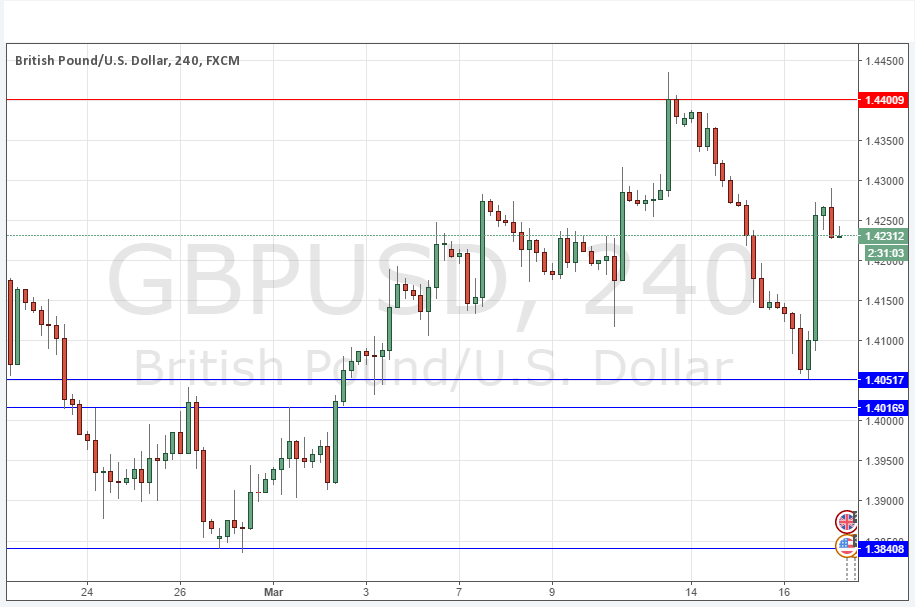

GBP/USD Signals Update

Yesterday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4400.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.4052 and 1.4017.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

Yesterday’s FOMC releases were very bearish for the USD, so like everything else the GBP initially went shooting up to reach close to 1.4300. However the GBP is relatively weak and so was unable to hold those highs, falling by about 60 pips or so during the Asian session. If the USD begins to recover, that recovery will probably be most strongly felt by a continued move downwards by this currency pair. Trading might be volatile as there are key Bank of England policy releases later during the London session.

Concerning the GBP, there will be releases of the Bank of England’s Monetary Policy Summary, and Official Bank Rate and Votes, at Noon London time. Regarding the USD, there will be a release of Unemployment Claims and Philly Fed Manufacturing Index data at 12:30pm.