The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 13th March 2016

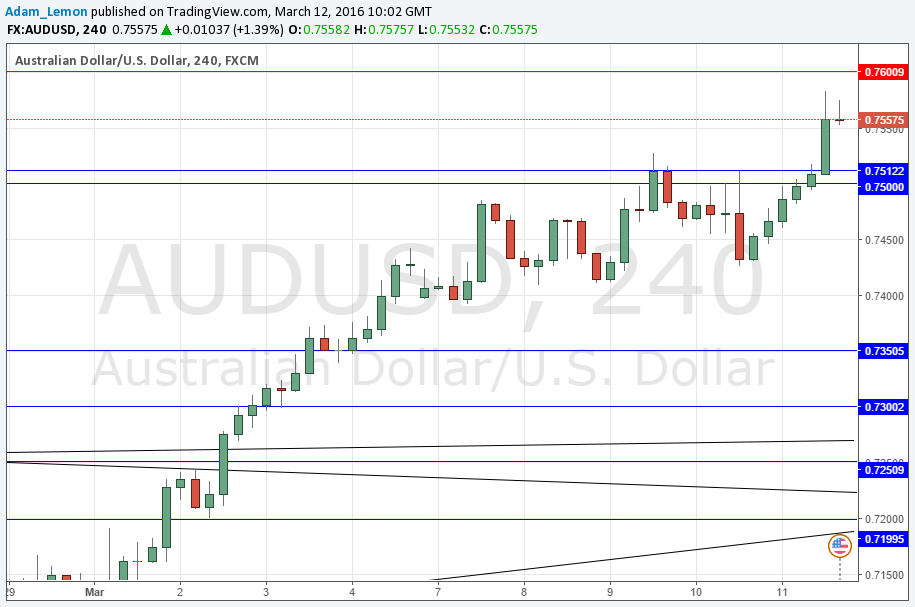

Last week I highlighted long AUD/USD as a good trade for this week. This worked out very well as the pair has risen by a strong 1.74% over the week.

Fundamental Analysis & Market Sentiment

Fundamental analysis is not very useful in Forex markets at the moment. Sentiment is a much stronger price driver right now.

The feature that really stands out right now is the weakness of the U.S. dollar. This currency is usually the key to the Forex market, and when it is the big mover, it tends to make the market really jump. The market is very skeptical that the Federal Reserve will be able to raise interest rates, even though it has proclaimed that it intends to do so. Poor Average Hourly Wage data from two weeks ago was a fundamental peg to hang this sentiment on.

Additionally, sentiment continued to shift this week from risk-off to risk-on, and this is producing the most convincing rally in stocks and commodities – and hence in related currencies – that has been seen in many weeks.

Although opinion polls are still showing that a British vote to exit the European Union is a definite possibility to happen in the referendum due next June, the market is not treating this as a big enough factor to halt a strong upwards move in the price of the British Pound.

Technical Analysis

USDX

The U.S. Dollar Index is moving down quite strongly, making new multi-month lows, and approaching very close to its level of six months ago, as can be seen in the weekly chart below. This suggests that the best trend trades are likely to be against the U.S. Dollar in the near future.

AUD/USD

This pair broke out bullishly quite strongly a couple of weeks ago, closing above the key 6 month high at 0.7381. It continued to rise this week by almost 2%. It makes good sense to continue looking for long trades here, especially following any pullbacks to 0.7512 or 0.7381.

USD/JPY

This pair has continued to consolidate, but a long-term chart shows that a downwards trend is still very much in force. It appears that the area between 114.50 and 116.09 is a key area where a major bearish reversal might take place and produce a major move if the JPY begins to show some strength.

The safest trade of the week is probably going to be long AUD/USD.