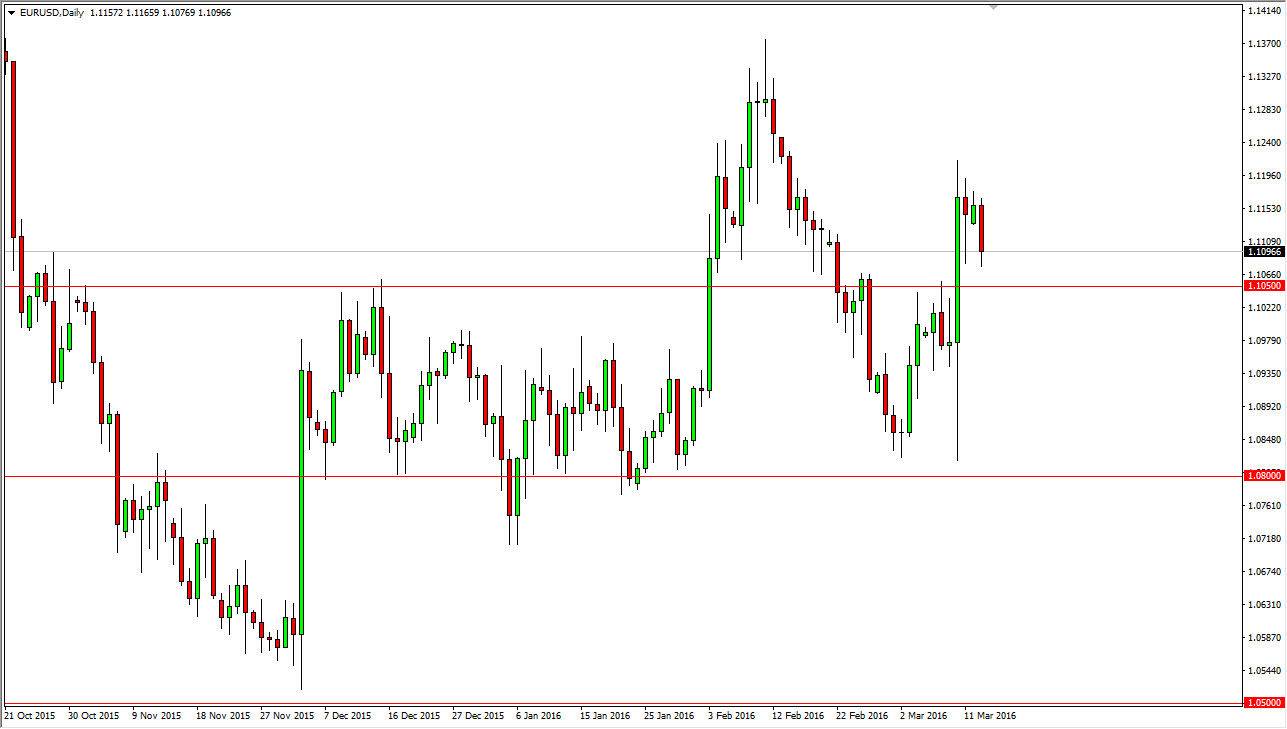

EUR/USD

The Euro fell a bit during the course of the session, and it now appears that we are trying to test the previous resistance yet again. The 1.1050 level below should be supportive, so I feel that it’s only a matter of time before we get a supportive candle that we can start buying. We obviously don’t have that yet, but looking at shorter-term charts you may be able to find that particular trade. Because of this, I think if you are patient enough, the 4-hour chart might give you an opportunity to go long.

If we did break down below the 1.1050 level, I feel that we could probably drop down to about 1.09 but it will be very choppy. It’s probably going to be true with either direction to be honest with you, because this pair tends to be choppy overall these days. You have to keep in mind that both central banks are looking to devalue their own currency, so there will be a lot of reactions from time to time to things that central bankers say.

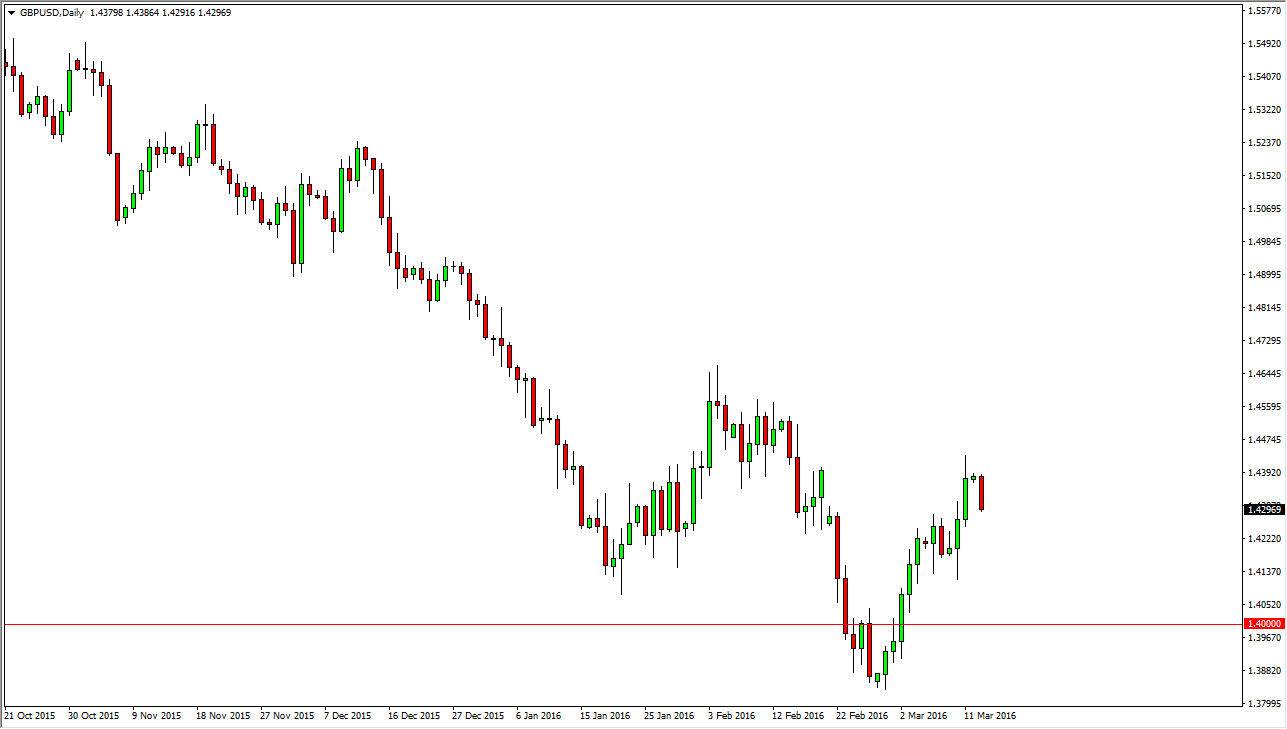

GBP/USD

The British pound fell rather significantly during the day on Monday, not so much in distance but as a real sign of resistance in this general vicinity. Because of this, I feel that this pair will probably go lower but I also recognize that there is a lot of noise just below. While I am bearish of the British pound, I believe that it is going to take a bit of wherewithal through the next several sessions to hang onto a short position.

Nonetheless, the market does look like it wants to go down from here, so if you have the ability to deal with the type of volatility, you could start shorting here. For myself, I would prefer to see a longer-term trades set up, which of course we’ll have quite yet. There is a lot of concern about the United Kingdom leaving the European Union, and that is part of what’s fueling the British pound’s decline.