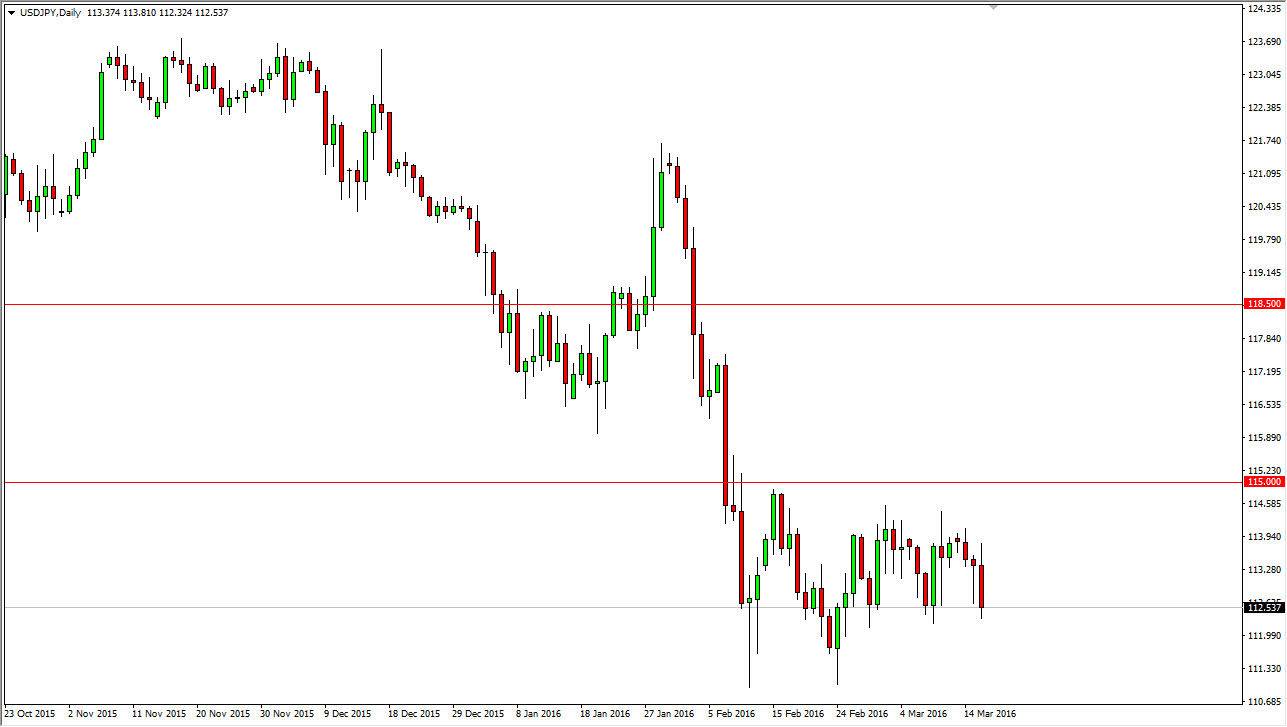

USD/JPY

The USD/JPY pair initially tried to rally during the course of the day on Wednesday, but turned right back around to fall towards the bottom of the recent consolidation area. This was in reaction to the Federal Reserve statement suggesting that there would only be two interest-rate hikes by the end of the year as opposed to the previously suggested four. Because of this, the US dollar lost value against most currencies, and of course the Japanese yen would be no different. However, we are still well within the range of the consolidation area, so it’s likely that the market will find buyers somewhere below this general vicinity. With this, I’m looking for some type of supportive candle to start going higher, perhaps reaching to the 114.50 level or so. If we did break above the 115 level though, that would be a very bullish sign.

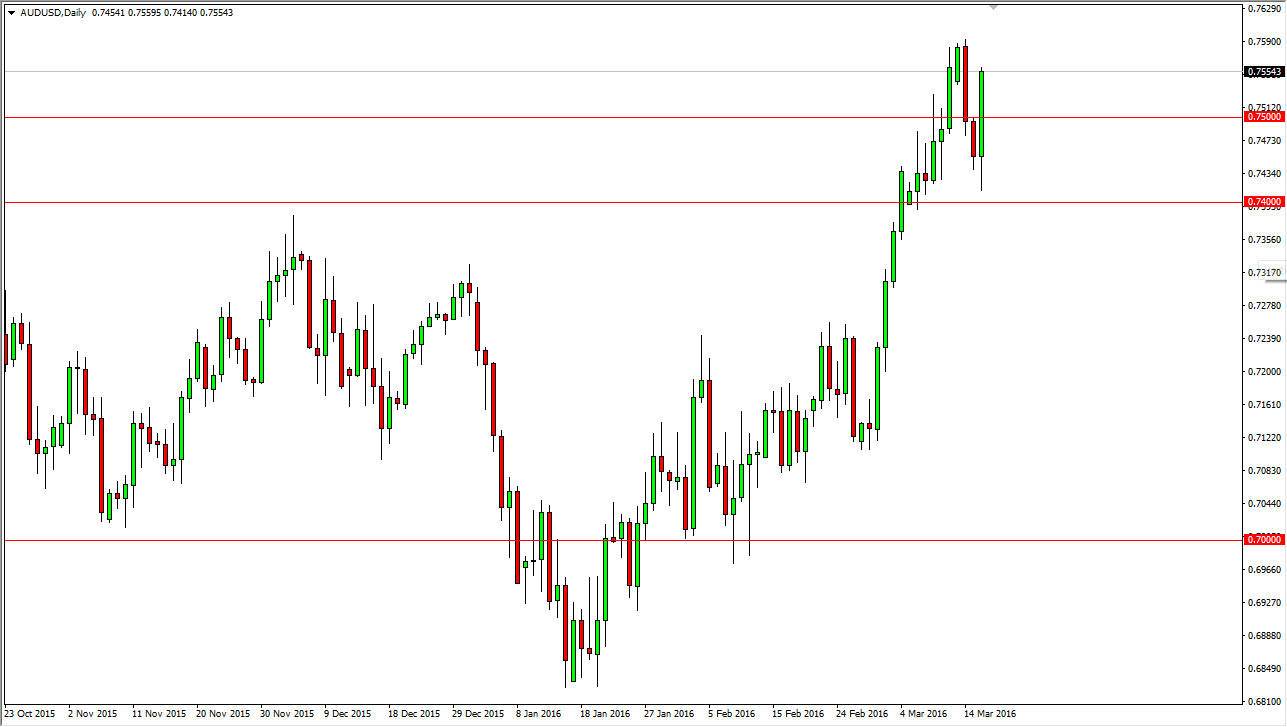

AUD/USD

The AUD/USD pair fell initially during the course of the session on Wednesday, but found enough support at the 0.74 level to turn things back around and bounced rather significantly. A break above the 0.75 level would be a very bullish sign, and as a result the market should continue to go much higher. With the Federal Reserve walking away from at least a couple of future interest-rate hikes, it’s likely that the Australian dollar will continue to rise as gold gets strengthened.

Any pullback at this point in time should be a buying opportunity as gold should continue to rise, and by extension the Australian dollar should as well. With this, the market will more than likely continue to go higher and towards the 0.80 level above as it is the next large, round, psychologically significant number. It was also a very important number for the longer-term charts anyways, and as a result the market has been attracted to it more than once.