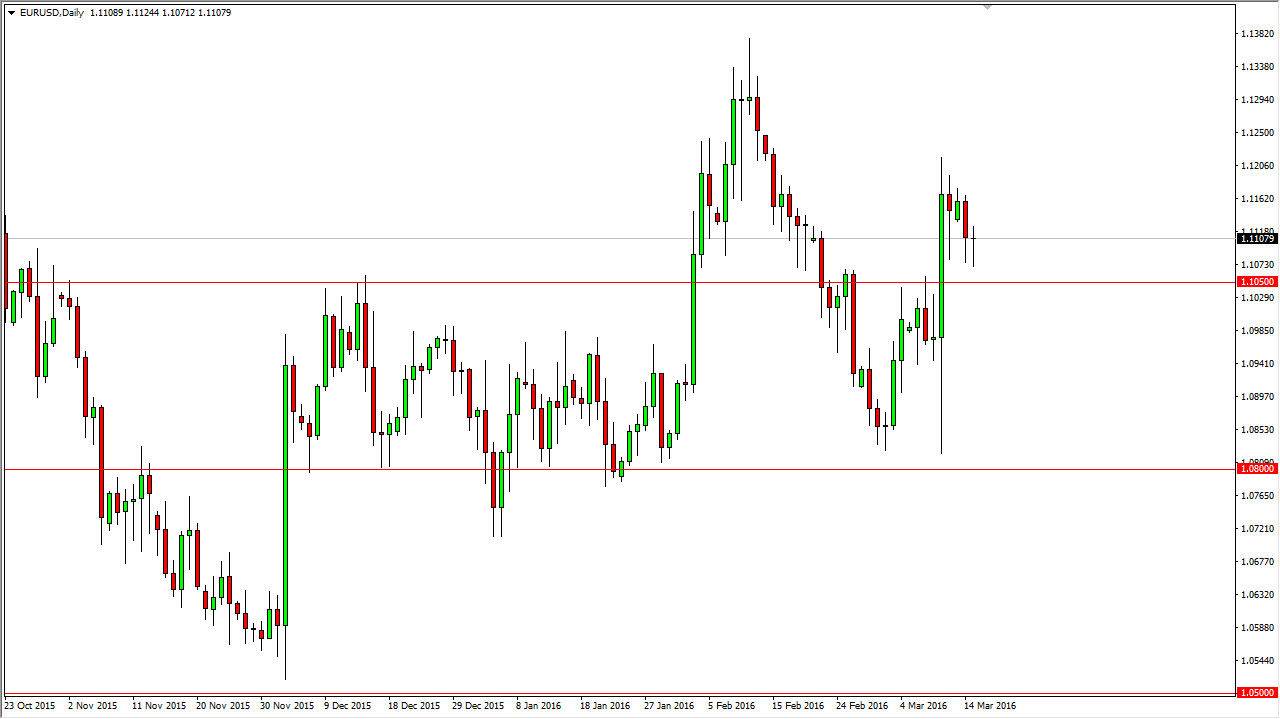

EUR/USD

The EUR/USD pair initially fell during the day on Tuesday, testing the 1.1050 level below for support. We found it there, and as a result we did up forming a hammer. The hammer of course is a very bullish sign, and it has me thinking that this pair is ready to go higher. If we can break above the top of the candle during the course of the day on Tuesday, I feel that the market then goes to the 1.13 level given enough time.

I think that the 1.1050 level below is massively supportive, and as a result it’s difficult to imagine that we go below there, but if we do I feel that would be very negative. We would then head to the 1.09 level for supportive action. If we can get below there, we then go to the 1.08 level, which I feel is a massive barrier for the sellers. Because of this, I think that it’s only a matter of time before we go long regardless.

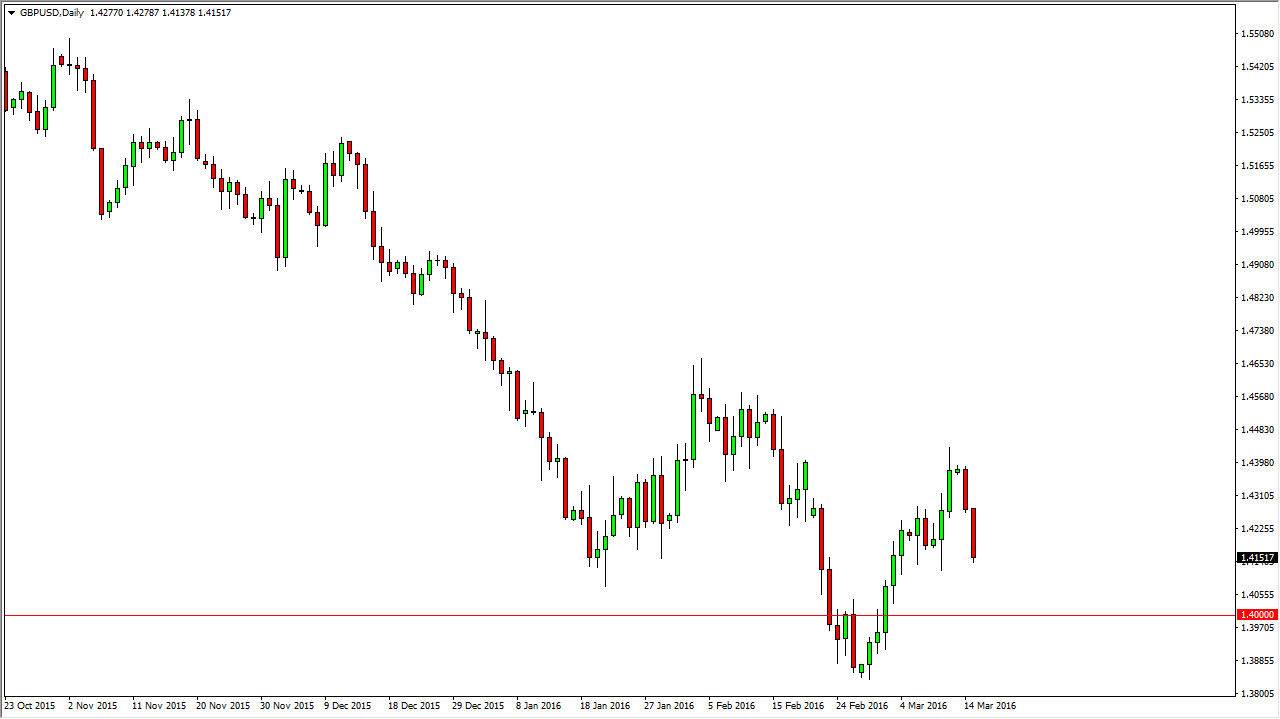

GBP/USD

The GBP/USD pair fell during the course of the day on Tuesday, as it looks like we are ready to head down to the 1.40 level below. That’s an area that of course is a very significant number based upon the round number theory. With that being the case, the market could very well have buyers in that general vicinity, so I’m going to start shorting this market on a break down below the lows of the session here on Tuesday. The 1.40 level below will be targeted obviously, and it could cause a bit of a bounce. However, if we get a bounce and some type of exhaustive candle, that would be a selling opportunity as well.

Remember, people are very concerned about the British pound as there are talks of the United Kingdom possibly leaving the European Union, which of course is a very significant moment. Because of this, the British pound should continue to be very volatile.