USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken between 8am New York time and 5pm Tokyo time.

Short Trade 1

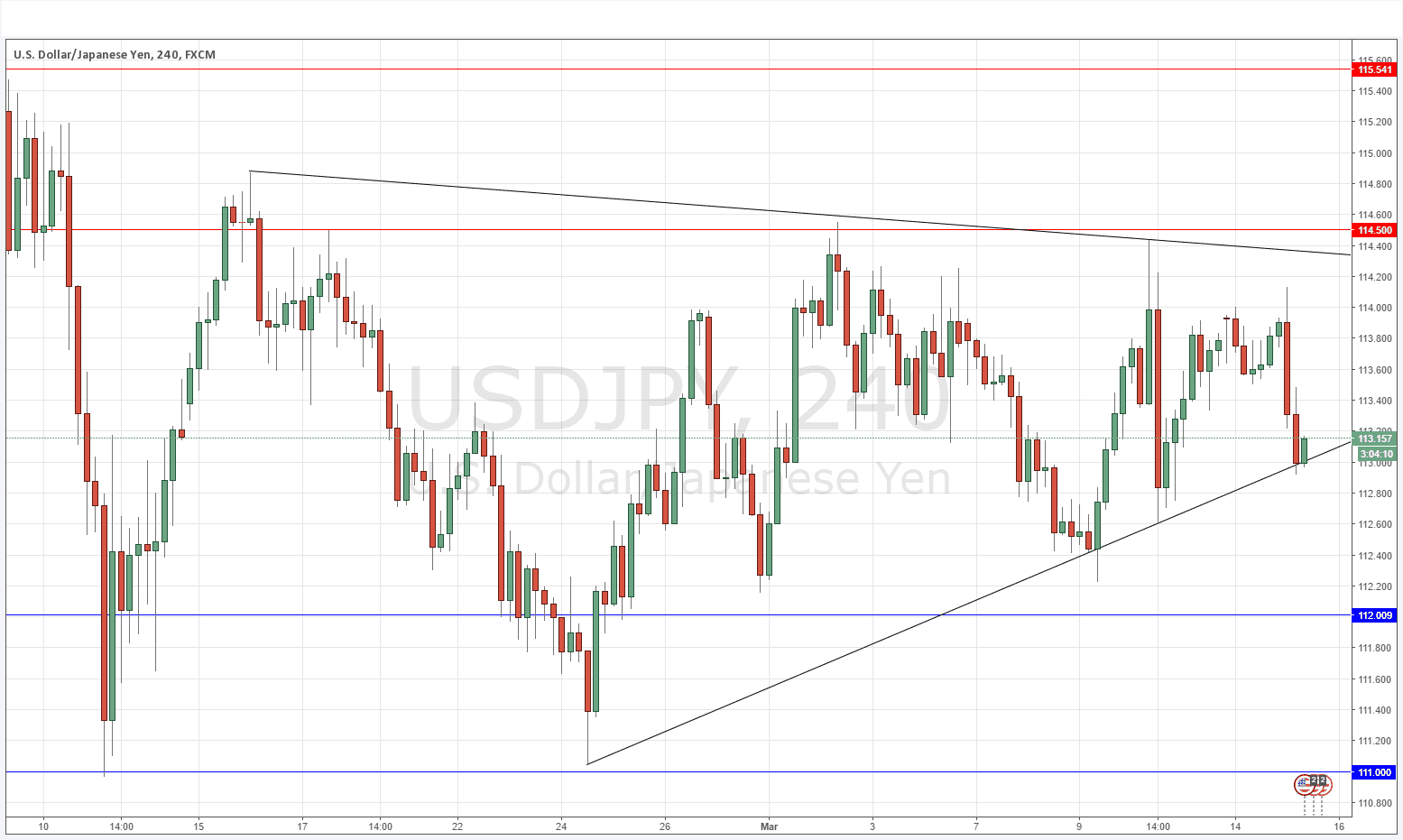

* Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 114.50

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 1

* Long entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 112.00.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

The Bank of Japan’s monthly policy statement was released earlier and had the effect of strengthening the Yen which sent this pair moving downwards. As can be seen in the chart below, the downwards thrust looks to have been halted, at least temporarily, by the lower triangle trend line. It is quite probable that this line will hold until the key U.S. data is released later around the New York open. Weak numbers will probably produce a stronger downwards move than positive numbers would produce an upwards move.

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of Retail Sales and PPI data at 12:30pm London time.