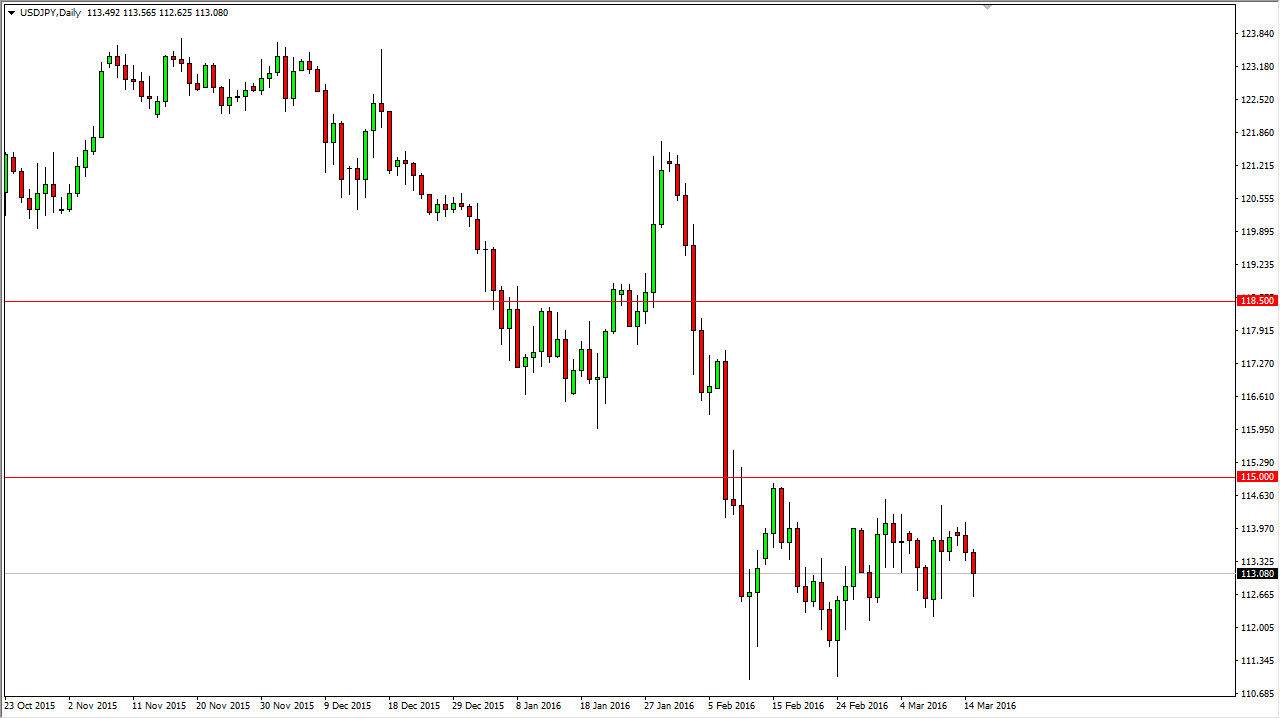

USD/JPY

The USD/JPY pair fell during the course of the day on Tuesday, but found enough support below at the 112.50 level to turn things back around and form a bit of a hammer. Ultimately, this means that the market will probably rally from here, but we should run into the resistance at the 114.50 level, which of course extends all the way to the 115 handle.

If we can break above the 115 level, the market will continue to go much higher, but at this point in time it looks as if the market is simply going to go back and forth for short-term trades. With this, the market will continue to attract scalpers if nothing else, and as a result short-term trading will continue to be the way going forward. Once we get above the 115 level though, it should be a longer-term move.

AUD/USD

The AUD/USD pair broke down during the course of the day on Tuesday, as we sliced through the 0.75 level. However, I see quite a bit of support all the way down to the 0.74 level, and as a result I’m not overly concerned about selling this pair right now, plus it looks as the gold market looks like it’s ready to bounce from current levels, and as a result it should continue to be a driver of this particular currency pair.

It is not until we break down below the 0.74 level that I feel that the market could sell off. At that point it will go looking for the 0.73 level. Nonetheless, I’m looking for signs of support in order to go long, or if we get an impulsive candle to turn things back around that breaks above the 0.75 level is a buying opportunity as well. It should then go to the 0.80 level over the longer term, but we could get pullbacks from time to time.