EUR/USD

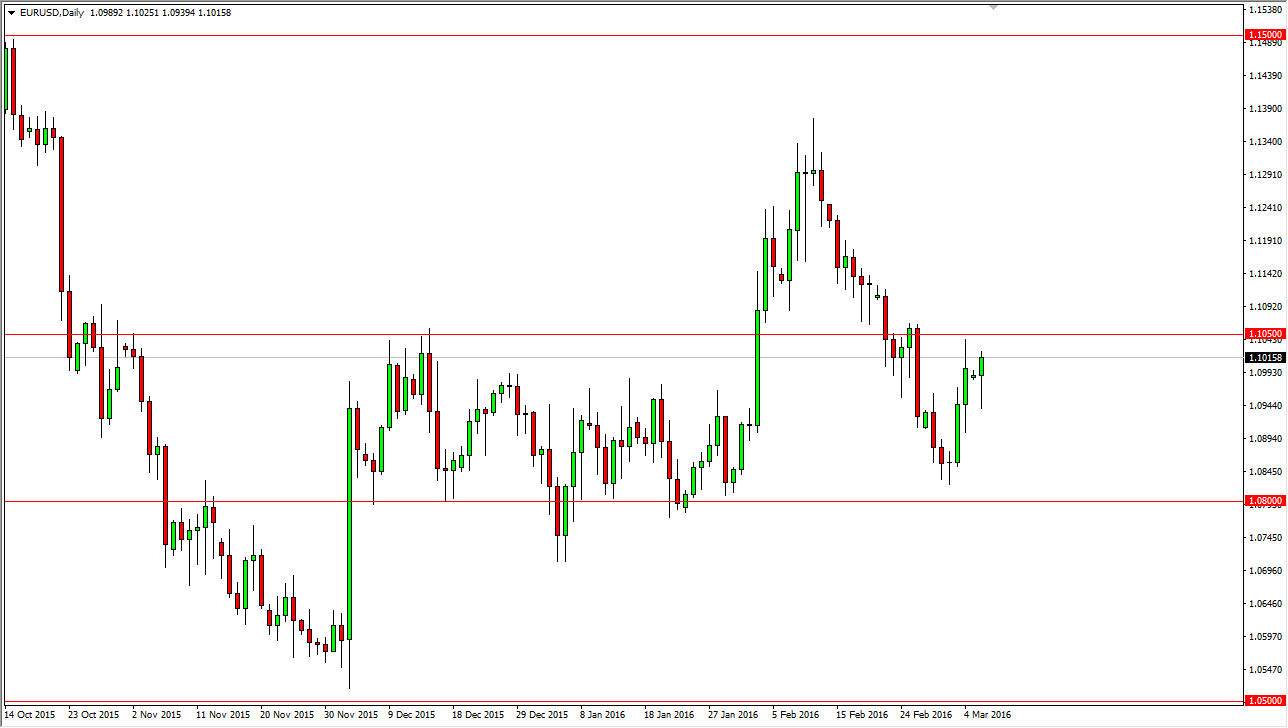

The EUR/USD pair initially fell during the course of the session on Monday, but turned back around to form a bit of a hammer. It looks like the market is really starting to try to break out to the upside. The 1.1050 level above is the top of the recent consolidation area, and it is more than likely that if we can break above there the Euro will continue to strengthen over the longer term. With this, I believe that a break above that level is reason enough to not only buy this pair, but probably aim to reach the 1.13 level.

If we break down below the bottom of the hammer for the Monday session, a think we will probably drop to the 1.08 level, but I do not expect this market to break down below there anytime soon. That would probably recognize the consolidation area being continued, and with that it’s very likely that we will be back to the choppy conditions.

GBP/USD

The GBP/USD pair initially fell during the day on Monday as well, but turned back around to form a hammer. The hammer of course is reason enough to think that we could try to go higher but I see so much in the way of resistance above that I am very hesitant to start buying this market right now. In fact, I think that there is a massive amount of resistance all the way to the 1.45 level, and possibly just a little bit above there. Quite frankly, I feel that the market would be easier to sell if we can break down below the bottom of the hammer as we would then reach towards the 1.40 level.

It will be interesting see what happens next, but as I said I am a bit hesitant to start buying, although I do certainly recognize that we are probably going to see the move higher happen soon. It’s just going to be too volatile for me.