Gold prices ended Monday's session up $15.91, recouping the previous two weeks' losses, as weaker than anticipated U.S. manufacturing and housing data led to a pullback in the dollar. The Chicago purchasing managers' index came in well below consensus estimates with a print of 47.6 and the National Association of Realtors reported that the index of pending home sales dropped 2.5%. This week sees a deluge of economic data, including the monthly non-farm payrolls report and factory orders.

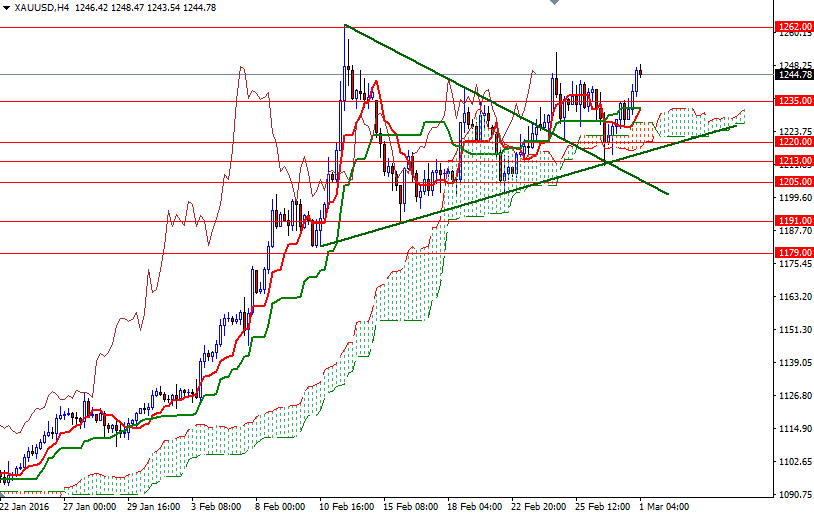

The XAU/USD pair is currently trading at $1244.78 an ounce, up 0.5% from the previous close. Yesterday, the market bounced off a key support at around the 1213 level and pushed through the resistance at 1235. From a technical point of view, the odds favor further upside as long as the XAU/USD pair sails above the Ichimoku cloud on the 4-hour time frame and short-term bullish trend line remains intact.

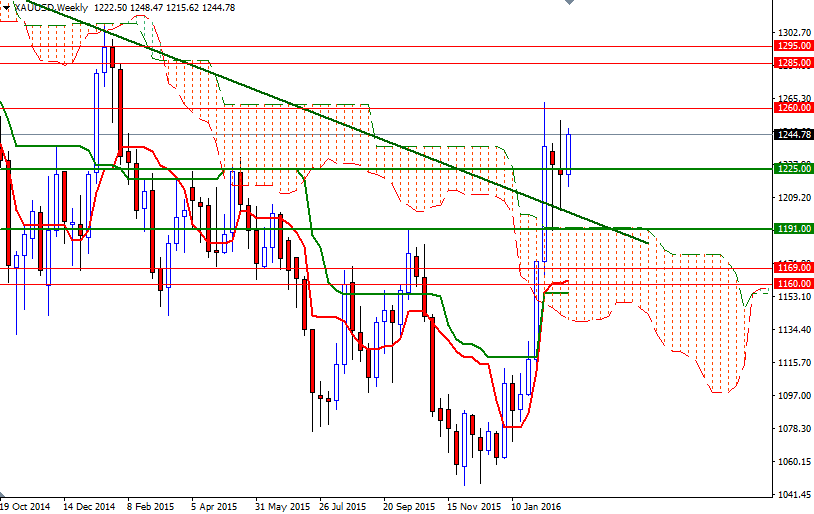

On the other hand, the potential upside is likely to be limited until the 1250 resistance is convincingly breached. Penetrating this barrier could provide the bulls extra momentum they need to test the 1262/0 region. A daily close above 1262 would make me think that XAU/USD is on its way to test the next obvious resistance in the 1290/85 area. However, if the market finds the 1250 level too resistive to conquer, then the bears will probably try to make an attempt to the 1235/2 zone where the Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) lines converge on the 4-hour chart. The bears will have to demolish this support so that they can march towards the ascending trend line.