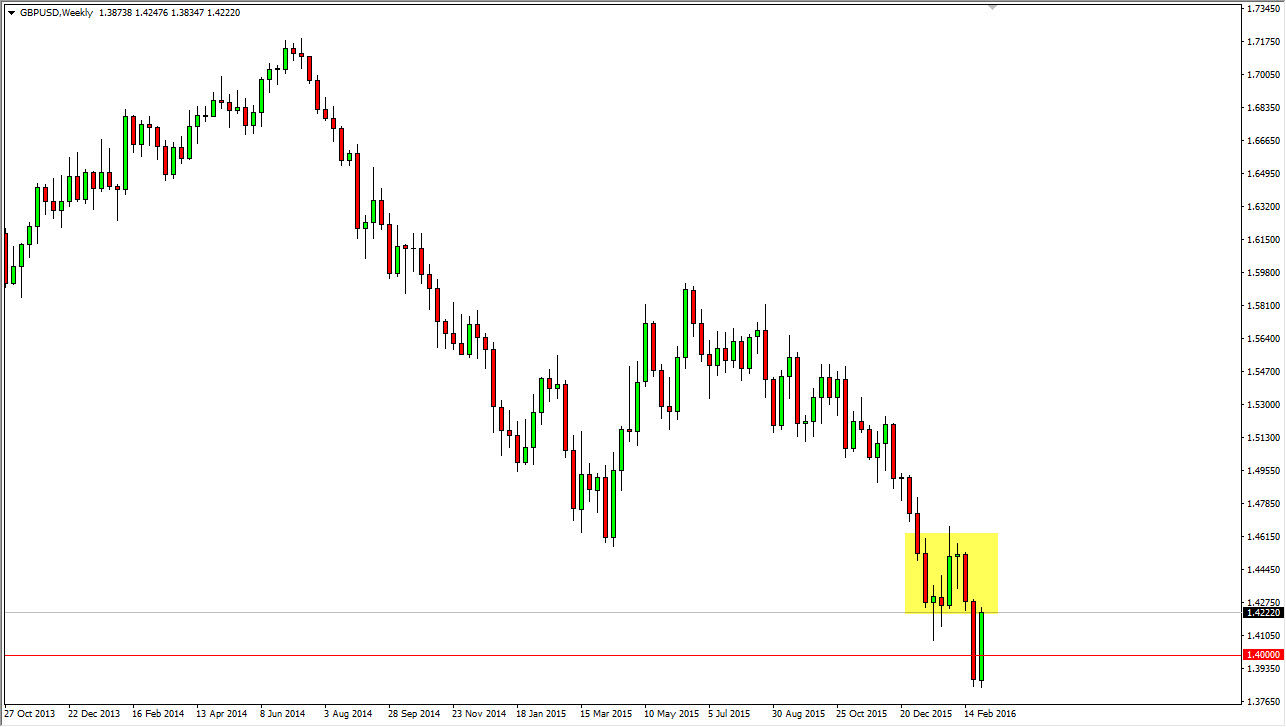

GBP/USD

The GBP/USD pair rose during the course of the week, showing quite a bit of resiliency. However, the market has quite a bit of resistance above and I believe that it’s only a matter of time before sellers start coming back into the market, pushing the British pound to lower levels given enough time. I believe that it’s only a matter of time before you get the opportunity to start shorting again.

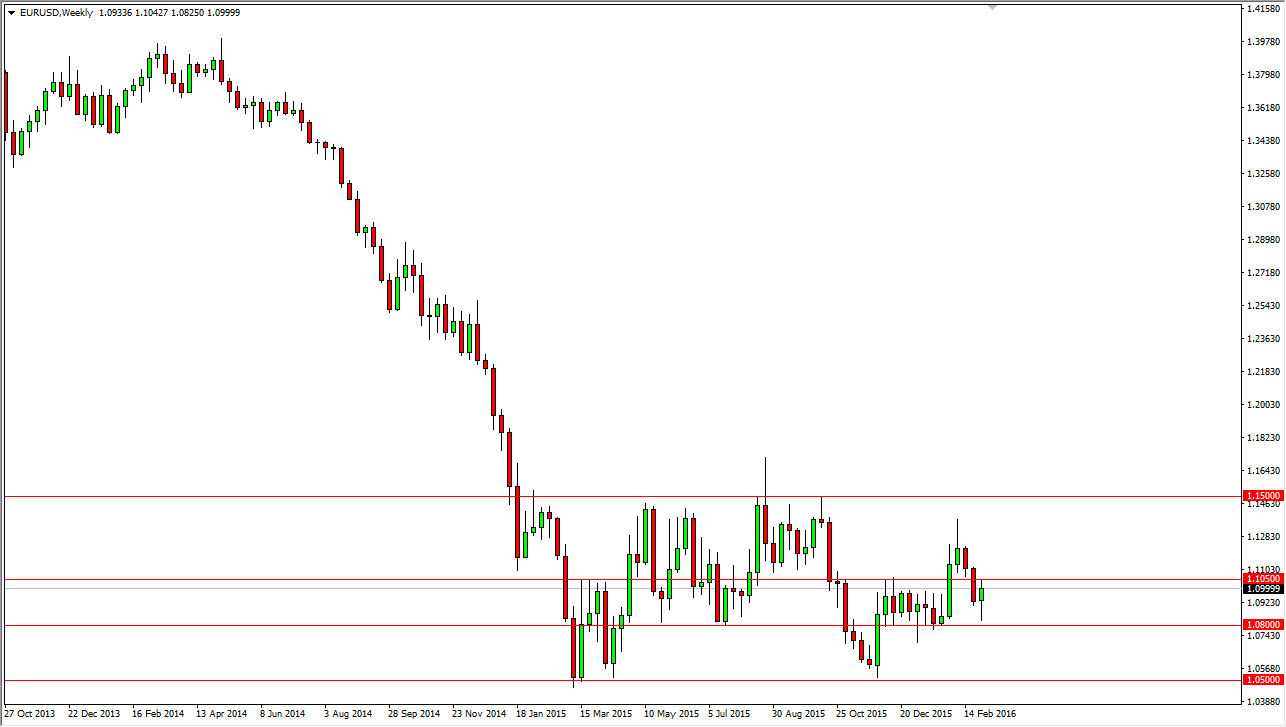

EUR/USD

EUR/USD initially fell during the course of the week but found enough support at the 1.08 level to turn things back around and form a hammer on the weekly chart. If we can break above the 1.1050 level, I believe at this point the Euro will reach towards the 1.13 level. Ultimately though, I think it’s going to be choppy regardless, and you have to be careful with any positions.

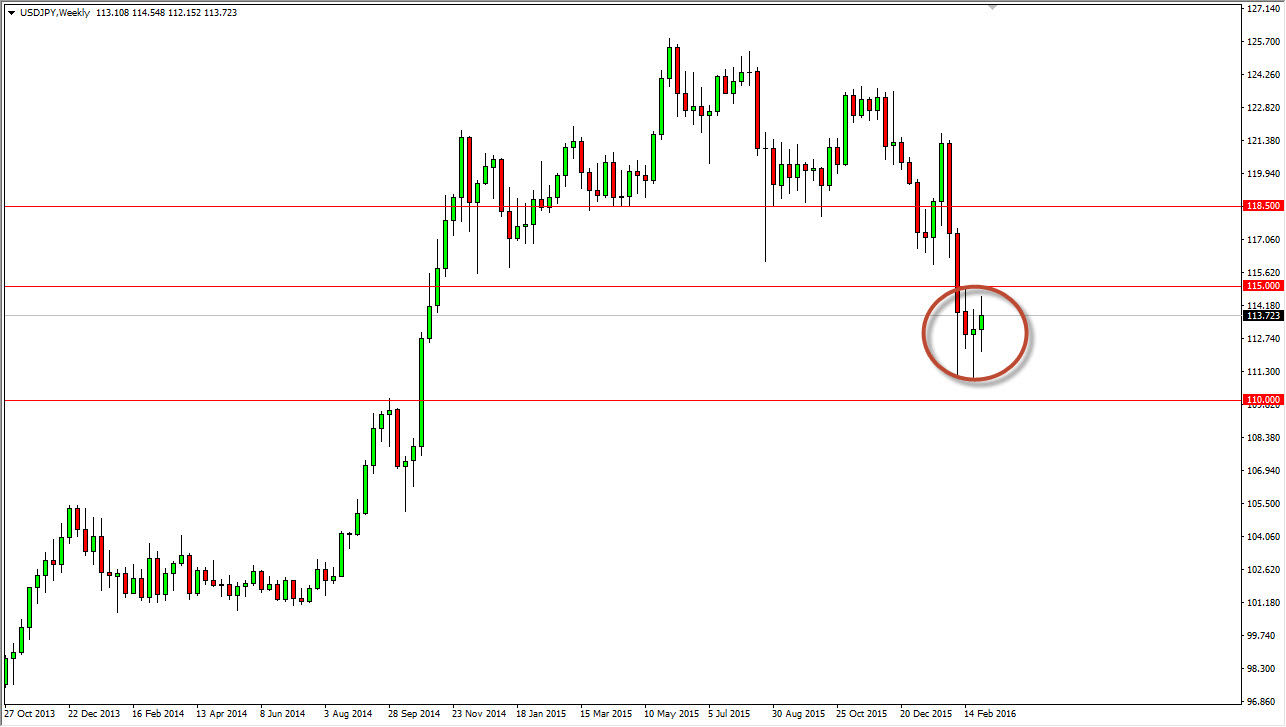

USD/JPY

The USD/JPY pair went back and forth during the course of the week, ultimately settling on a slightly bullish candle. I still believe that the 115 level above is a massive resistance barrier, so it’s not until we get above there that I feel you can buy this pair with any confidence. However, if it does happen, the market should reach towards the 118.50 level.

AUD/USD

The Australian dollar rose rapidly during the course of the week, breaking above the resistance barrier at the 0.74 level. It looks now as if the markets ready to continue going higher, so short-term pullbacks should be buying opportunities in this market going forward.