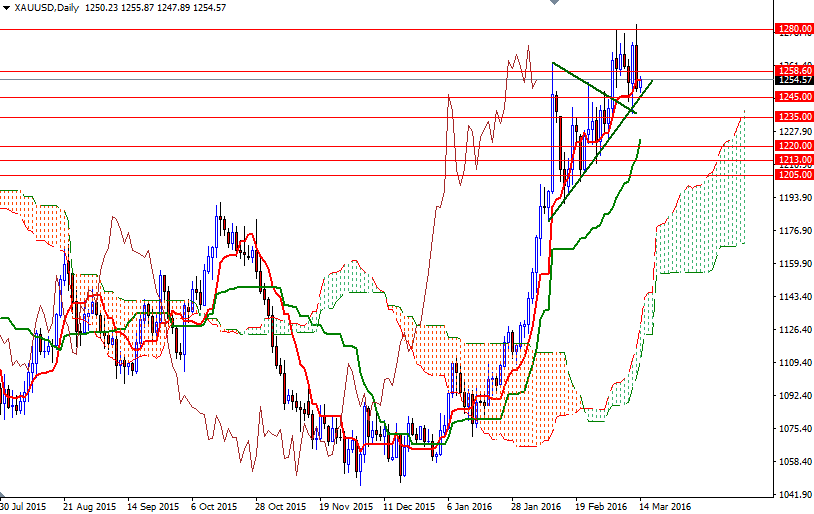

Gold prices settled at $1250.04 an ounce on Friday, suffering a loss of $9.58 on the week. The XAU/USD pair tried to pass through the $1280/79 resistance after bouncing off a bullish trend line that the market has been respecting lately but found significant amount of resistance and investors took it as a sign of exhaustion. Consequently, the precious metal extended its losses as the bulls' failure to hold prices above the $1267.50-$1266 area prompted profit taking.

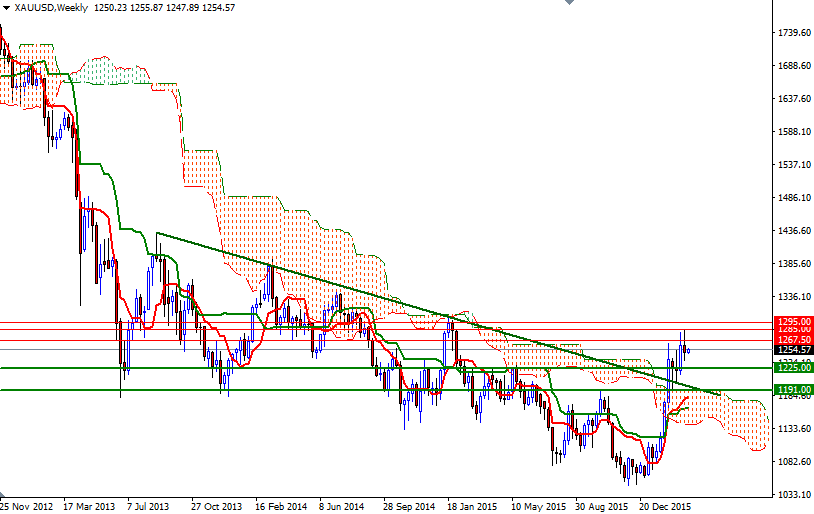

Even with a turnaround in stock markets around the globe and signs of a resilient U.S. labor sector, investors are still piling into the metal. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 174810 contracts, from 152413 a week earlier. Based on the fact that the market is moving above the weekly and daily Ichimoku clouds, the general outlook suggests that there is the possibility of further price gains over the medium-term. However, we might see a range bound movement in the next couple of days as market participants will probably opt to remain on the sidelines until the Fed statement on Wednesday. Trading within the boundaries of the 4-hourly Ichimoku cloud also supports this view.

At this point, the XAU/USD pair will have to either break through the 1280 level and challenge the next barriers at 1285 and 1295 or fall below the 1235 level and retreat to the 1225/0 region. While a sustained drop below this zone would prolong the bearish momentum and open up the risk of a move towards 1205, clearing the resistance at 1295 would make me think that the bulls are ready to tackle the 2015 high of 1307.