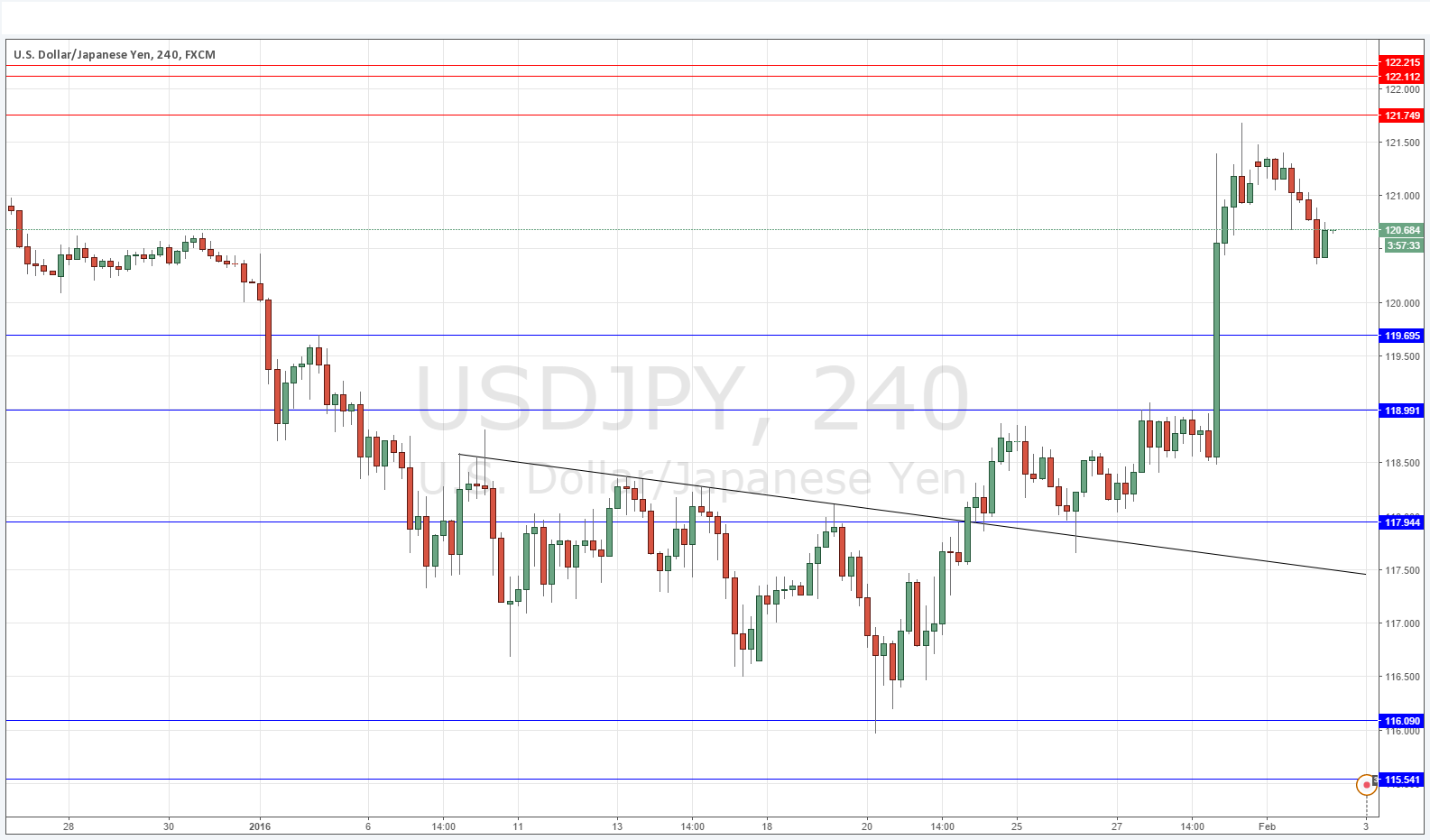

USD/JPY Signal Update

Yesterday’s signals were not triggered as there was no bullish price action at 120.64.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be entered between 8am New York time and 5pm Tokyo time.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 119.70.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 119.00.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 121.75.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 122.11.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

There is not much new worth saying about this pair. After Friday’s central bank driven spike up, the price has met resistance just under the key level of 121.75 and has been falling off relatively slowly from there. We are just erasing or breaking the previously anticipated support at 120.64 and there are no key levels until 119.70.

Although the picture looks bullish superficially, the Bank of Japan has acted to weaken the Yen, a look at a long-term chart shows that there is actually a bearish trend with a rough channel shape that is holding, so although the fundamental factors do not match, holding a bearish bias long-term might pay off.

Regarding the JPY, the Governor of the Bank of Japan will be speaking at 4:30am London time. There is nothing due concerning the USD.