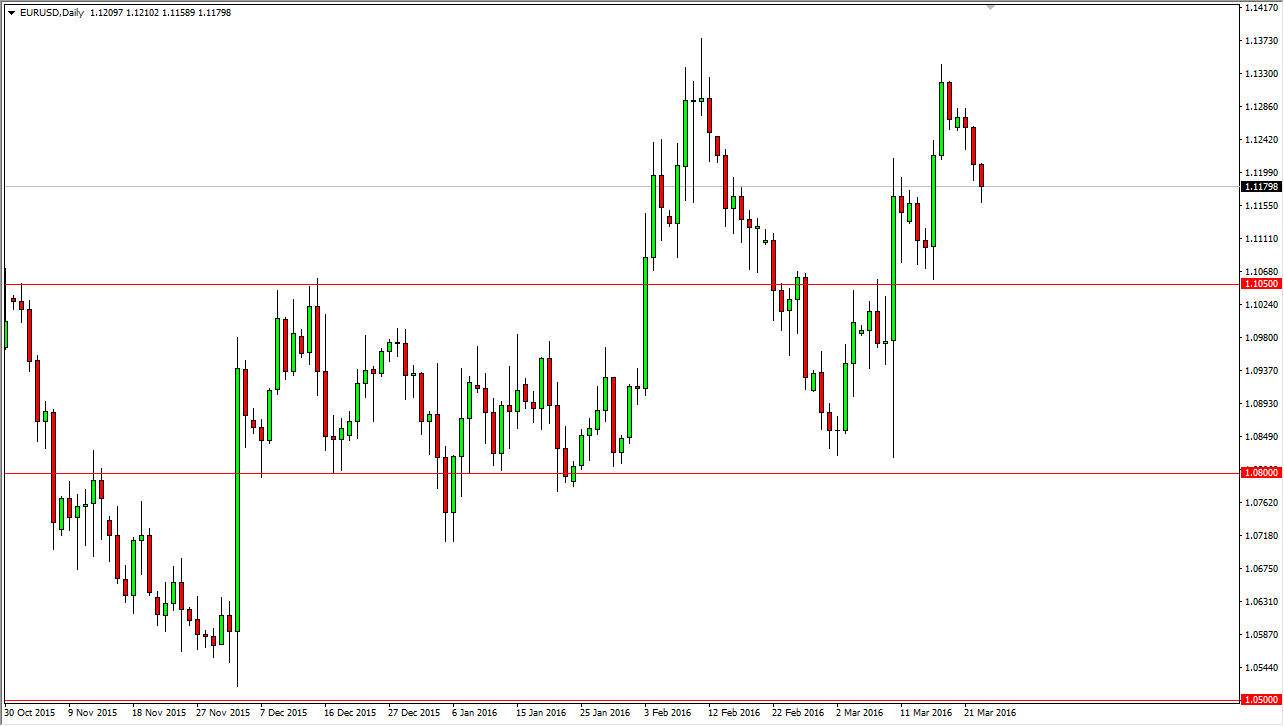

EUR/USD

The EUR/USD pair fell during the day on Wednesday, testing the 1.12 level. We broke down below there by just a little bit, and it looks like we are continuing to go lower from here. There is a massive amount of support below though, and we believe that the market should continue to find support all the way down to the 1.1050 level. With this, I am simply waiting for a supportive candle to start going long again. At that point, we should then reach towards the 1.13 level as it has been a magnet for price and of course has been resistive. With this, it’s likely that we will go higher so I’m just simply waiting to see an opportunity to start going long. I don’t see it yet though, so at this point I am on the sidelines.

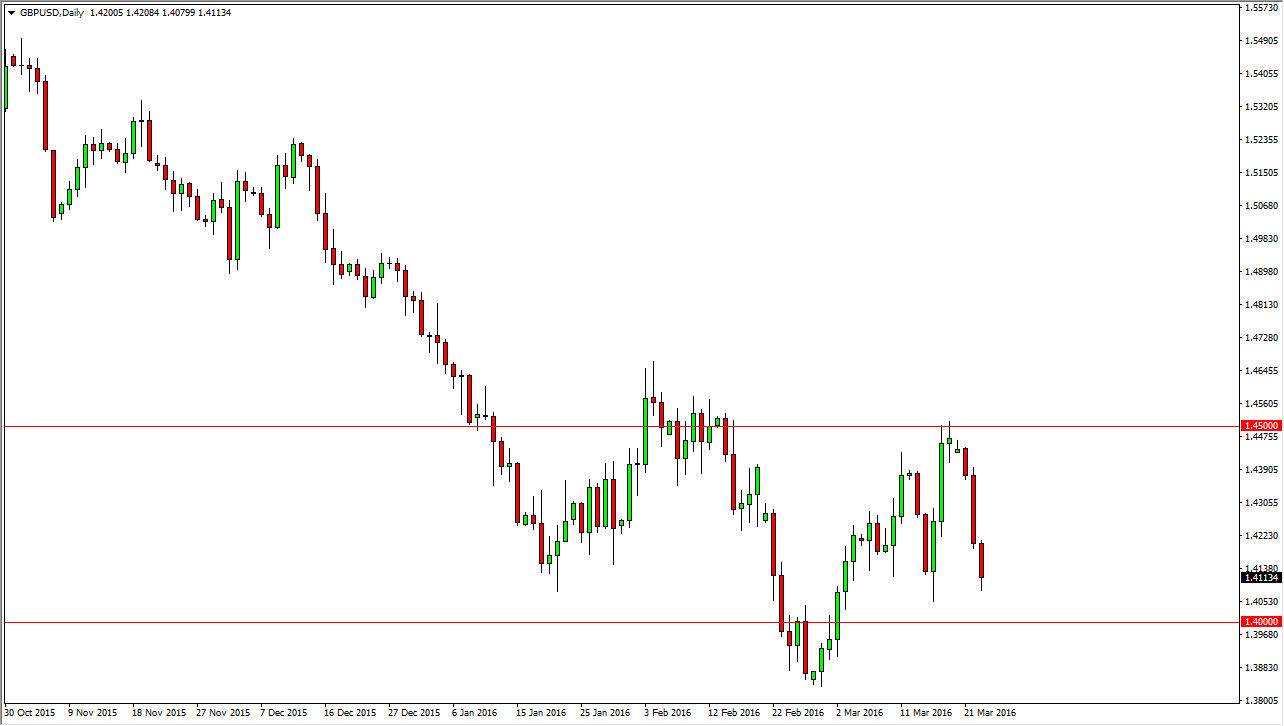

GBP/USD

The GBP/USD pair fell during the course of the day on Wednesday, as we continue to see bearish pressure. At this point though, I believe that the 1.40 level is massively supportive, so it’s only a matter of time before we get a buying opportunity down in this area, so I’m going to wait to see whether or not the daily candle forms a supportive enough look to find an opportunity to go long. I do believe that we will bounce and continue to consolidate overall, but we will have to pay attention to the 1.40 level. If we do break down below there, that would be extraordinarily negative, and the market could go much lower based upon that.

We have the Federal Reserve stepping away from interest-rate hikes, and that will put quite a bit of pressure on the US dollar, but at the same time we have to worry about whether or not the United Kingdom is going to leave the European Union. In other words, there should be continued volatility.