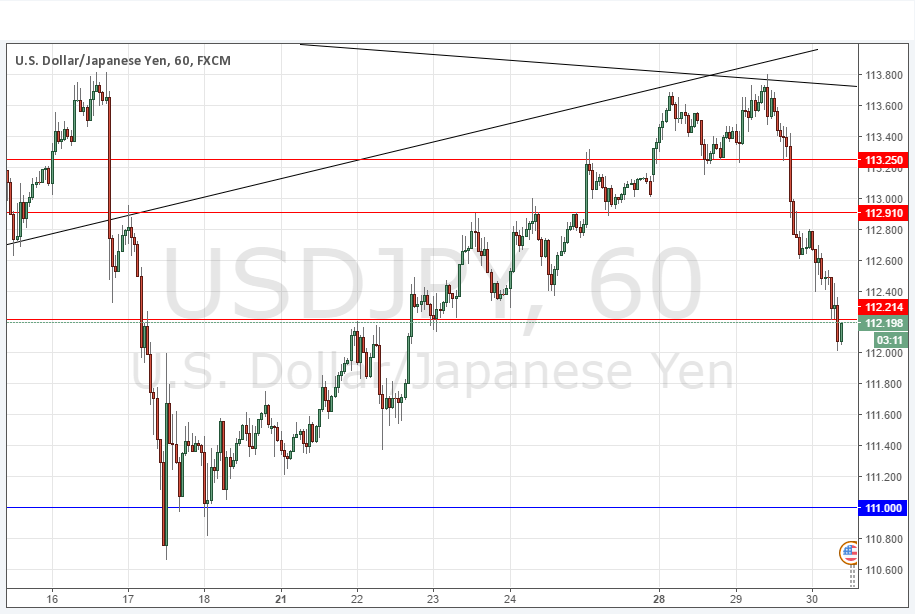

USD/JPY Signal Update

Yesterday’s signals were not triggered as unfortunately the high was made just a few pips short of 113.85. There was no bullish price action at support.

Today’s USD/JPY Signals

Risk 0.75%

Trades may only be taken from 8am New York time until 5pm Tokyo time.

Short Trade 1

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 112.91.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 1

Go long following extremely bullish price action reversal on the H1 time frame immediately upon the next touch of 111.00.

Put the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

There had been a fairly steep correction against the long term downwards trend following the triple bottom at the supportive level of 111.00. There was a major and sharp turn resuming the trend yesterday off 113.80, following which the price fell sharply following Janet Yellen’s remarks.

There is possible resistance very close by the current price at the time of writing, but it is too close to give it as a level, as it has just broken. The level is 112.21.

What has happened is a good example of how it can pay to look for reversals back into a longer-term trend.

There is nothing due today concerning the JPY. Regarding the USD, there will be a release of the ADP Non-Farm Employment Change at 1:15pm London time, followed later by Crude Oil Inventories at 3:30pm.