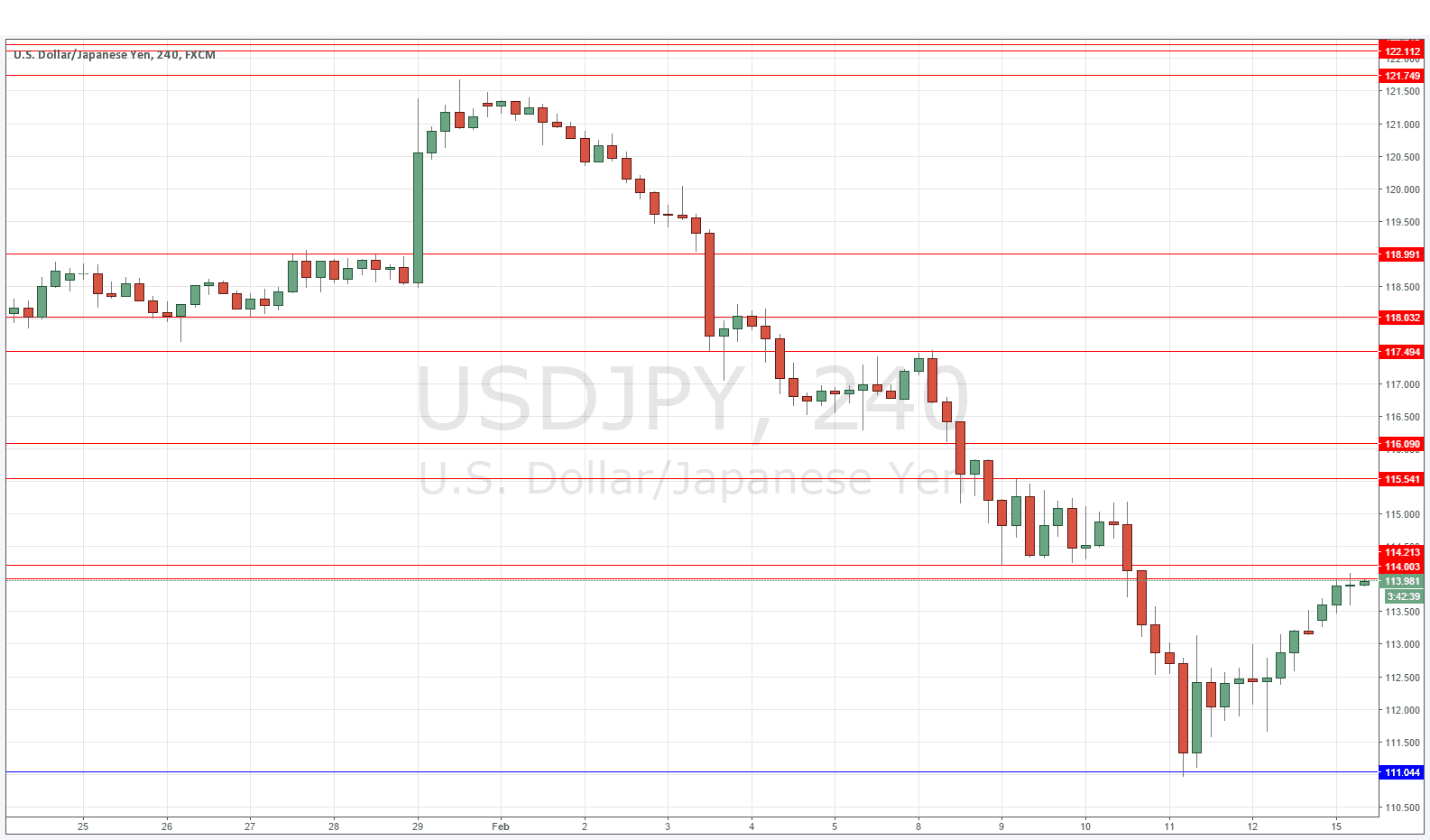

USD/JPY Analysis

This pair just collapsed towards the end of last week with market turmoil sending flow into the JPY as a safe have, while the USD crumbled with Yellen’s back tracking over the Fed’s proposed rate cut timetable.

However there was strong buying from 111.00 which was suspected to be an intervention from the Bank of Japan, and the price has risen quite smoothly to retest the structure just above 114.00 which is where the final push down originated from.

It is a public holiday in the U.S. today, but the possibility of another move down from 114.21 if it is reached again today is quite real. It might not happen until the Asian session later, or perhaps even during tomorrow’s New York session.

There is nothing due today concerning either the JPY or the USD.