GBP/USD Signals Update

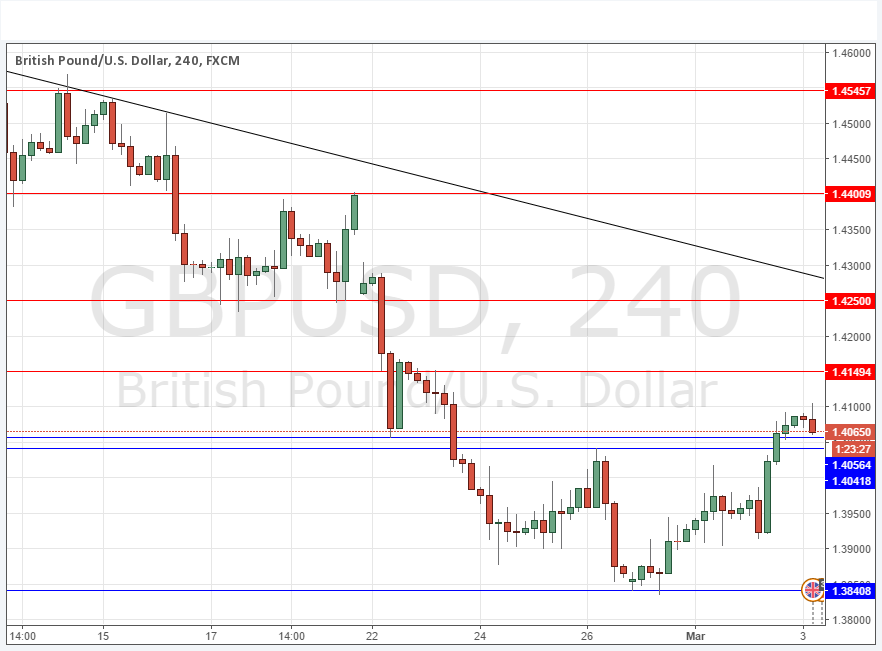

Yesterday’s signals were not triggered as there was no bearish price action between 1.4041 and 1.4062.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be taken between 8am and 5pm London time today.

Short Trade 1

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.4149.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Long Trade 1

* Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4056 and 1.4041.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Remove 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

GBP/USD Analysis

This pair rallied quite strongly yesterday and held up during the Asian session. It now looks as if the small resistant zone centred around 1.4050 will probably now have flipped to become support, although the upwards move does look overdue for a pull back. Just after the London open this was tested but trading has been relatively quiet. Of course above there is the round number of 1.4100 that could also be providing resistance. I do not think the price is quite ready to fall just yet but I suspect the pair will struggle to rise above 1.4100. However we have data due today for both sides of this pair, so anything could happen as both are important items that are going to be keenly watched by the market.

Concerning the GBP, there will be a release of Services PMI data at 9:30am London time. Regarding the USD, there will be a release of Unemployment Claims data at 1:30pm London time followed later by ISM Non-Manufacturing PMI at 3pm.