GBP/USD Signals Update

Yesterday’s signals expired without being triggered.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades must be entered before 5pm London time today only.

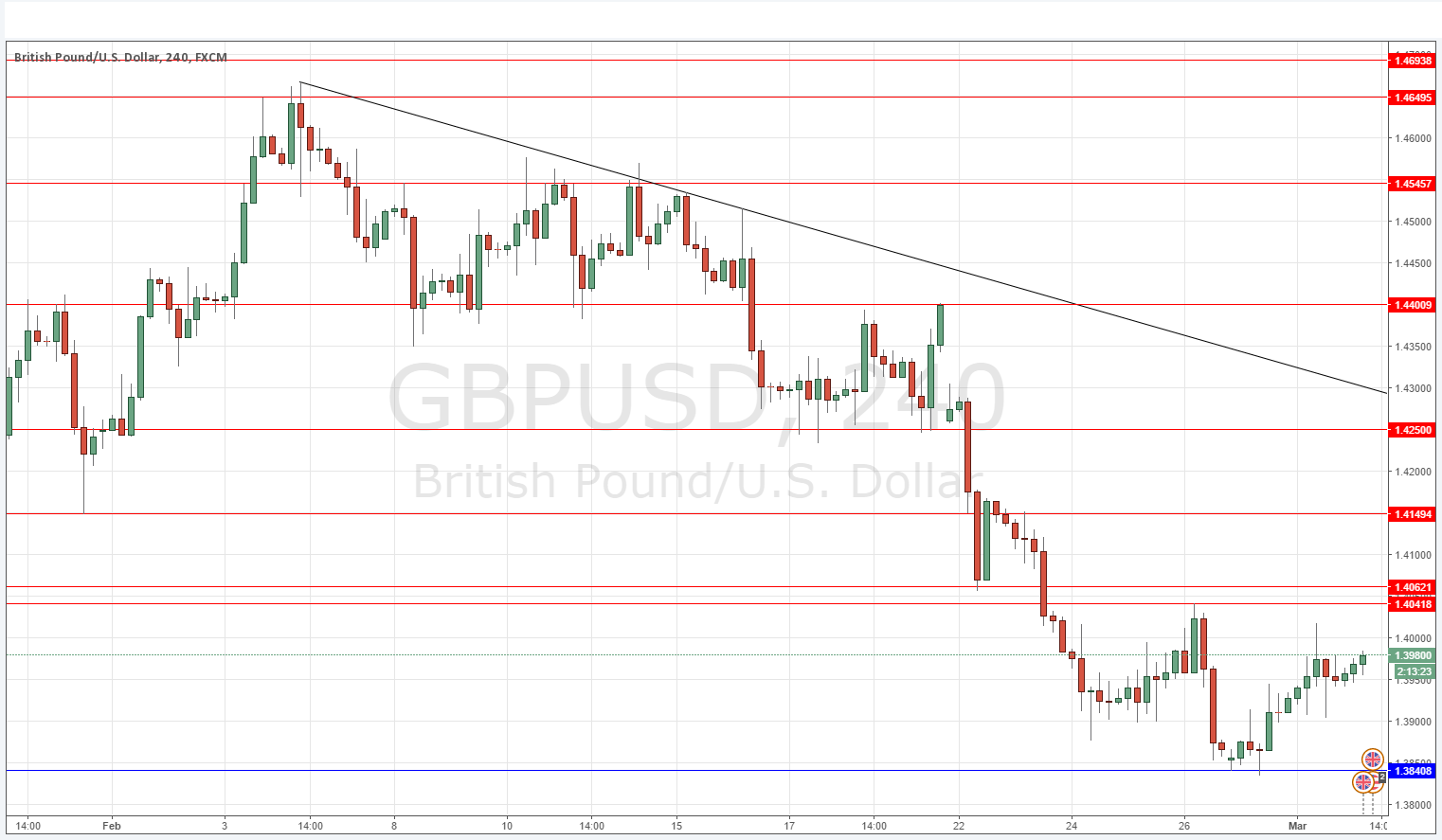

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next entry into the zone between 1.4041 and 1.4062.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.3841.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

This pair initially dropped yesterday upon some poor U.K. economic data before rallying very strongly, and trading above 1.4000 for a while. The price then dropped quite sharply but was bid up again, and in early trading this morning it looks to be rising to test 1.4000 again. Regardless of why, the Pound seems to have a bid in it, so we might well reach the key resistance zone from about 1.4040 to 1.4060 at which price there may be a reversal.

It looks as if major bulls and bears are fighting in the area between 1.3900 and 1.4000 and there has been some speculation that the Bank of England have intervened to prop up the Pound although obviously they have only limited means to do so.

Concerning the GBP, there will be a release of Construction PMI data at 9:30am London time. Regarding the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm, followed later by Crude Oil Inventories at 3:30pm.