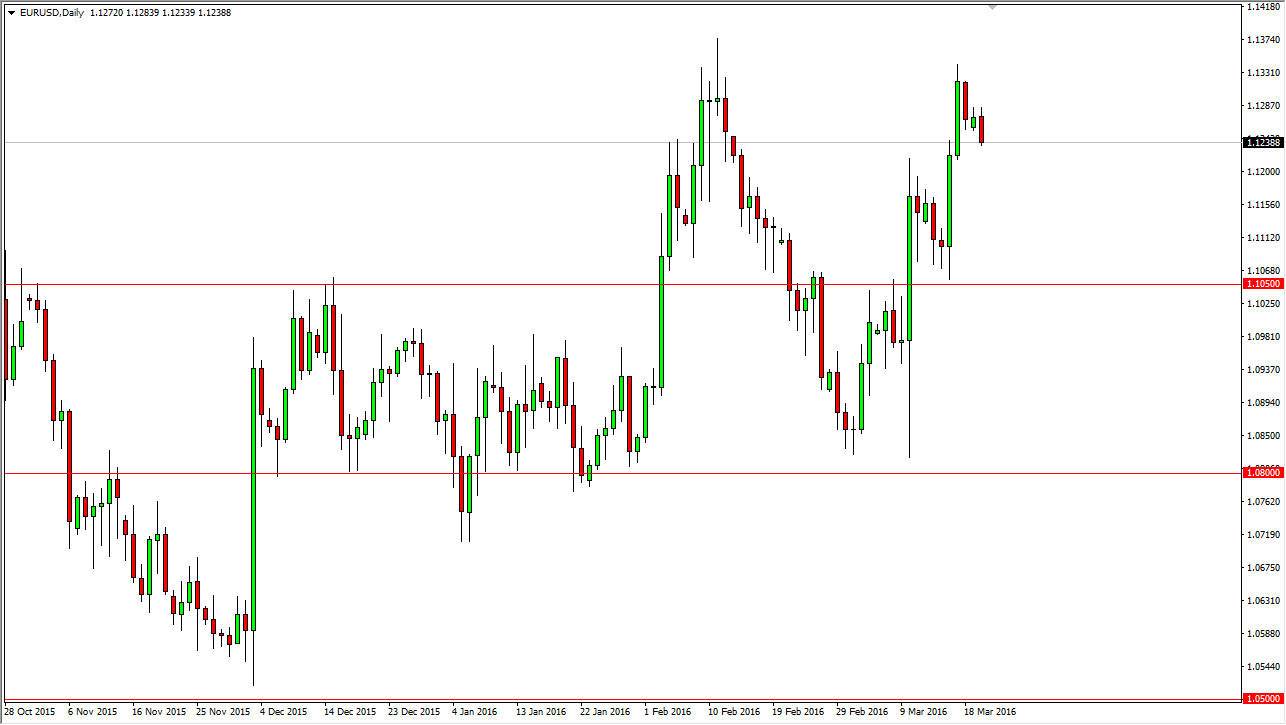

EUR/USD

The EUR/USD pair initially tried to rally during the course of the day on Monday, but turned right back around to show a very negative candle. It looks as if we are going to pull back and perhaps try to find support below, and on a supportive candle I am willing to buy this market. Yes, we have had a very impulsive candle in that there is a significant amount of resistance at the 1.13 level. However, I feel it is only a matter of time before the buyers get involved based upon the impulsivity that we’ve seen. I think that there is a floor at the 1.1050 level as well, and with that being the case, I believe that it’s only a matter of time before the bullish traders return. After all, it was a fairly strong move.

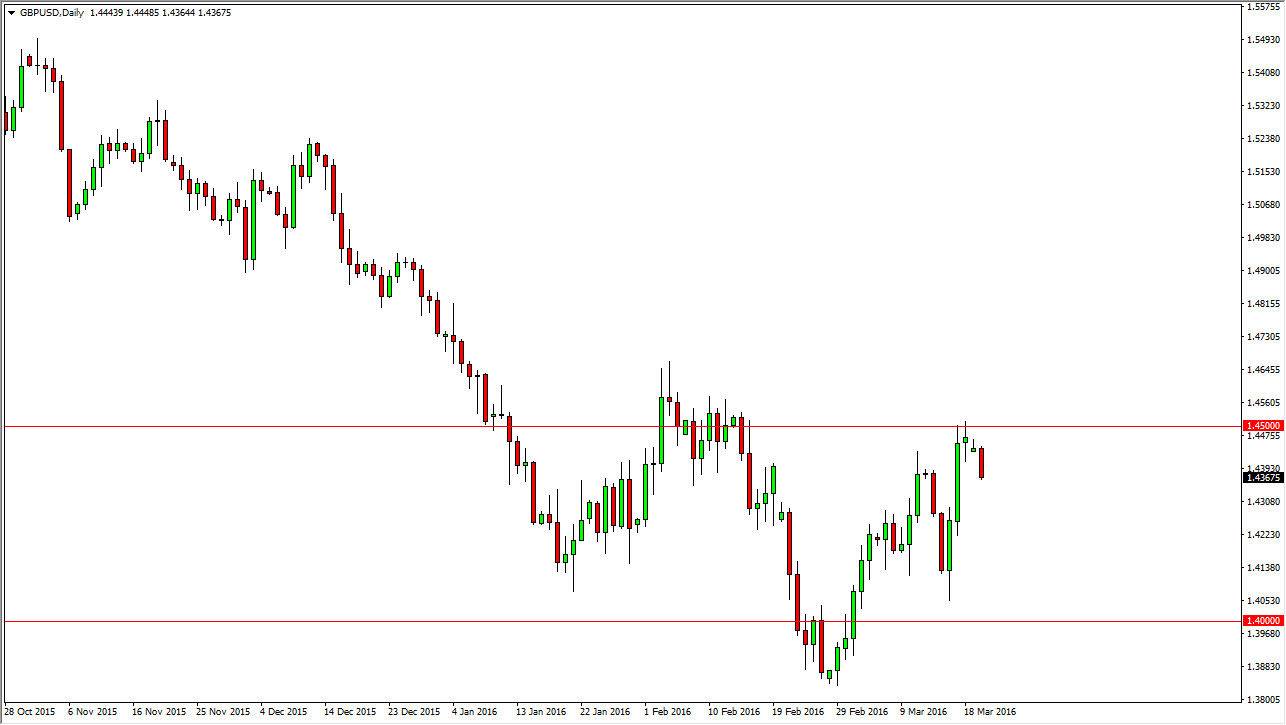

GBP/USD

The GBP/USD pair fell during the day on Monday, as the 1.45 level looks to be very resistive. Because of this, the market could very well drop from here, and I do expect that will happen. However, there should be quite a bit of bullish pressure underneath, so given enough time we should get a supportive candle that we can start buying. If we do get that, I am more than willing to start buying again. I believe that the market will then break above the 1.45 level, and then go to the 1.46 level. Once we get above that level, it’s very likely that we go much higher, perhaps even changing the overall trend. In the meantime, I don’t think that’s ready to happen yet. After all, we have to worry about whether or not the United Kingdom is going to leave the European Union, and as a result there will be a little bit of an overhang when it comes to the British pound. Having said that, I do believe that the market goes higher, it’s just that the British pound underperforms the Euro.