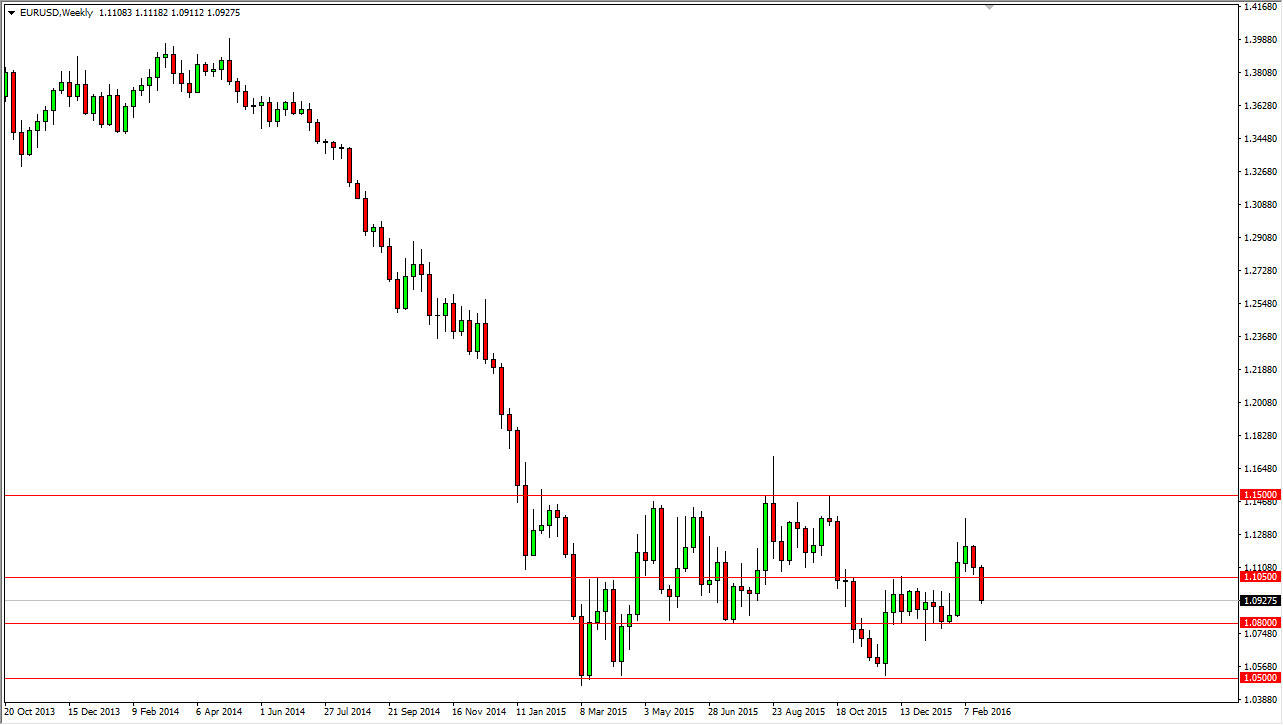

EUR/USD

The EUR/USD pair fell significantly during the course of the week, breaking below the 1.1050 level. That being the case, the market looks as if it is trying to reach towards the 1.08 level, which was massively supportive in the past. At this point in time, look for short-term rallies that show signs of exhaustion that you can sell again and again, but a longer-term move is probably off the table at this moment in time.

GBP/USD

The GBP/USD pair broke down significantly during the course of the week, slicing through the 1.40 level significantly, and it now looks as if the British pound will continue to drop from here. Ultimately, the 1.35 level below should be the next target, and as the British are voting on whether or not to stay in the European Union, there’s likely going to be more volatility ahead. At this point in time, I think that anytime this market rallies you can start selling again.

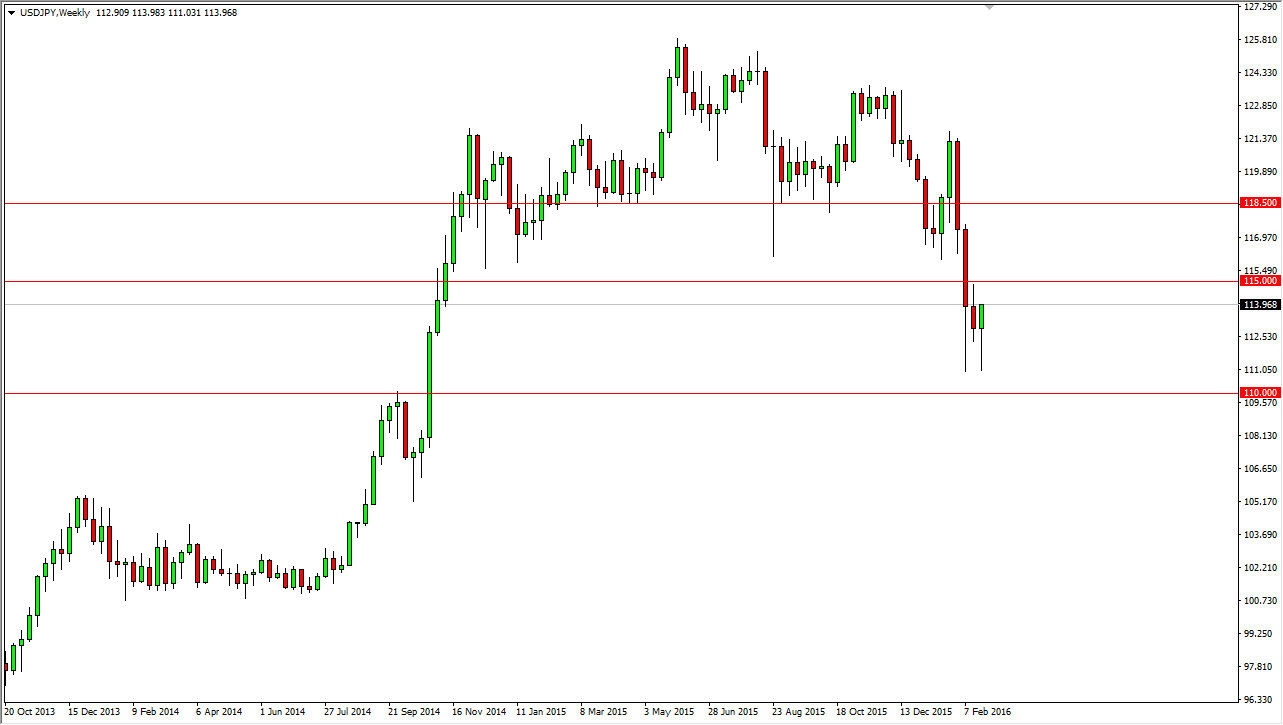

USD/JPY

The USD/JPY pair initially fell during the course the week but turned back around and form a hammer. While this is a very bullish sign, I’m not comfortable buying this pair until we get above the 115 level. With that being the case, the market then could be bought but until then you have to be very careful. If there is an exhaustive candle on a short-term chart, you can start to think about selling for short-term trades at best.

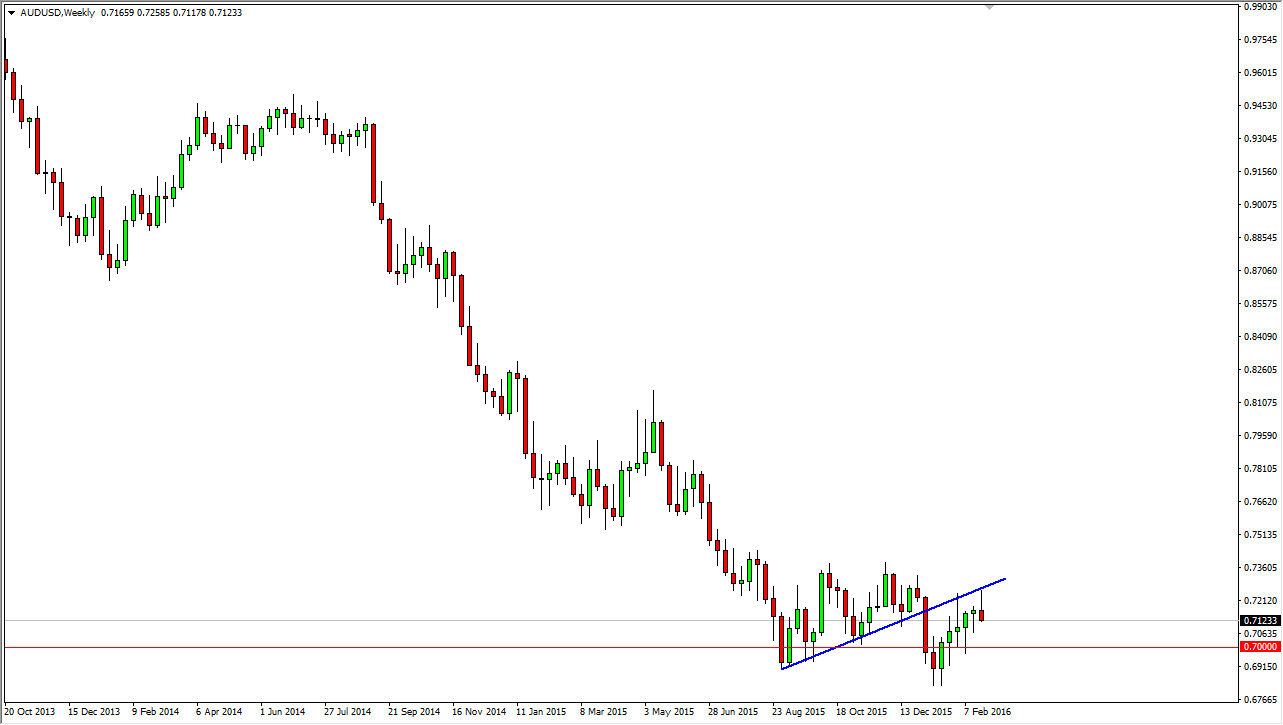

AUD/USD

The AUD/USD pair initially tried to rally during the course of the week but found the previous uptrend line as resistance yet again. By doing so, we ended up turning back around to form a shooting star. With that being the case, looks as if the market will fall from here and I now believe that the Australian dollar will go down to the 0.70 level.