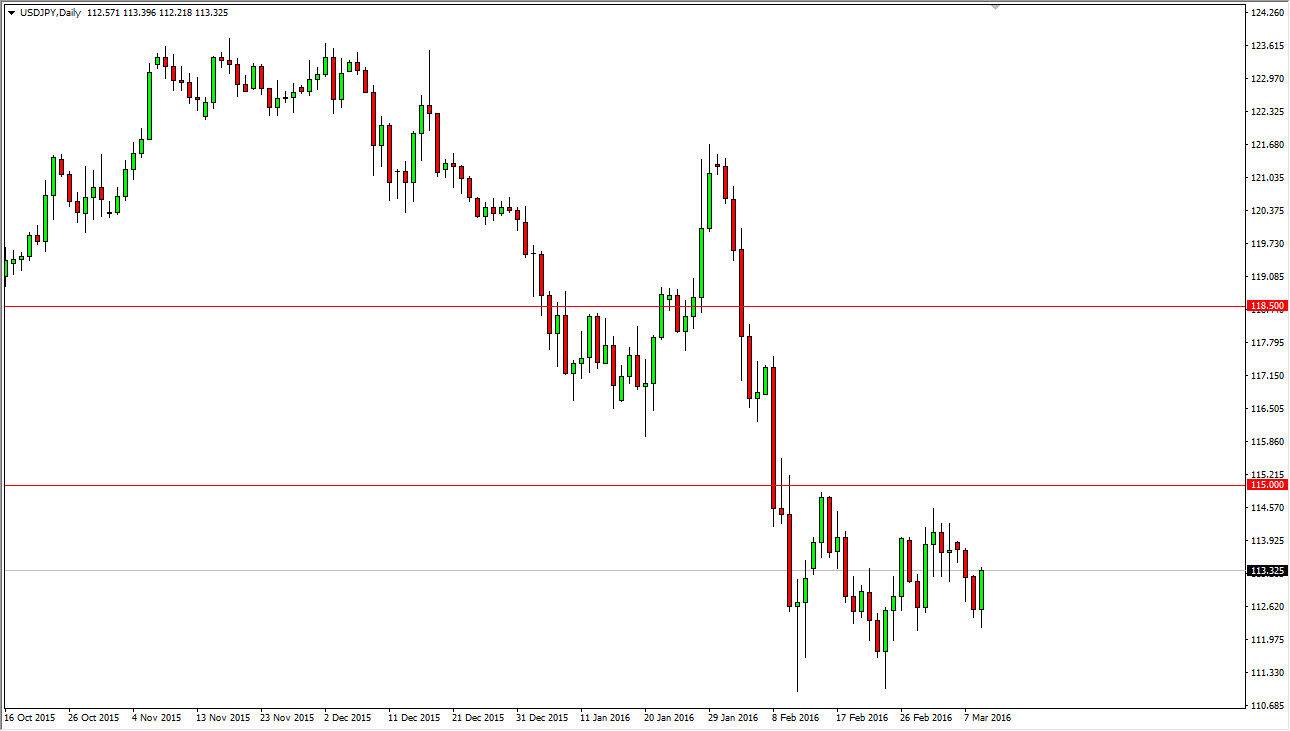

USD/JPY

The USD/JPY pair initially fell on Wednesday but found enough support near the 112 level to turn things around and form a slightly positive candle. By doing so, the market looks as if it is ready to head towards the 115 handle, which is where I expect to see quite a bit of resistance. In the short-term, I think you can go ahead and buy this pair, but I recognize that it’s going to be choppy and probably more or less a short-term based type of trade. I don’t have any interest in shorting, I believe that once you get below the 112 level, things get very supportive at this point. This can be seen by all of the long wicks below that area on the daily charts. You should also keep in mind that this pair tends to be very sensitive to risk appetite.

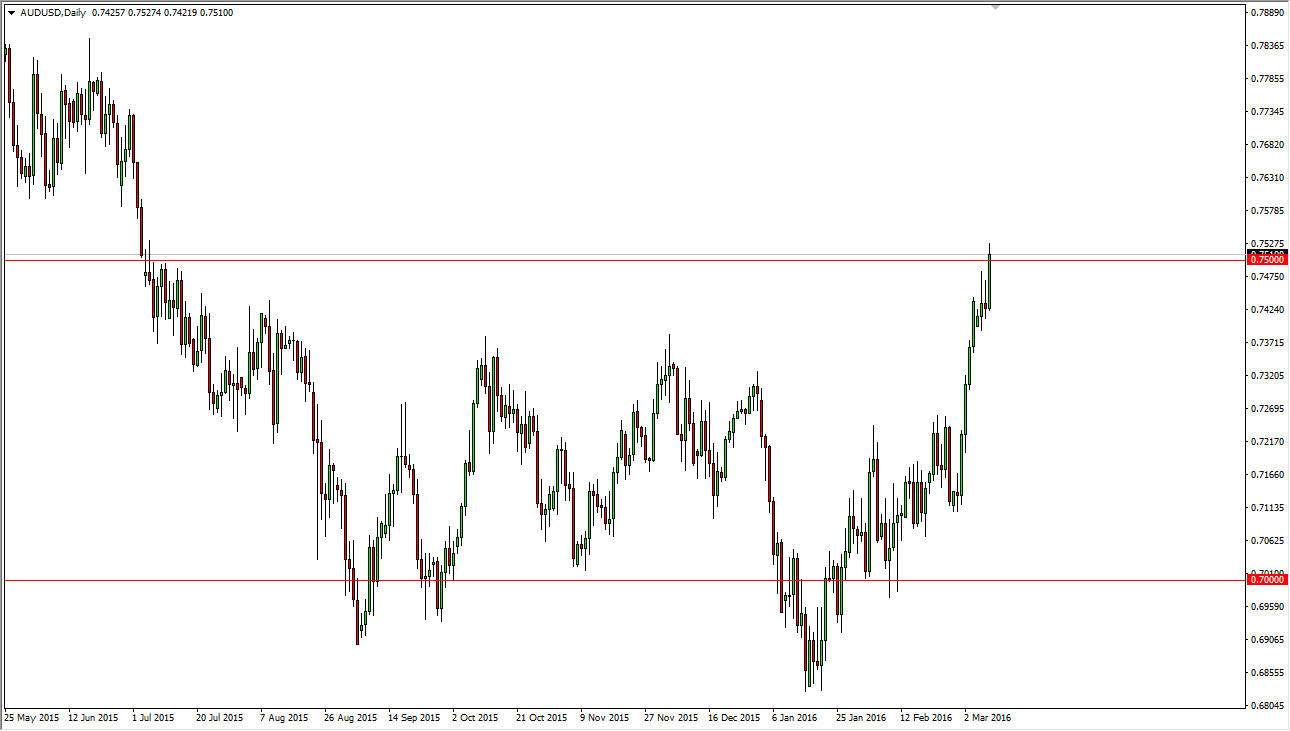

AUD/USD

The Australian dollar broke above the 0.75 level for the first time in ages during the session on Wednesday. If we can break above the top of the range for the day, I believe that this market will then reach towards the 0.76 level, followed by the 0.78 level. While this move has been overdone recently, the fact that we sliced through a couple of shooting stars during the session on Wednesday should show that the uptrend will continue. I believe the pullbacks will come, but quite frankly they are going to be value proposition when it comes to the Australian dollar.

Even though the move has been very sudden and very violent, I still believe that there is a massive amount of support just below, and it appears that this could be driven partially by gold which of course is done quite well recently. Because of this, I believe that if gold rallies today, the Australian dollar will break out above the top of the range and continue to go much higher.