USD/JPY

During the course of the session on Thursday, the USD/JPY pair initially fell but we found enough support near the 112 level to turn around and form a hammer. It looks as if this pair is going to grind into the consolidation area that extends all the way to the 114.50 level. Because of this, it’s very likely that we had go higher but it’s going to be very volatile. This market looks as if it is going to struggle but show signs of positivity. There is a lot of noise between here and the 114.50 level, which of course extends all the way to the 115 level. I think that it’s only a matter of time before we break out to the upside, especially if the stock markets continue to rally, but we are simply going to be climbing a wall of worry on the way up there.

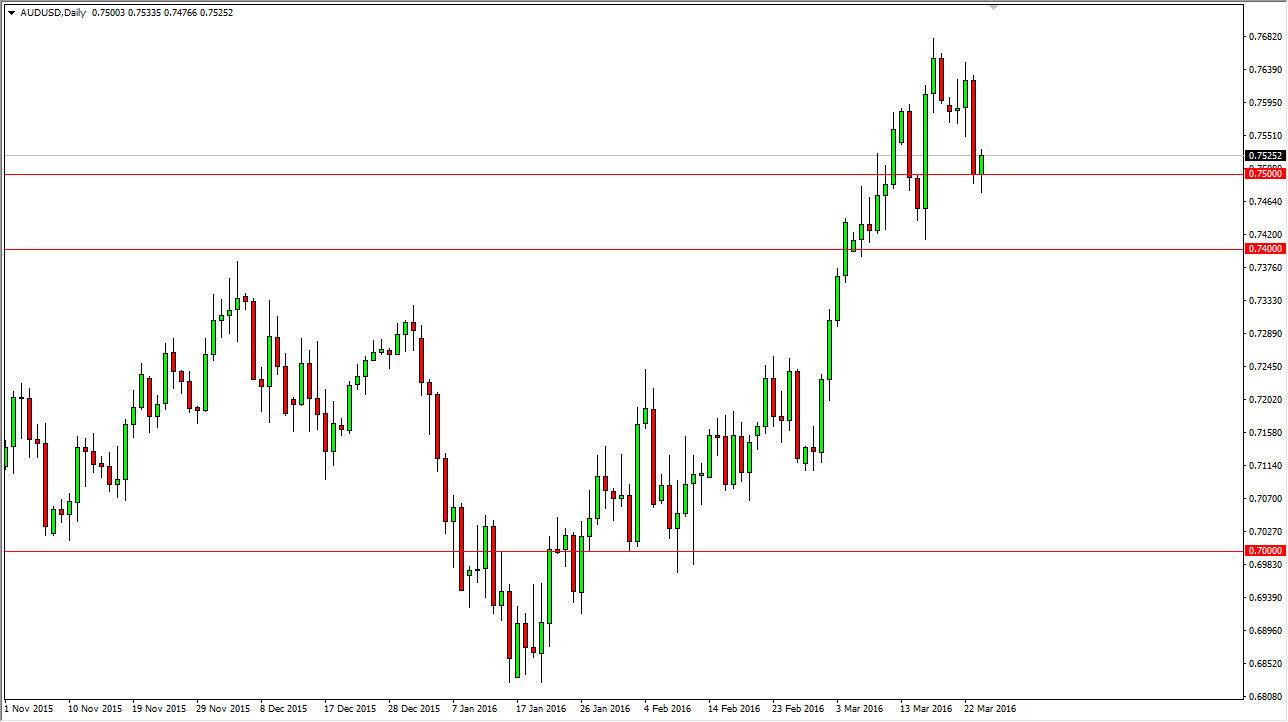

AUD/USD

The AUD/USD pair fell initially during the course of the session on Thursday, but the area below the 0.75 offered enough support to turn the market back around and form a hammer. That hammer of course will be a positive sign that catches a lot of people’s attention. If we can break above the top of that, I feel that the Australian dollar climbs as we should continue to see a lot of support all the way down to the 0.74 level.

The market will more than likely follow the gold markets as they look like they are suddenly well supported and could go higher also. Remember, there is a bit of a knock on effect in the Australian dollar when it comes to gold, and with this being the case it’s likely that both will rally during the session on Friday. I believe that both should continue to do fairly well over the longer term as well, so a move higher makes a lot of sense to me.