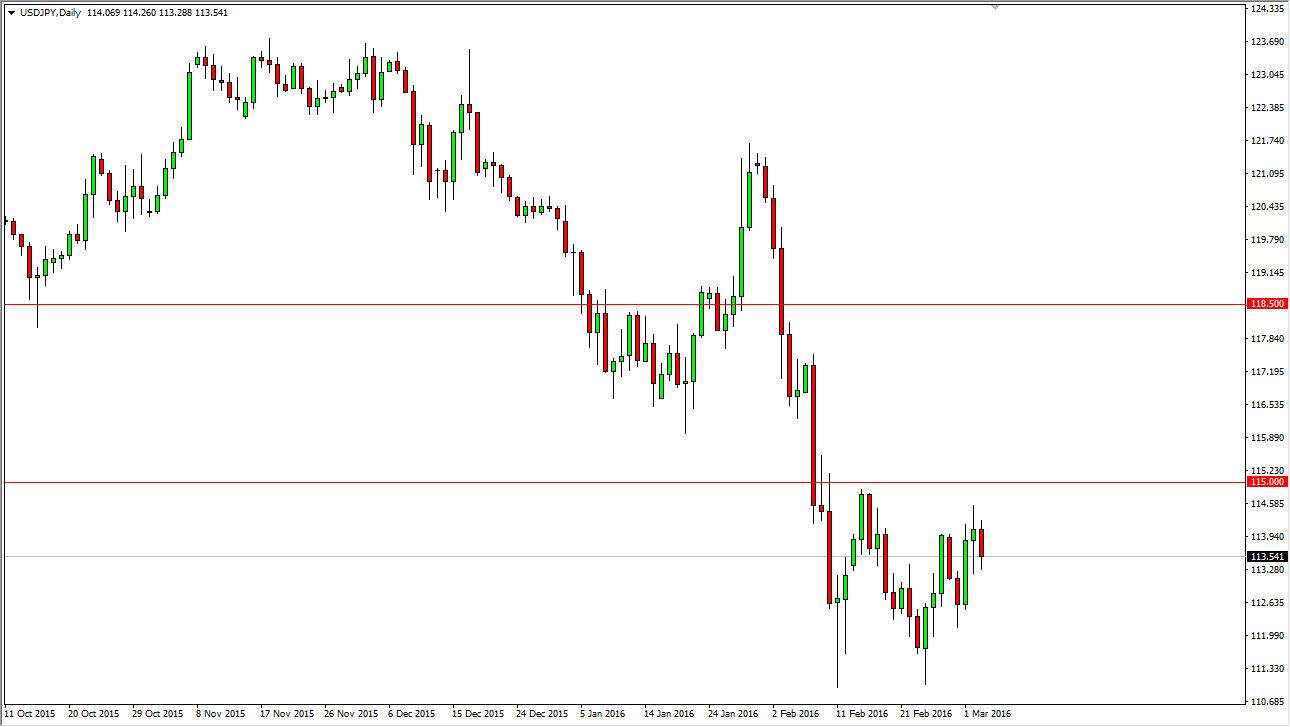

USD/JPY

The USD/JPY pair fell during the day on Thursday, testing the bottom of the candle that formed for the Wednesday session. We struggled at roughly 114.50, so I think that the consolidation area is going to hold in the meantime. However, you have to keep in mind that this is Nonfarm Payroll Friday, and that means that this pair could move rather drastically. If we can break above the 115.50 level, I feel that the pair will break out all the way to the 118.50 level. Alternately, if we get an exhaustive candle just above that would be a selling opportunity as it would simply be a return to the consolidation that we have seen recently. That should send this pair down to the 112 handle. I also feel the same way if we break down below the bottom of the range for the Wednesday candle, selling will resume.

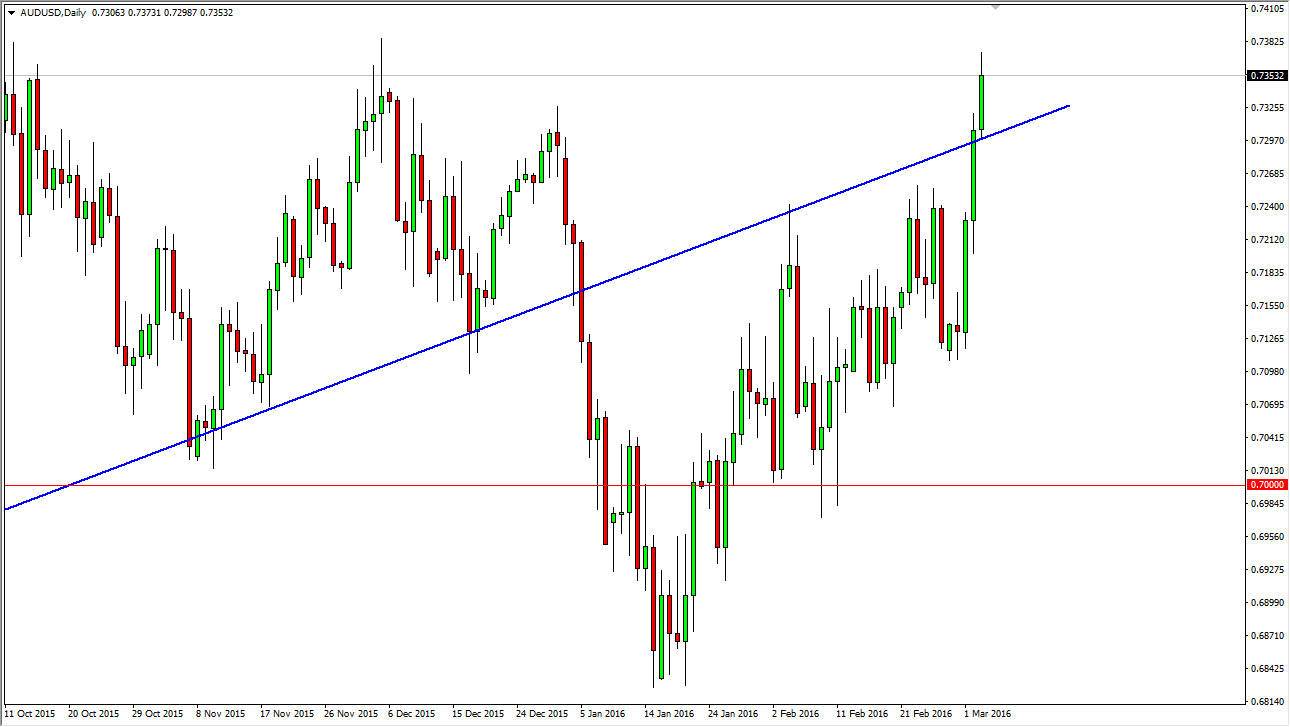

AUD/USD

The Australian dollar has broken out. I have had an uptrend line recently that I’ve been using as resistance. Now that we have cleared that, I feel that the Australian dollar can go much higher. Yes, we may have to pull back a little bit of a short-term just to build up enough momentum to keep going higher, and that should offer a nice opportunity to go long. The jobs number could be the catalyst for that to happen, so on a short-term pullback that show signs of support I am more than willing to start going long on this pair. I believe that the markets will ultimately go much higher and make a fresh, new high, but today could be a bit volatile. Look at any pullback as potential value that you can take advantage of, with quite a bit of support to be found somewhere near the 0.7250 level in my estimation.