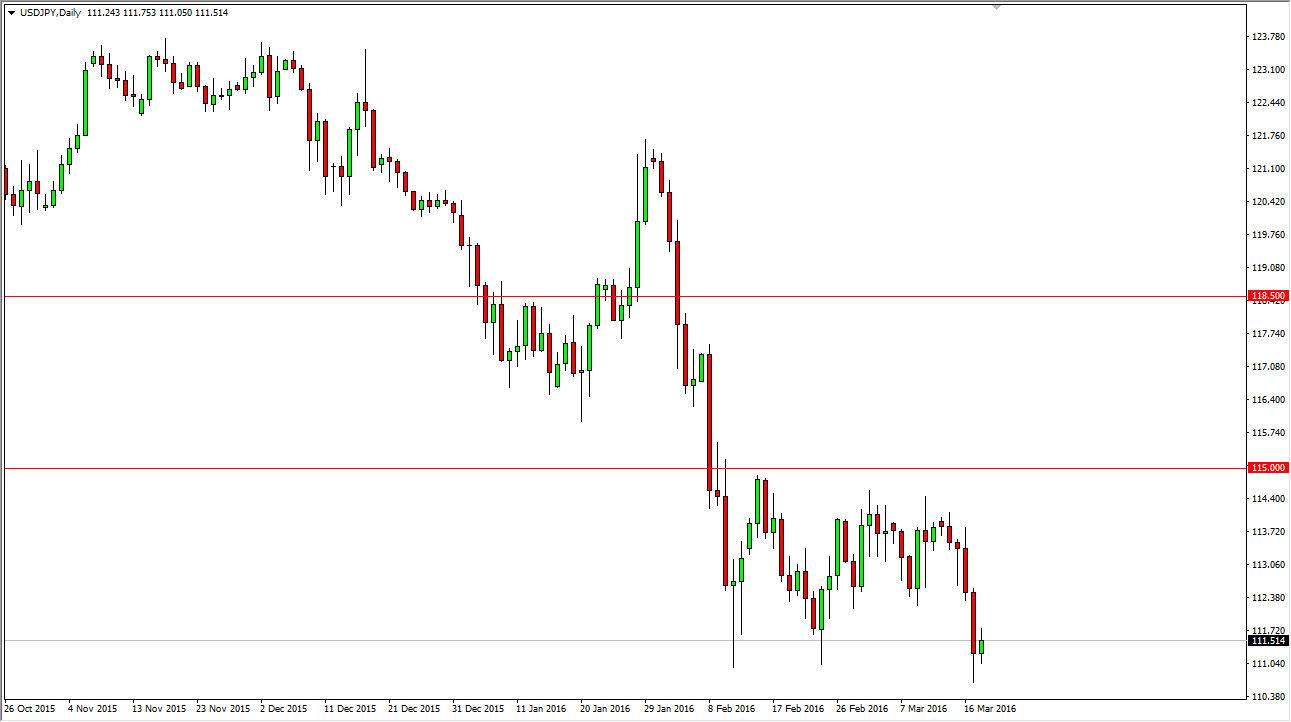

USD/JPY

The USD/JPY pair initially tried to rally during the course of the day on Friday, bouncing off of the 111 level below that of course has offered quite a bit of support. Because of this, it looks if we are ready to continue consolidating in general, and we could rise as high as the 114.50 level above. Ultimately, this is a market that will continue to bounce around, but given enough time it looks as if we are trying to break down. If we can break down below the lows again, we should then head to the 110 level.

Given enough time, we will of course break out of this area sooner or later, but at this point we don’t have signs of doing so yet. Once we do, I will simply follow the markets, but at this point in time we don’t have any signs of breaking up or down.

AUD/USD

The AUD/USD pair fell during the course of the session on Friday, but quite frankly this is a market that has broken out fairly significantly lately and I believe it’s only a matter of time before this market find buyers. There should be a support zone between the 0.75 level and the 0.74 level below, and as a result I’m willing to buy any type of supportive candle in that general vicinity if we fall that far. Quite frankly though, I don’t think we are going to break down significantly enough to test that region with any serious attempt.

I think at this point in time any supportive candle between here and there should be thought of as signs of buying, and these pullbacks should be thought of as value in the Australian dollar. At this point in time, keeping attention to the gold markets as well, as they of course will drive the Australian dollar higher if they rise incongruence.