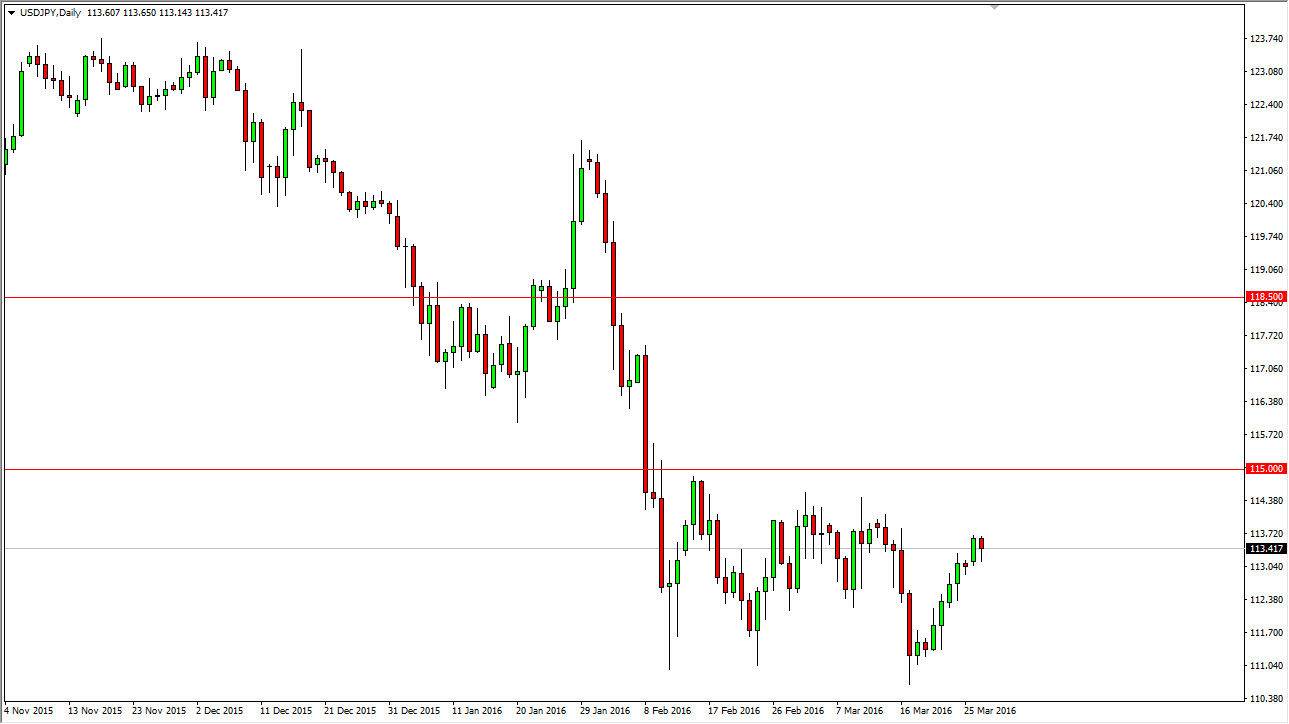

USD/JPY

The USD/JPY pair initially fell during the course of the session on Monday, but found enough support near the 130 level to turn things back around and form a hammer. That of course is a bullish sign and therefore if we can break above the top of this hammer I feel that the market then goes to the 114.50 level, perhaps trying to extend all the way to the 115 level. I don’t think that we will break above there quite yet, as I feel that we will need to build up enough momentum to finally go higher. Pullbacks should offer value that we can take advantage of though, and you have to keep in mind that this pair is very sensitive to risk appetite out there, so pay attention to the stock markets. If they rally, this pair could as well.

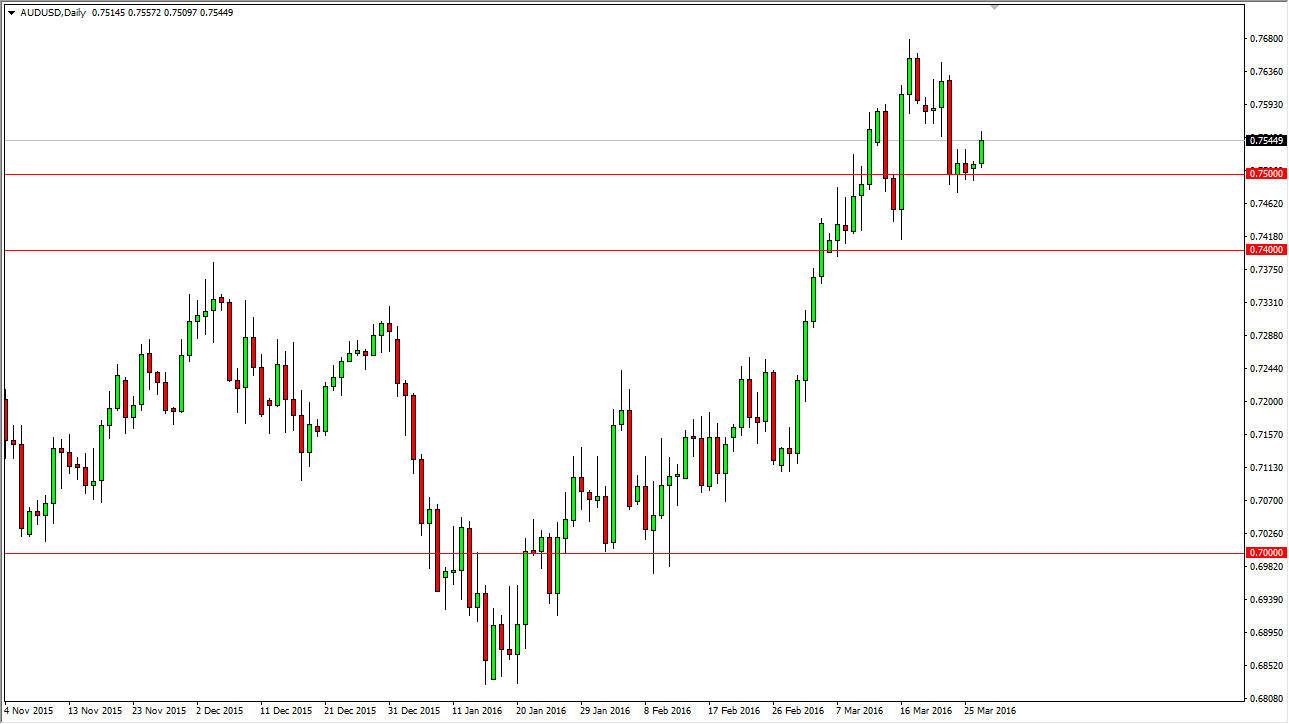

AUD/USD

The AUD/USD pair rose during the day on Monday, as we continue to find the 0.75 level very supportive. The support extends all the way down to the 0.74 level, and as a result it’s very likely that the market will continue to find buyers every time we dipped down in that area, and we also will more than likely find buyers on a break above the top of the range for the session on Monday, as it would show a continuation of the strength of the Aussie dollar.

With this being the case, you also have to pay attention to the gold markets, as they look like they are well supported and ready to go higher. With that, it should continue to put pressure on the Australian dollar to rise, and I believe that this will extend much further due to the fact that the Federal Reserve is stepping away from interest-rate hikes already, and that of course should continue to support gold and work against the value the US dollar in general.