EUR/JPY

The EUR/JPY pair initially fell during the course of the week, but found enough support underneath the 125 level to turn things back around and form a hammer. The hammer of course is a very bullish sign, so I feel that this market is going to continue to grind higher during the course of the week. Pullbacks should be buying opportunities on signs of support as well.

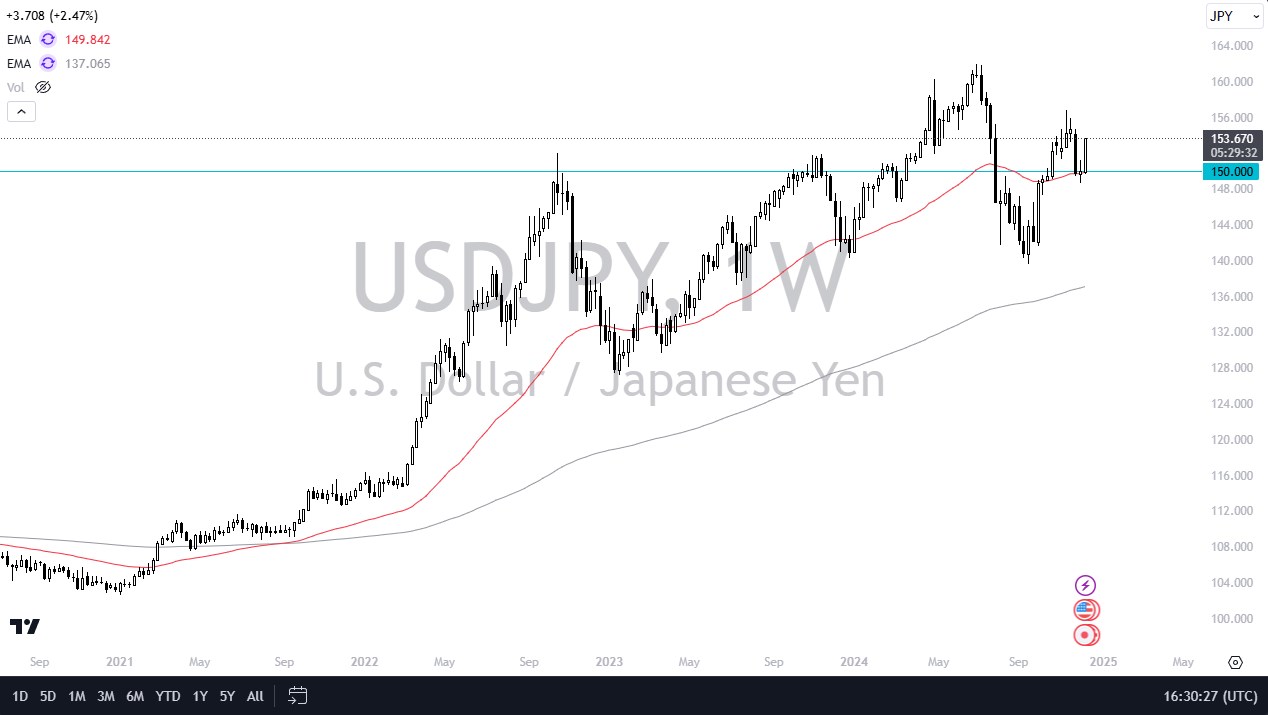

USD/JPY

The USD/JPY pair rose during the course of the week, showing signs of strength. With that being the case, the market looks as if it is going to try to reach towards the 115 level given. With that, I remain bullish but also recognize that this market is still very much in consolidation. So having said that I believe that the market is one that we can buy on short-term dips, but I am not expecting anything major.

EUR/USD

The EUR/USD pair fell during the course of the week, looking as if it is going to drive down to the 1.1050 level. That area should be supportive though, so I believe that short-term traders will short this market initially, but should find plenty of buying pressure underneath so I believe that this will be a very choppy market during this week.

USD/CAD

The USD/CAD pair rose during the course of the week, bouncing off of the uptrend line, which of course has been very reliable. With this being the case, I believe that this market will continue to grind higher this week, perhaps trying to get up to the 1.35 handle. It’s going to take quite a bit of momentum to get there is so expect quite a bit of volatility and back and forth type of action of the next several sessions, this will be especially true considering that the oil markets have been so active.