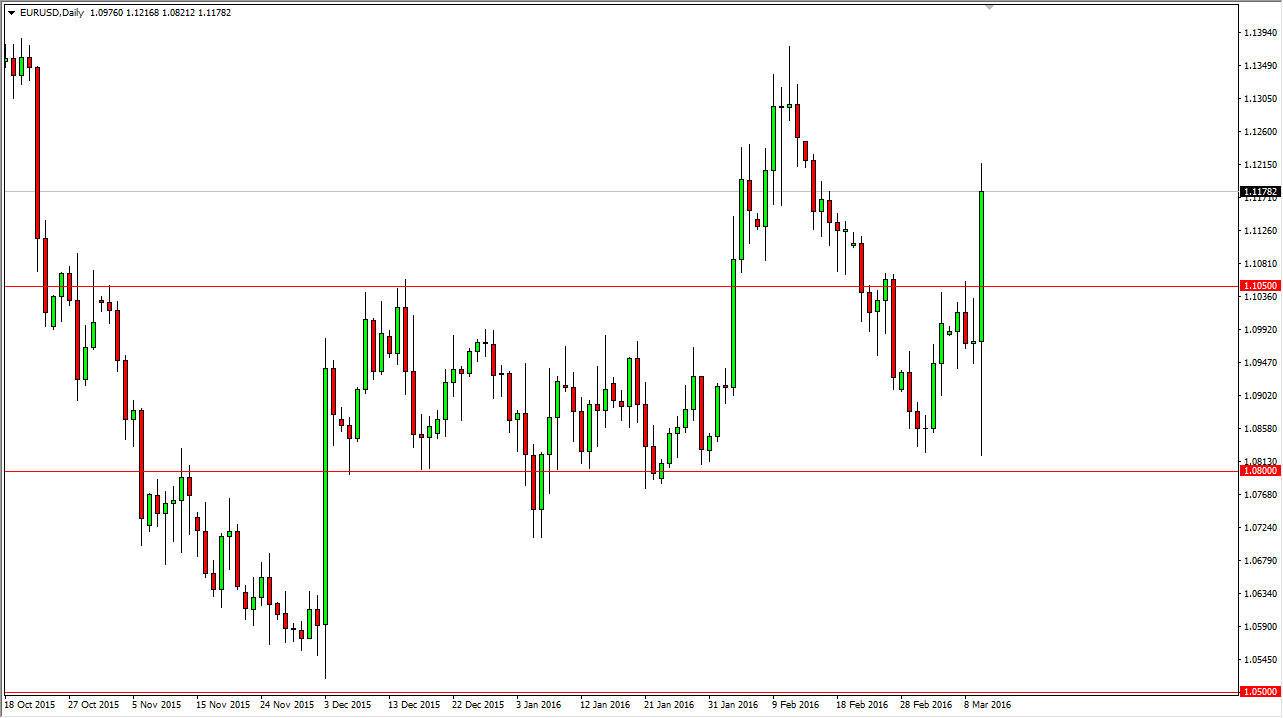

EUR/USD

The EUR/USD pair initially fell during the course of the day on Thursday, testing the 1.08 level below. That was an area that offered quite a bit of support, and quite frankly it has been in the past. The European Central Bank had an interest-rate announcement as well as the monetary policy statement coming out and obviously this did not impress currency traders as the ECB’s attempt to bring down the value of the Euro completely failed. We pullback and then bounced drastically to break above the 1.1050 level, an area that had been massively resistive. Now that we are broken above there, we should continue to go much higher. A pullback in the meantime should be a buying opportunity on signs of support. The 1.1050 level below is going to be support now, as it was previously resistance.

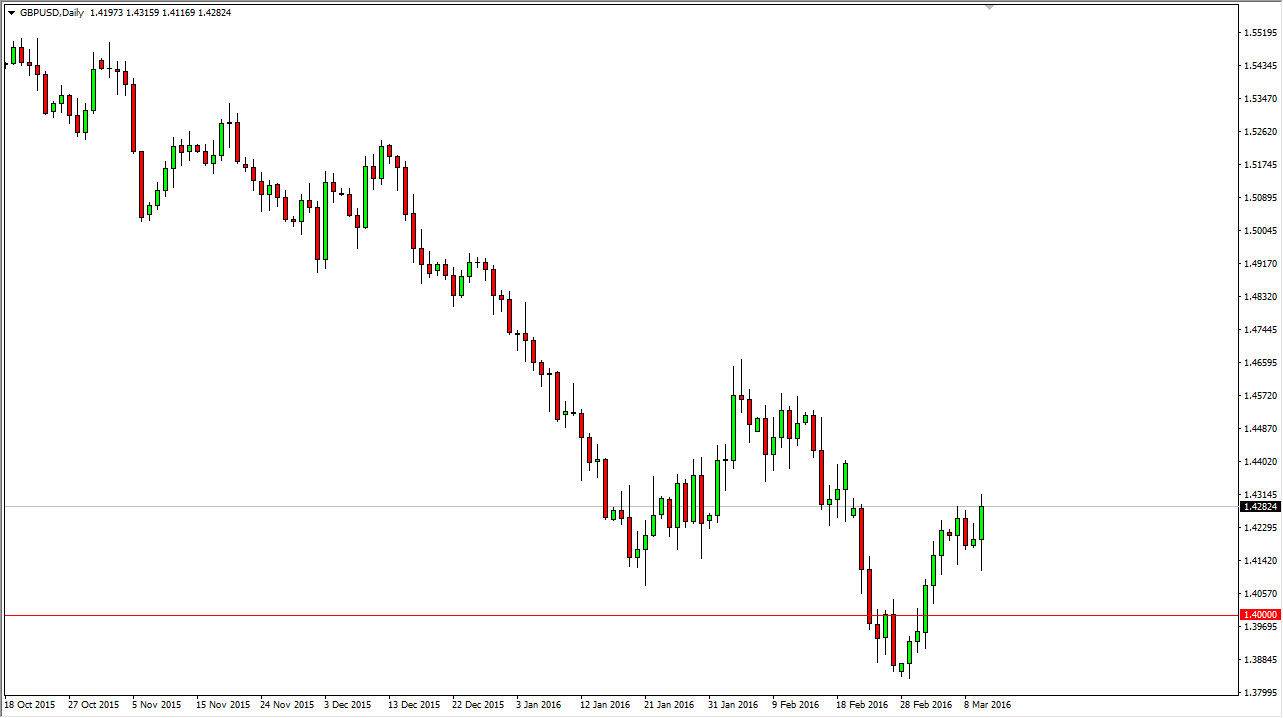

GBP/USD

The GBP/USD pair fell during the course of the session on Thursday, testing the 1.41 level for support. We found support in that area, and then bounced significantly to test the 1.43 handle. Ultimately, this is a market that will probably grind its way to the 1.45 handle over the longer term, but there is a lot of noise above. Because of this, although I believe that the market goes higher I think it’s probably going to be easier to trade other currency pairs at the moment as this market certainly has a lot of noise in it.

On top of that, you have to worry about whether or not the situation of the United Kingdom possibly leaving the European Union should continue to cause quite a bit of chaos in this market and bearishness when it comes to the British pound so. With that being the case, I think it’s easier to sell this market but we need to break down below the bottom of the range during the course of the session to start shorting.