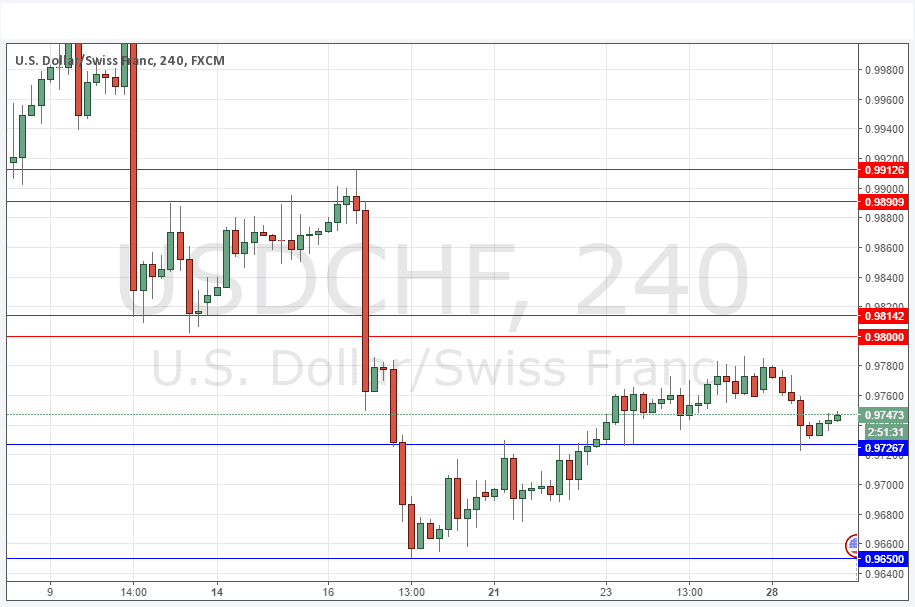

USD/CHF Signal Update

Yesterday’s Signals produced a long trade following the bullish pin candle on the H1 chart rejecting the support at 0.9725 at the end of yesterday’s London session. The price is moving up nicely and looks as if it is about to reach the 20 pips of profit required to move the stop to break even.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be taken before 5pm London time today only.

Long Trade 1

Go long after bullish price action on the H1 time frame following the next touch of 0.9725.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

Go short after bearish price action on the H1 time frame following the next entry into the zone between 0.9800 and 0.9814.

Place the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

We hit the supportive level again at 0.9725 and the price is moving up fairly purposefully from there. It looks as if we are heading to 0.9800 now where there is likely to be considerable resistance which may hold.

There is nothing due today concerning the CHF. Regarding the USD, there will be a release of CB Consumer Confidence data at 2pm London time, and the Chair of the Fed will be speaking at an event at 3:30pm.