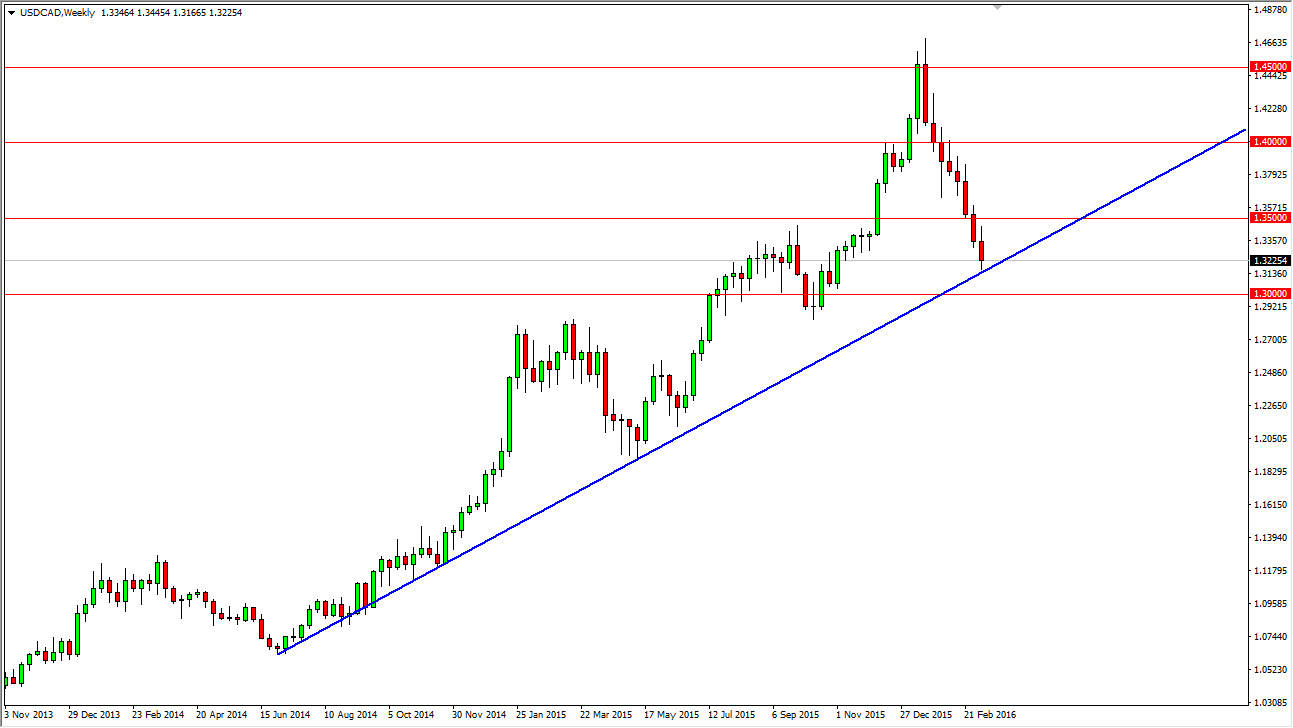

USD/CAD

The USD/CAD pair fell during the course of the week, testing a significant uptrend line in this pair. It is because of this that I feel we need to pay attention to this market over the next week or so. I also believe that the 1.30 level just below will be massively supportive, so there is a chance we get a bounce off of their as well. I am not looking to short this market anymore, and believe that sooner or later the buyers get involved.

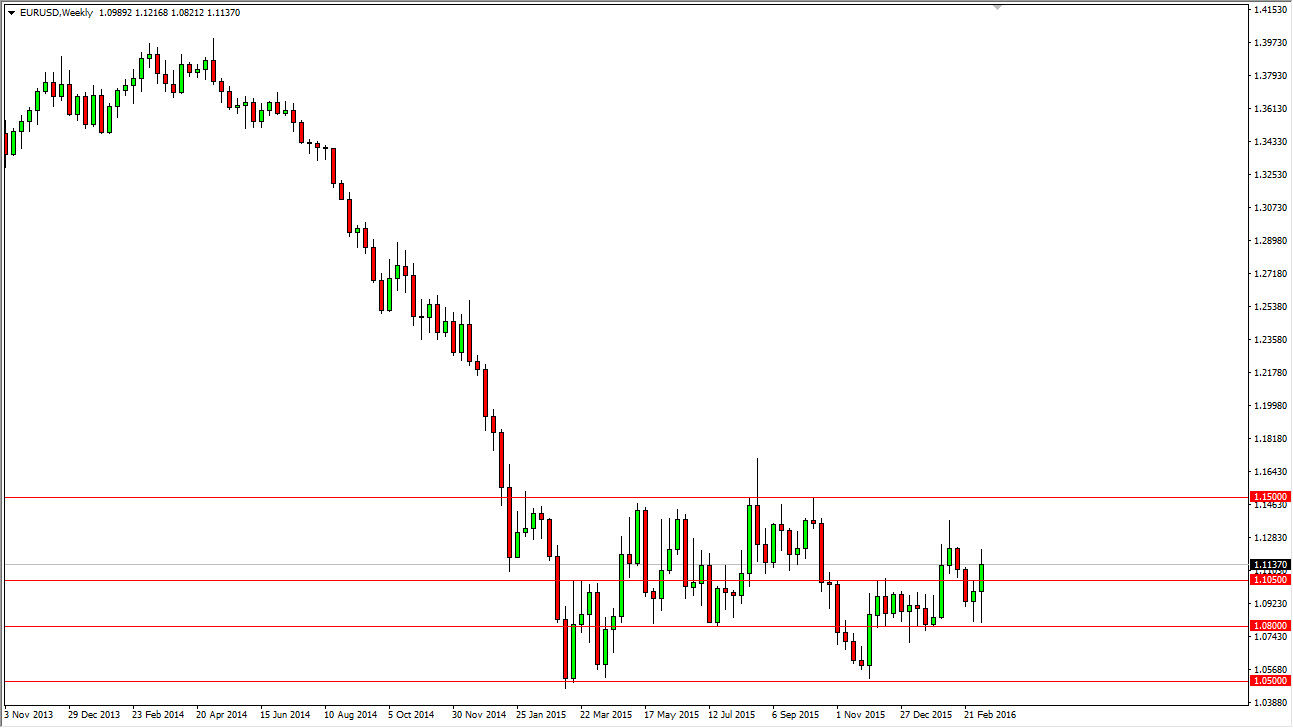

EUR/USD

Clearly, the Euro is going to rise from here. We sold off rather drastically after the ECB announcement, and then turn right back around to form a very positive looking candle. I think this week we try to get up to the 1.13 level, but it will probably be easier done off of shorter-term charts.

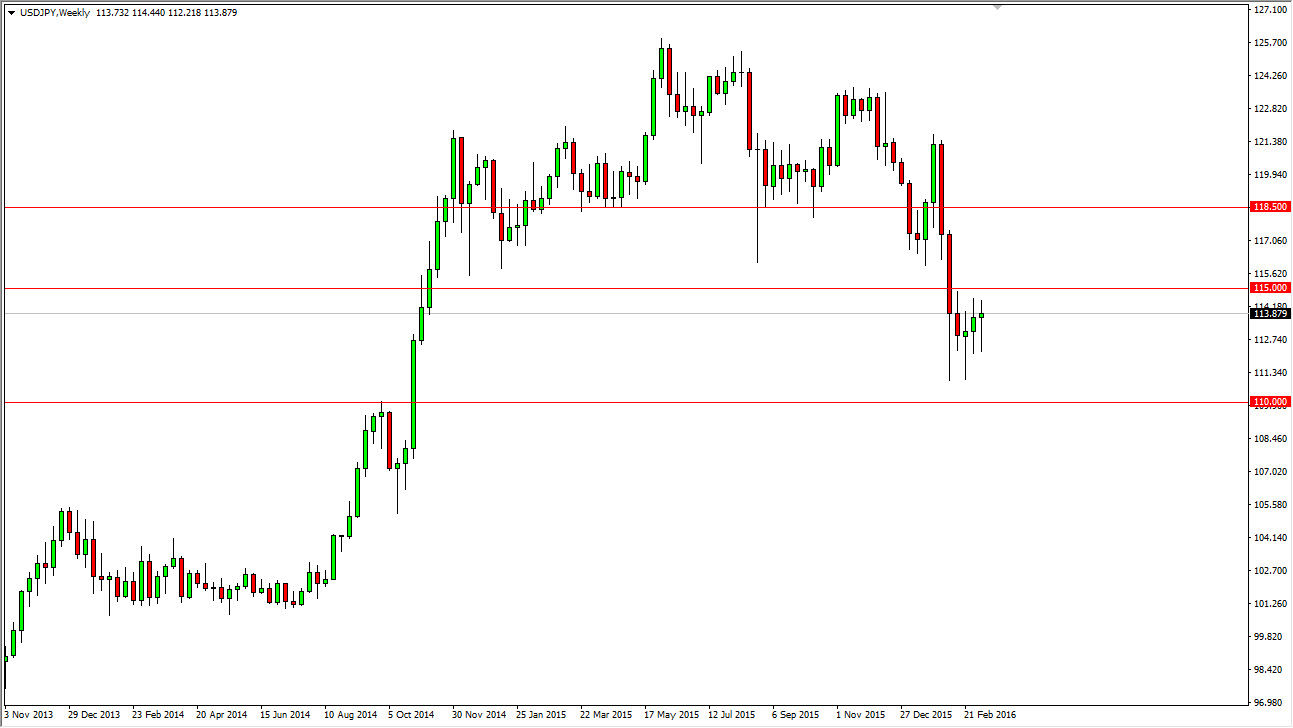

USD/JPY

The USD/JPY pair initially fell during the course the week but turned back around to form a nice-looking hammer. Because of this, it looks as if the parity is trying to build up enough momentum to bounce from here, and I believe that the signal to start buying this particular currency pair is going to be a move above the 115 handle. If we get that, I don’t see why we don’t go all the way to the 118 level next.

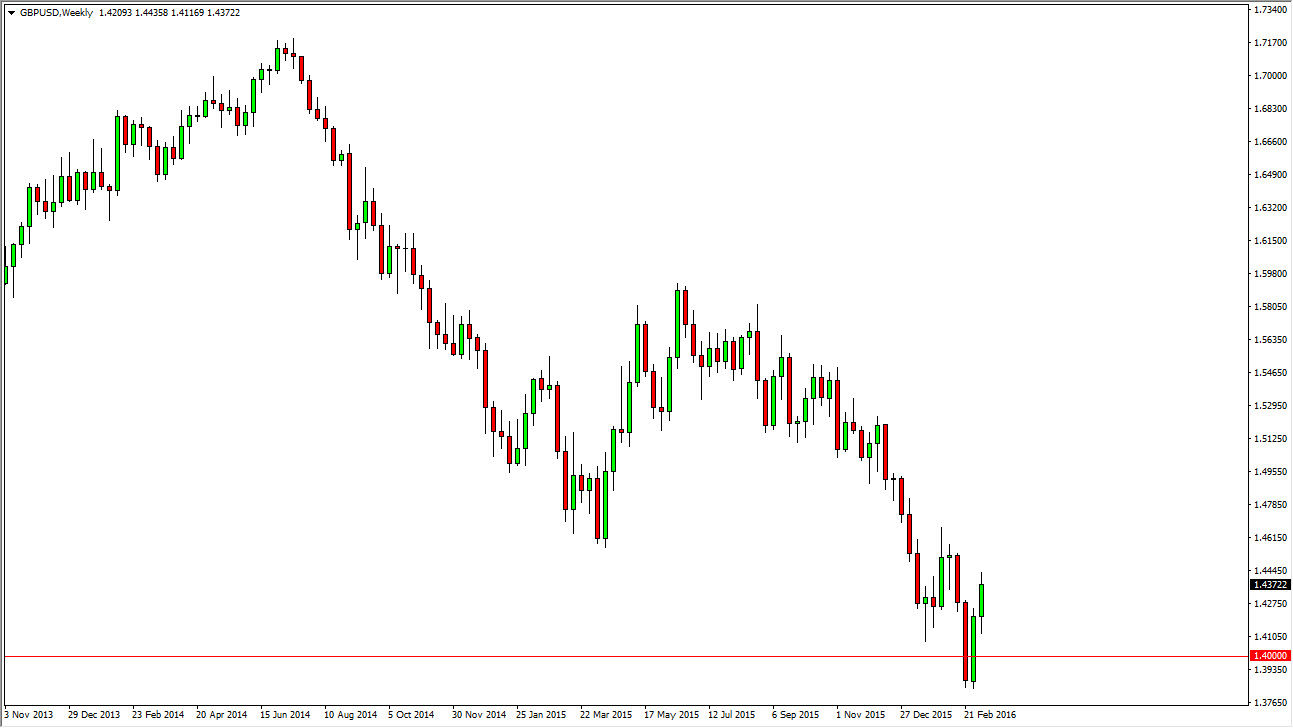

GBP/USD

The British pound has sold off rather wickedly over the last several months, but we’ve had a couple of weeks of strength now. I think this is a simple return to the 1.45 handle where we should see sellers. In other words, I believe that this is essentially a “to speed market” as there will be more than enough bearish pressure at the 1.45 level to turn things around. The meantime though, I would anticipate that the buyers will take control and push this market to the upside over the next week.